Question

QUESTION 2 [25 MARKS] An endowment that is currently invested 100% in an S&P 500 index fund is considering reallocating some of its portfolio to

QUESTION 2 [25 MARKS]

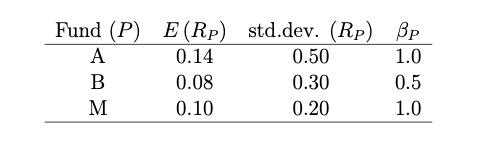

An endowment that is currently invested 100% in an S&P 500 index fund is considering reallocating some of its portfolio to one of two hedge funds. The foundation's objective in selecting the hedge fund, and the amount to allocate to it, is to obtain the highest Sharpe ratio for the foundation's overall portfolio. You have been asked to advise the foundation, and thus far you have estimated, means, standard deviations, and the following CAPM regression for each fund,

RP,t=?P+?PRM,t+?P,t

whereRP,tis the annual return (in excess of the risk-free rate) on the fund andRM,tis the excess annual return on the S&P 500. Your estimates include the following:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started