Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (25 MARKS) Astrazeneca Bhd is a tax resident manufacturing company in Johor Bharu. The products of the company have been granted with

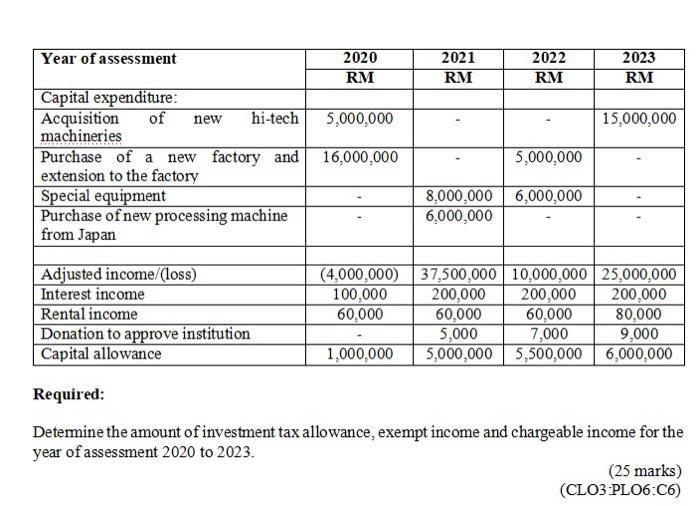

QUESTION 2 (25 MARKS) Astrazeneca Bhd is a tax resident manufacturing company in Johor Bharu. The products of the company have been granted with investment tax allowance in the previous years. Astrazeneca is currently in the process of business expansion program as to enhance the production of the company. Therefore, the management is applying for the reinvestment allowance. The following forecasted information and capital expenditure is provided as follows: Year of assessment Capital expenditure: Acquisition machineries of new hi-tech Purchase of a new factory and extension to the factory Special equipment Purchase of new processing machine from Japan Adjusted income/(loss) Interest income Rental income Donation to approve institution Capital allowance 2020 RM 5,000,000 16,000,000 2021 RM 2022 RM 5,000,000 8,000,000 6,000,000 6,000,000 2023 RM 60,000 7,000 15,000,000 (4,000,000) 37,500,000 10,000,000 25,000,000 200,000 200,000 200,000 100,000 60,000 60,000 80,000 5,000 9,000 1,000,000 5,000,000 5,500,000 6,000,000 Required: Determine the amount of investment tax allowance, exempt income and chargeable income for the year of assessment 2020 to 2023. (25 marks) (CLO3PLO6:C6)

Step by Step Solution

★★★★★

3.45 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Investment tax allowance Year of assessment 2020 RM5000000 Year of assessment 2021 RM15000000 Year o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started