Answered step by step

Verified Expert Solution

Question

1 Approved Answer

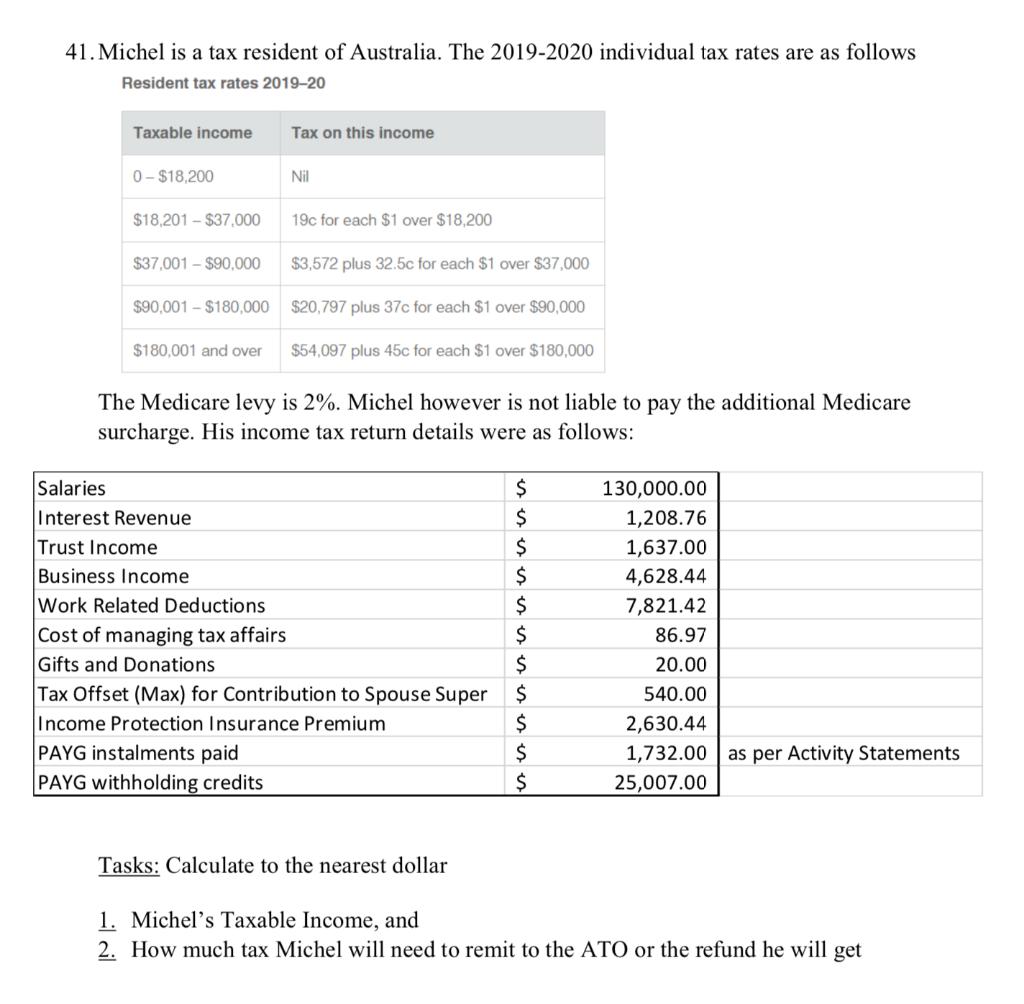

41. Michel is a tax resident of Australia. The 2019-2020 individual tax rates are as follows Resident tax rates 2019-20 Taxable income Tax on

41. Michel is a tax resident of Australia. The 2019-2020 individual tax rates are as follows Resident tax rates 2019-20 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $37,000 19c for each $1 over $18,200 $37,001 - $90,000 $3,572 plus 32.5c for each $1 over $37,000 $90,001 - $180,000 $20,797 plus 37c for each $1 over $90,000 $180,001 and over $54,097 plus 45c for each $1 over $180,000 The Medicare levy is 2%. Michel however is not liable to pay the additional Medicare surcharge. His income tax return details were as follows: Salaries 2$ 130,000.00 Interest Revenue Trust Income $ 1,208.76 1,637.00 Business Income Work Related Deductions 2$ 4,628.44 7,821.42 Cost of managing tax affairs 86.97 Gifts and Donations 2$ 20.00 Tax Offset (Max) for Contribution to Spouse Super Income Protection Insurance Premium PAYG instalments paid 540.00 2$ 2,630.44 1,732.00 as per Activity Statements PAYG withholding credits 25,007.00 Tasks: Calculate to the nearest dollar 1. Michel's Taxable Income, and 2. How much tax Michel will need to remit to the ATO or the refund he will get

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Taxable Income Particulars Amt in AUD Salaries 13000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started