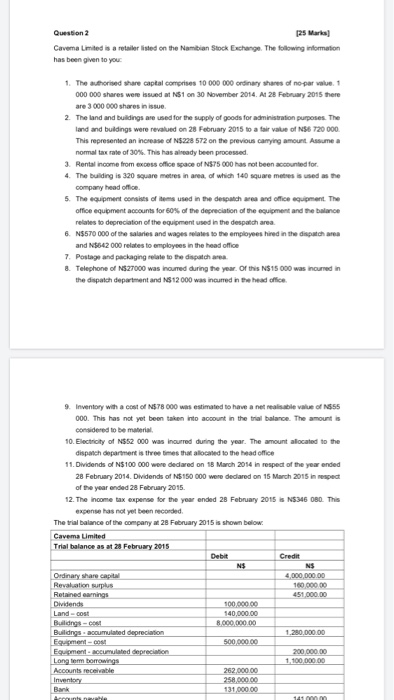

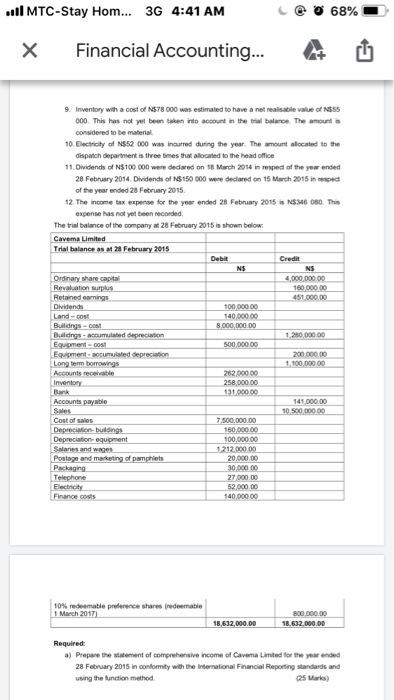

Question 2 [25 Marks Cavema Limited is a retailer listed on the Namibian Stock Exchange. The following information has been given to you 1. The authorised share capital comprises 10 000 000 ordinary shares of no par value 1 000 000 shares were issued at $1 on 30 November 2014. Al 28 February 2015 there are 3 000 000 shares in issue 2. The land and buildings are used for the supply of goods for administration purposes. The land and buildings were revalued on 28 February 2015 to a fair value of N56 720 000 This represented an increase of N$228 572 on the previous carrying amount. Assume a normal tax rate of 30%. This has already been processed 3. Rental income from excess office space of N$75 000 has not been accounted for 4. The building is 320 square metres in area of which 140 square metres is used as the company head office 5. The equipment consists of items used in the despatch area and office equipment. The office equipment accounts for 60% of the depreciation of the equipment and the balance relates to depreciation of the equipment used in the despatch area. 6. N$570 000 of the salaries and wages relates to the employees hired in the dispatch area and N$642 000 relates to employees in the head office 7. Postage and packaging relate to the dispatchares & Telephone of N$27000 was incurred during the year of this N$15 000 was incurred in the dispatch department and N$12000 was incurred in the head office 9. Inventory with a cost of N$78 000 was estimated to have a net realisable value of $55 000. This has not yet been taken into account in the trial balance. The amount is considered to be material 10. Electricity of N552 000 was incurred during the year. The amount allocated to the dispatch department is three times that allocated to the head office 11. Dividends of N$100 000 were dedared on 18 March 2014 in respect of the year ended 28 February 2014. Dividends of N$150 000 were declared on 15 March 2015 in respect of the year ended 28 February 2015. 12. The income tax expense for the your ended 28 February 2015 is N5346 OBD. This expense has not yet been recorded The trial balance of the company at 28 February 2015 is shown below. Cavema Limited Trial balance as at 28 February 2015 Debit Credit N$ N$ Ordinary share capital 4,000,000.00 Revaluation surplus 160.000.00 Retained earnings 451.000.00 Dividends 100.000.00 Land-cost 140,000.00 Buildings-0001 8.000.000.00 Bullings-accumulated depreciation 1.280.000.00 Equipment COM 500 000.00 Equipment accumulated depreciation 200 000.00 Long term borrowings 1.100.000,00 Accounts receivable 262.000.00 Inventory 250,000.00 Bank 131,000.00 Amunt ... MTC-Stay Hom... 3G 4:41 AM 68% Financial Accounting... 9. Inventory with a cost of N$78000 was estimated to have a net realisable value of 555 000. This has not yet been taken into account in the trial balance. The amount is considered to be material 10. Electricity of N552 000 was incurred during the year. The amount alocated to the dispatch department is three times that allocated to the head office 11. Dividends of N$100 000 were dedared on 18 March 2014 in respect of the year ended 28 February 2014 Dividends of N$150 000 were declared on 15 March 2015 in respect of the year ended 28 February 2015 12. The income tax expense for the year ended 28 February 2015 is $346 080. This expense has not yet been recorded The trial balance of the company at 28 February 2015 is shown below Cavema Limited Trial balance as at 28 February 2015 Debit Credit NS NS Ordinary share capital 4,000,000.00 Revaluation sur 160 000.00 Retained earnings 451.000.00 Dividends 100.000.00 Land-cost 140,000.00 Buildngs-006 8,000,000.00 Builidngs-accumulated depreciation 1,280,000.00 Equipment -cost 500 000.00 Equipment accumulated depreciation 200,000.00 Long term borrowings 1.100 000 00 Accounts recalable 262.000.00 Inventory 258,000.00 131.000.00 Accounts payable 141,000.00 Sales 10 500 000.00 Cost of sales 7.500.000,00 Depreciation buildings 160.000.00 Depreciation equipment 100,000.00 Salaries and wages 1212.000.00 Postage and marketing of pamphlets 20,000.00 Packaging 30.000.00 Telephone 27.000.00 Electricity 52.000.00 Finance cost 140,000.00 10% redeemable preference shares indeemable 1 March 2017 800.000.00 18,632,000.00 18,632,000.00 Required: a) Prepare the statement of comprehensive income of Cavema Limited for the year ended 28 February 2015 in conformity with the International Financial Reporting standards and using the function method 25 Marks)