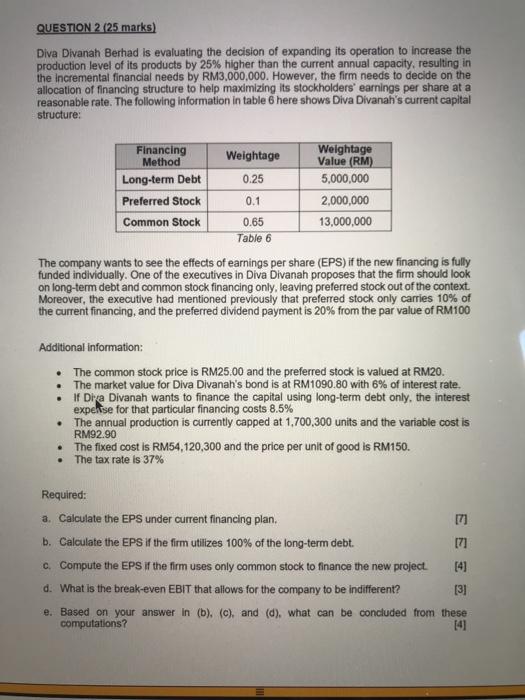

QUESTION 2 (25 marks) Diva Divanah Berhad is evaluating the decision of expanding its operation to increase the production level of its products by 25% higher than the current annual capacity, resulting in the incremental financial needs by RM3,000,000. However, the firm needs to decide on the allocation of financing structure to help maximizing its stockholders' earnings per share at a reasonable rate. The following information in table 6 here shows Diva Divanah's current capital structure: Financing Method Weightage Weightage Value (RM) Long-term Debt 0.25 5,000,000 Preferred Stock 0.1 2,000,000 Common Stock 0.65 13,000,000 Table 6 The company wants to see the effects of earnings per share (EPS) if the new financing is fully funded individually. One of the executives in Diva Divanah proposes that the firm should look on long-term debt and common stock financing only, leaving preferred stock out of the context. Moreover, the executive had mentioned previously that preferred stock only carries 10% of the current financing, and the preferred dividend payment is 20% from the par value of RM100 Additional information: The common stock price is RM25.00 and the preferred stock is valued at RM20. The market value for Diva Divanah's bond is at RM1090.80 with 6% of interest rate. If Diva Divanah wants to finance the capital using long-term debt only, the interest expense for that particular financing costs 8.5% The annual production is currently capped at 1,700,300 units and the variable cost is RM92.90 The fixed cost is RM54,120,300 and the price per unit of good is RM150. The tax rate is 37% . Required: a. Calculate the EPS under current financing plan. b. Calculate the EPS if the firm utilizes 100% of the long-term debt. 171 c. Compute the EPS if the firm uses only common stock to finance the new project [4] d. What is the break-even EBIT that allows for the company to be indifferent? (31 e. Based on your answer in (b), (c), and (d), what can be concluded from these computations? 141 QUESTION 2 (25 marks) Diva Divanah Berhad is evaluating the decision of expanding its operation to increase the production level of its products by 25% higher than the current annual capacity, resulting in the incremental financial needs by RM3,000,000. However, the firm needs to decide on the allocation of financing structure to help maximizing its stockholders' earnings per share at a reasonable rate. The following information in table 6 here shows Diva Divanah's current capital structure: Financing Method Weightage Weightage Value (RM) Long-term Debt 0.25 5,000,000 Preferred Stock 0.1 2,000,000 Common Stock 0.65 13,000,000 Table 6 The company wants to see the effects of earnings per share (EPS) if the new financing is fully funded individually. One of the executives in Diva Divanah proposes that the firm should look on long-term debt and common stock financing only, leaving preferred stock out of the context. Moreover, the executive had mentioned previously that preferred stock only carries 10% of the current financing, and the preferred dividend payment is 20% from the par value of RM100 Additional information: The common stock price is RM25.00 and the preferred stock is valued at RM20. The market value for Diva Divanah's bond is at RM1090.80 with 6% of interest rate. If Diva Divanah wants to finance the capital using long-term debt only, the interest expense for that particular financing costs 8.5% The annual production is currently capped at 1,700,300 units and the variable cost is RM92.90 The fixed cost is RM54,120,300 and the price per unit of good is RM150. The tax rate is 37% . Required: a. Calculate the EPS under current financing plan. b. Calculate the EPS if the firm utilizes 100% of the long-term debt. 171 c. Compute the EPS if the firm uses only common stock to finance the new project [4] d. What is the break-even EBIT that allows for the company to be indifferent? (31 e. Based on your answer in (b), (c), and (d), what can be concluded from these computations? 141