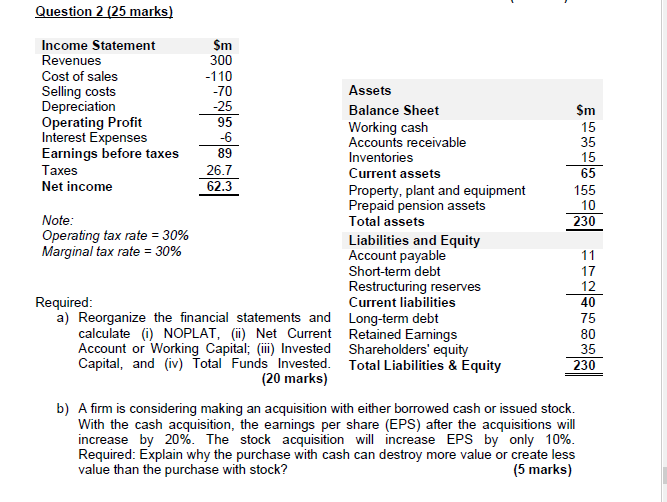

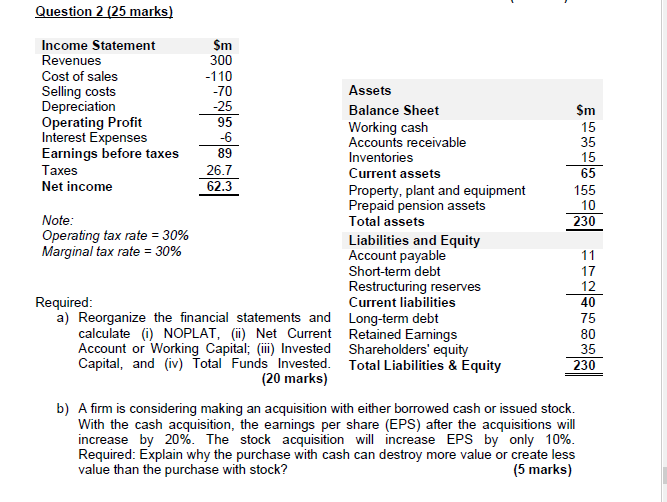

Question 2 (25 marks) Income Statement $m Revenues 300 Cost of sales -110 Selling costs -70 Assets Depreciation -25 Balance Sheet $m Operating Profit 95 Working cash 15 Interest Expenses -6 Accounts receivable 35 Earnings before taxes 89 Inventories 15 Taxes 26.7 Current assets 65 Net income 62.3 Property, plant and equipment 155 Prepaid pension assets 10 Note: Total assets 230 Operating tax rate = 30% Liabilities and Equity Marginal tax rate = 30% Account payable 11 Short-term debt 17 Restructuring reserves 12 Required: Current liabilities 40 a) Reorganize the financial statements and Long-term debt 75 calculate (1) NOPLAT, () Net Current Retained Earnings 80 Account or Working Capital; (iii) Invested Shareholders' equity 35 Capital, and (iv) Total Funds Invested. Total Liabilities & Equity 230 (20 marks) b) A firm is considering making an acquisition with either borrowed cash or issued stock. With the cash acquisition, the earnings per share (EPS) after the acquisitions will increase by 20%. The stock acquisition will increase EPS by only 10%. Required: Explain why the purchase with cash can destroy more value or create less value than the purchase with stock? (5 marks) selse H2 Es Question 2 (25 marks) Income Statement $m Revenues 300 Cost of sales -110 Selling costs -70 Assets Depreciation -25 Balance Sheet $m Operating Profit 95 Working cash 15 Interest Expenses -6 Accounts receivable 35 Earnings before taxes 89 Inventories 15 Taxes 26.7 Current assets 65 Net income 62.3 Property, plant and equipment 155 Prepaid pension assets 10 Note: Total assets 230 Operating tax rate = 30% Liabilities and Equity Marginal tax rate = 30% Account payable 11 Short-term debt 17 Restructuring reserves 12 Required: Current liabilities 40 a) Reorganize the financial statements and Long-term debt 75 calculate (1) NOPLAT, () Net Current Retained Earnings 80 Account or Working Capital; (iii) Invested Shareholders' equity 35 Capital, and (iv) Total Funds Invested. Total Liabilities & Equity 230 (20 marks) b) A firm is considering making an acquisition with either borrowed cash or issued stock. With the cash acquisition, the earnings per share (EPS) after the acquisitions will increase by 20%. The stock acquisition will increase EPS by only 10%. Required: Explain why the purchase with cash can destroy more value or create less value than the purchase with stock? (5 marks) selse H2 Es