Answered step by step

Verified Expert Solution

Question

1 Approved Answer

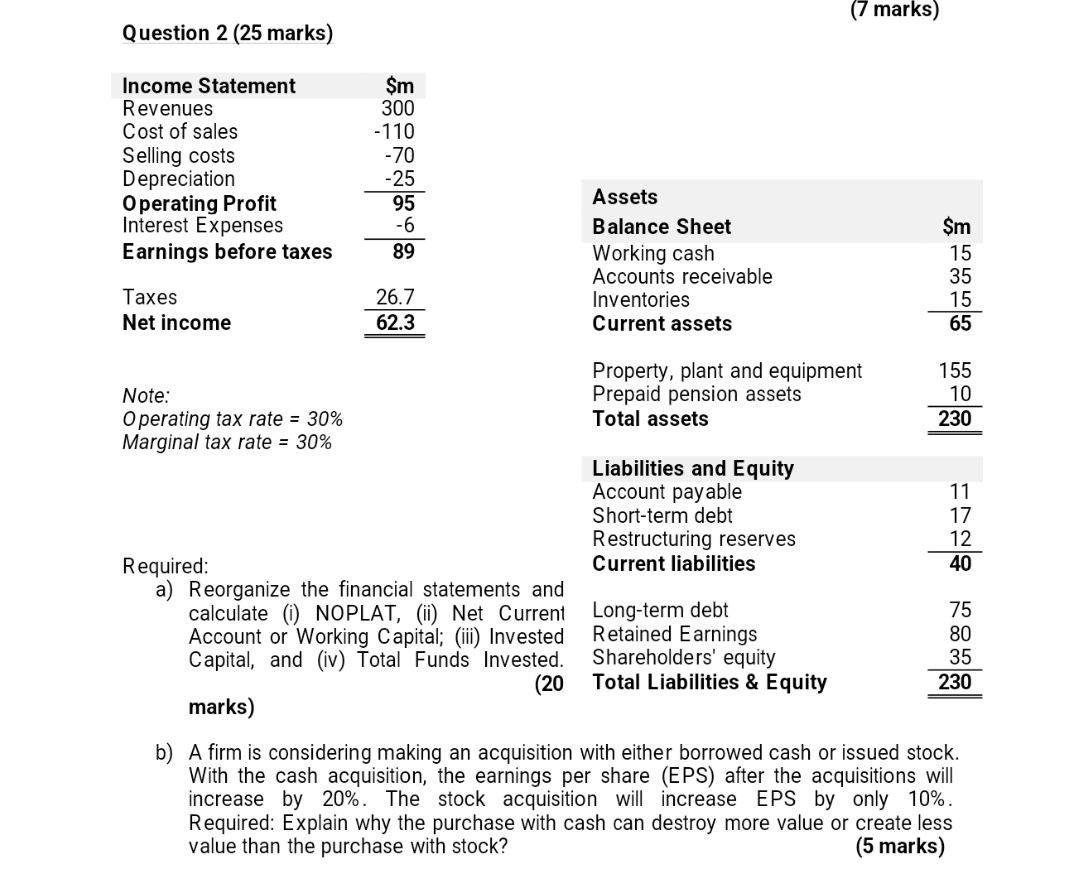

Question 2 (25 marks) Income Statement Revenues Cost of sales Selling costs Depreciation Operating Profit Interest Expenses Earnings before taxes Taxes Net income Note: Operating

Question 2 (25 marks) Income Statement Revenues Cost of sales Selling costs Depreciation Operating Profit Interest Expenses Earnings before taxes Taxes Net income Note: Operating tax rate = 30% Marginal tax rate = 30% $m 300 -110 -70 -25 95 -6 89 26.7 62.3 Assets Balance Sheet Working cash Accounts receivable Inventories Current assets Property, plant and equipment Prepaid pension assets Total assets Liabilities and Equity Account payable Short-term debt Restructuring reserves Current liabilities (7 marks) Long-term debt Retained Earnings Shareholders' equity Total Liabilities & Equity $m P823 38 = 2888|| 15 35 15 65 155 10 230 11 17 12 Required: a) Reorganize the financial statements and calculate (i) NOPLAT, (ii) Net Current Account or Working Capital; (iii) Invested Capital, and (iv) Total Funds Invested. (20 marks) b) A firm is considering making an acquisition with either borrowed cash or issued stock. With the cash acquisition, the earnings per share (EPS) after the acquisitions will increase by 20%. The stock acquisition will increase EPS by only 10%. Required: Explain why the purchase with cash can destroy more value or create less value than the purchase with stock? (5 marks) 40 75 80 35 230 Question 2 (25 marks) Income Statement Revenues Cost of sales Selling costs Depreciation Operating Profit Interest Expenses Earnings before taxes Taxes Net income Note: Operating tax rate = 30% Marginal tax rate = 30% $m 300 -110 -70 -25 95 -6 89 26.7 62.3 Assets Balance Sheet Working cash Accounts receivable Inventories Current assets Property, plant and equipment Prepaid pension assets Total assets Liabilities and Equity Account payable Short-term debt Restructuring reserves Current liabilities (7 marks) Long-term debt Retained Earnings Shareholders' equity Total Liabilities & Equity $m P823 38 = 2888|| 15 35 15 65 155 10 230 11 17 12 Required: a) Reorganize the financial statements and calculate (i) NOPLAT, (ii) Net Current Account or Working Capital; (iii) Invested Capital, and (iv) Total Funds Invested. (20 marks) b) A firm is considering making an acquisition with either borrowed cash or issued stock. With the cash acquisition, the earnings per share (EPS) after the acquisitions will increase by 20%. The stock acquisition will increase EPS by only 10%. Required: Explain why the purchase with cash can destroy more value or create less value than the purchase with stock? (5 marks) 40 75 80 35 230

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started