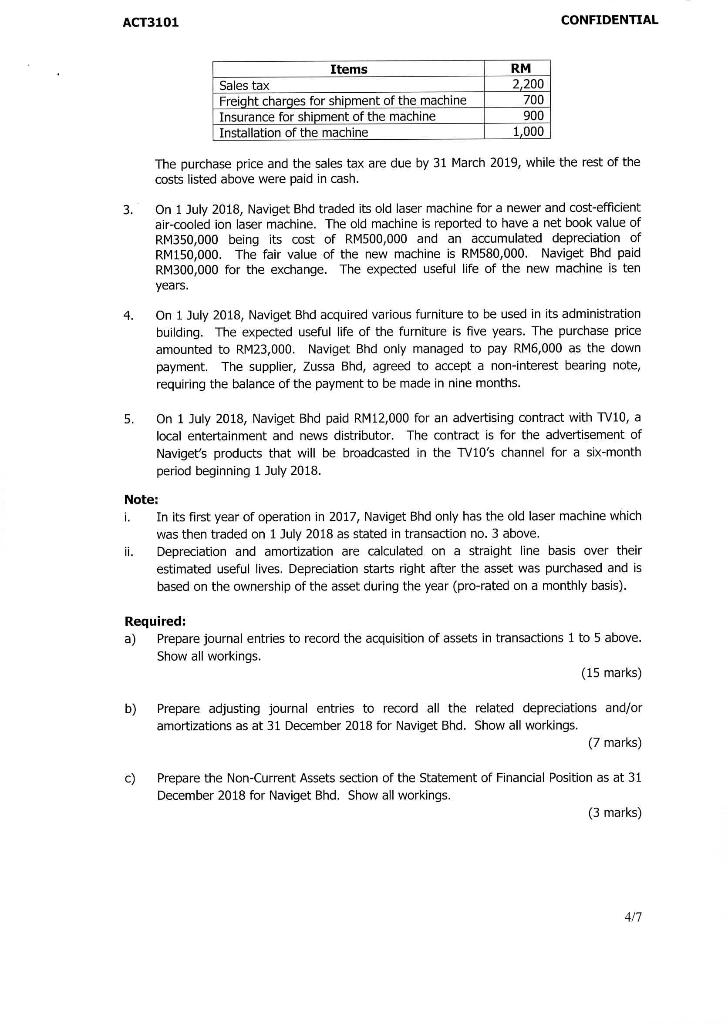

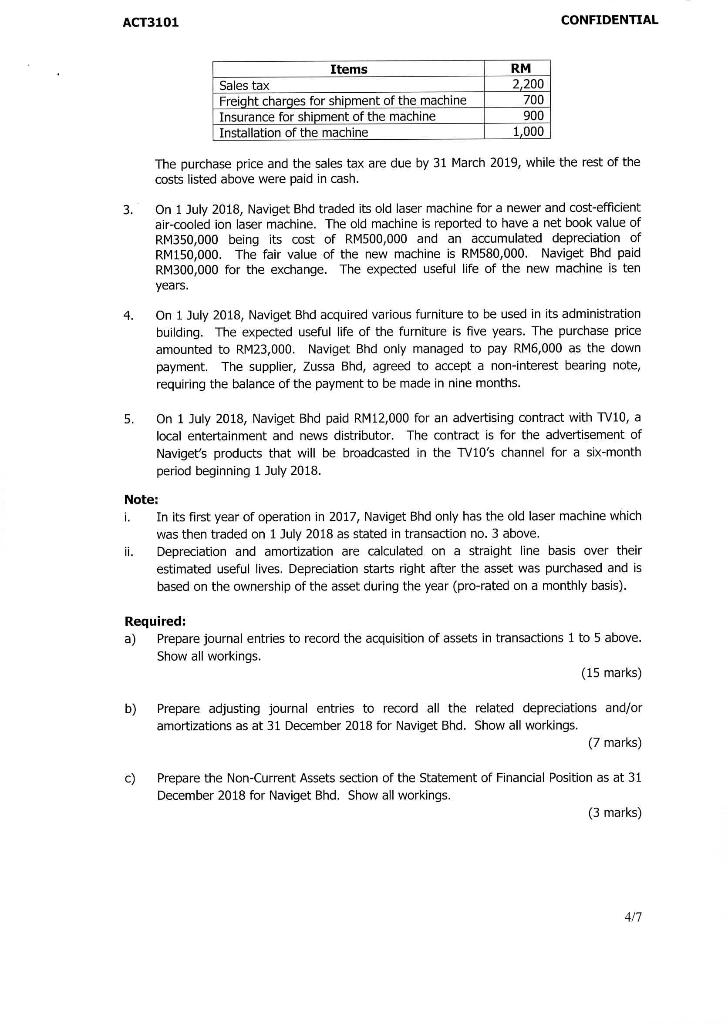

QUESTION 2 (25 Marks) Naviget Bhd is currently in its second year of operation. As a newly set up company, the company is still in the process of building up the capacity of the business. During the financial year ended 31 December 2018, the following transactions were incurred: 1. On 1 January 2018, Naviget Bhd bought a trademark for RM100,000. The purpose of the purchase is to differentiate the company's products from the products of other existing and potential competitors. The trademark is expected to produce net cash inflows for five years. 2. On 1 April 2018, Naviget Bhd acquired a new machine for RM45,000. This new machine is expected to have a useful life of ten years. In addition to the purchase price, the company made the following expenditures related to the acquisition: ACT3101 CONFIDENTIAL Items Sales tax Freight charges for shipment of the machine Insurance for shipment of the machine Installation of the machine RM 2,200 700 900 1,000 The purchase price and the sales tax are due by 31 March 2019, while the rest of the costs listed above were paid in cash. 3. On 1 July 2018, Naviget Bhd traded its old laser machine for a newer and cost-efficient air-cooled ion laser machine. The old machine is reported to have a net book value of RM350,000 being its cost of RM500,000 and an accumulated depreciation of RM150,000. The fair value of the new machine is RM580,000. Naviget Bhd paid RM300,000 for the exchange. The expected useful life of the new machine is ten years. 4. On 1 July 2018, Naviget Bhd acquired various furniture to be used in its administration building. The expected useful life of the furniture is five years. The purchase price amounted to RM23,000. Naviget Bhd only managed to pay RM6,000 as the down payment. The supplier, Zussa Bhd, agreed to accept a non-interest bearing note, requiring the balance of the payment to be made in nine months. 5. On 1 July 2018, Naviget Bhd paid RM12,000 for an advertising contract with TV10, a local entertainment and news distributor. The contract is for the advertisement of Naviget's products that will be broadcasted in the TV10's channel for a six-month period beginning 1 July 2018. Note: i. In its first year of operation in 2017, Naviget Bhd only has the old laser machine which was then traded on 1 July 2018 as stated in transaction no. 3 above. ii. Depreciation and amortization are calculated on a straight line basis over their estimated useful lives. Depreciation starts right after the asset was purchased and is based on the ownership of the asset during the year (pro-rated on a monthly basis). Required: a) Prepare journal entries to record the acquisition of assets in transactions 1 to 5 above. Show all workings. (15 marks) b) Prepare adjusting journal entries to record all the related depreciations and/or amortizations as at 31 December 2018 for Naviget Bhd. Show all workings. (7 marks) Prepare the Non-Current Assets section of the Statement of Financial Position as at 31 December 2018 for Naviget Bhd. Show all workings. (3 marks) 4/7