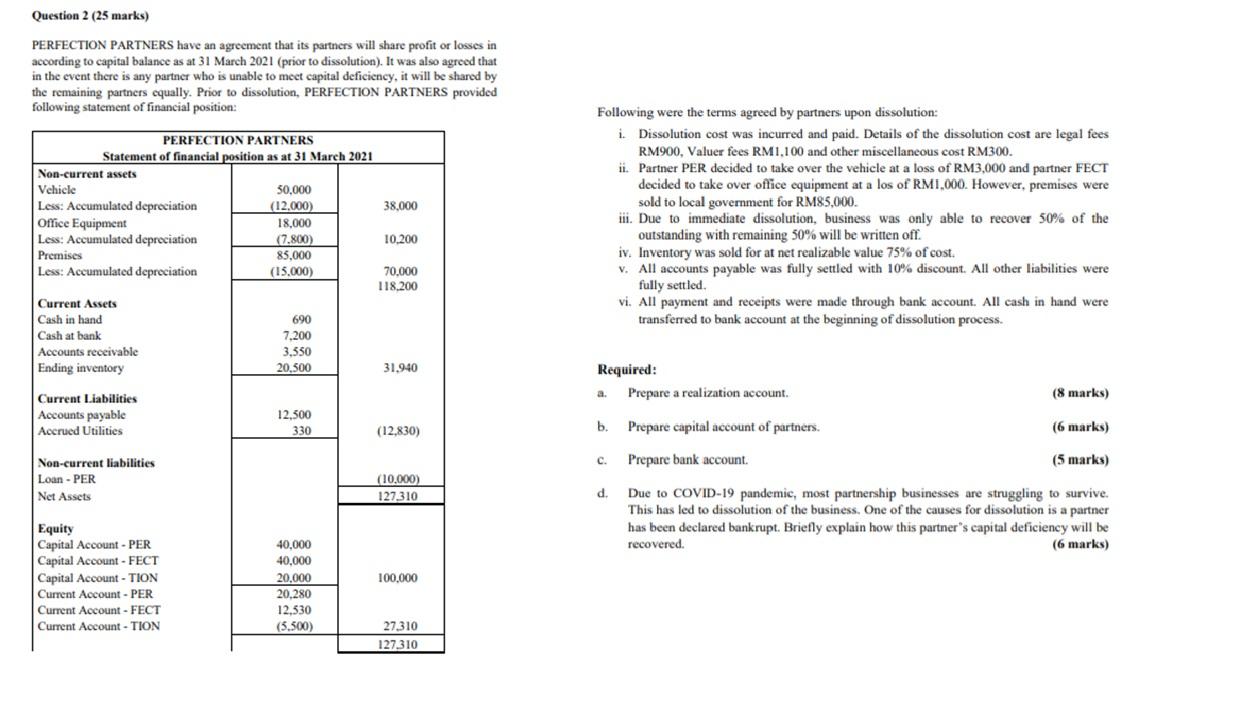

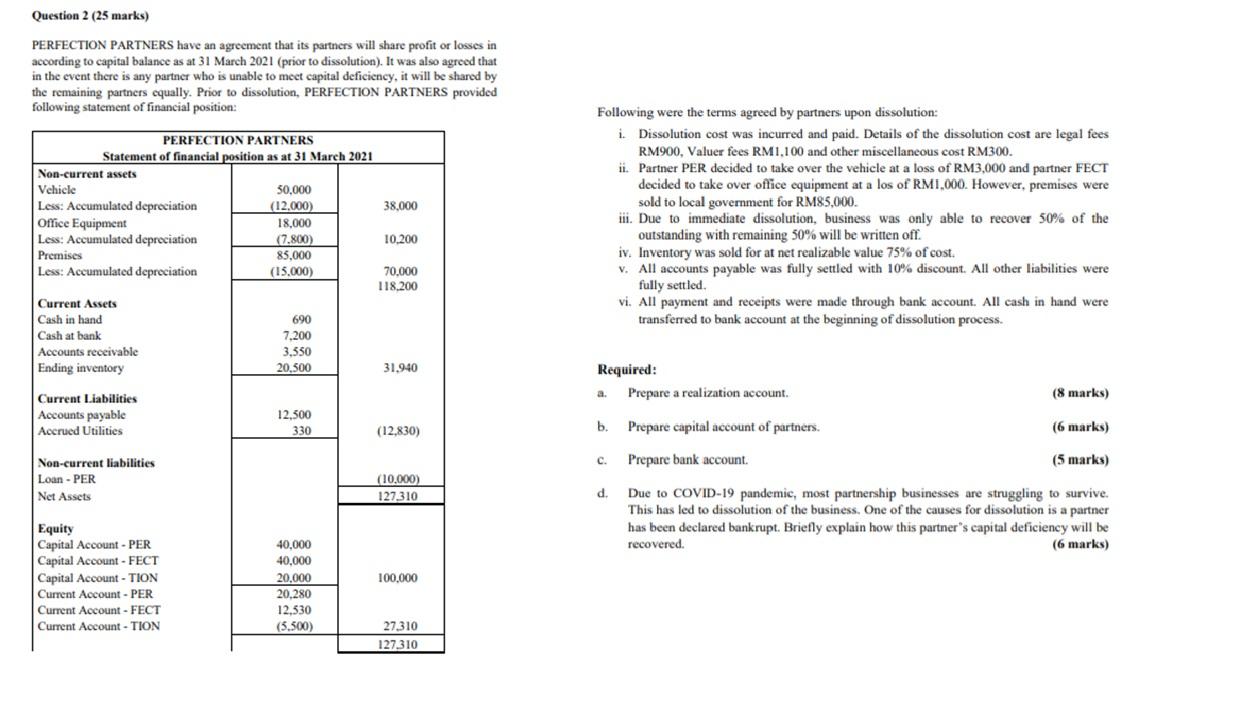

Question 2 (25 marks) PERFECTION PARTNERS have an agreement that its partners will share profit or losses in according to capital balance as at 31 March 2021 (prior to dissolution). It was also agreed that in the event there is any partner who is unable to meet capital deficiency, it will be shared by the remaining partners equally. Prior to dissolution, PERFECTION PARTNERS provided following statement of financial position: PERFECTION PARTNERS Statement of financial position as at 31 March 2021 Non-current assets Vehicle 50,000 Less: Accumulated depreciation (12.000 38.000 Office Equipment 18,000 Less: Accumulated depreciation (7.800) 10.200 Premises 85,000 Less: Accumulated depreciation (15.000) 70,000 118.200 Current Assets Cash in hand 690 Cash at bank 7.200 Accounts receivable 3,550 Ending inventory 20,500 31.940 Following were the terms agreed by partners upon dissolution: i. Dissolution cost was incurred and paid. Details of the dissolution cost are legal fees RM900, Valuer fees RM 1,100 and other miscellaneous cost RM300. ii. Partner PER decided to take over the vehicle at a loss of RM3,000 and partner FECT decided to take over office equipment at a los of RM1,000. However, premises were sold to local government for RM85,000. iii. Due to immediate dissolution, business was only able to recover 50% of the outstanding with remaining 50% will be written off. iv. Inventory was sold for at net realizable value 75% of cost. v. All accounts payable was fully settled with 10% discount. All other liabilities were fully settled. vi. All payment and receipts were made through bank account. All cash in hand were transferred to bank account at the beginning of dissolution process. Required: Prepare a realization account. a (8 marks) Current Liabilities Accounts payable Accrued Utilities 12.500 330 (12.830) b. Prepare capital account of partners. (6 marks) ilities c. Prepare bank account (5 marks) Non-current Loan - PER Net Assets (10.000) 127.310 d. Due to COVID-19 pandemic, most partnership businesses are struggling to survive. This has led to dissolution of the business. One of the causes for dissolution is a partner has been declared bankrupt. Briefly explain how this partner's capital deficiency will be recovered. (6 marks) Equity Capital Account - PER Capital Account -FECT Capital Account - TION Current Account - PER Current Account - FECT Current Account - TION 100.000 40,000 40,000 20.000 20.280 12.530 (5.500) 27.310 127.310