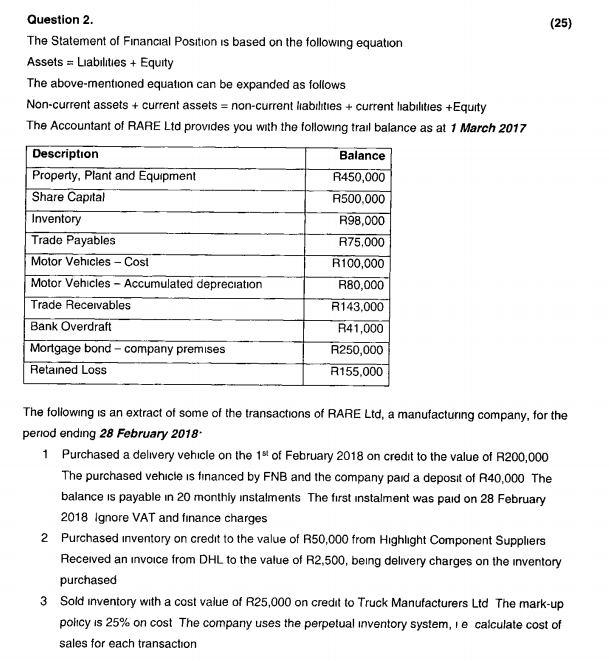

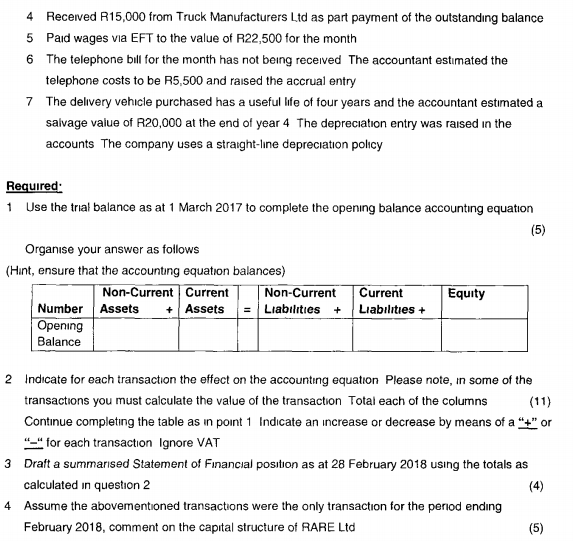

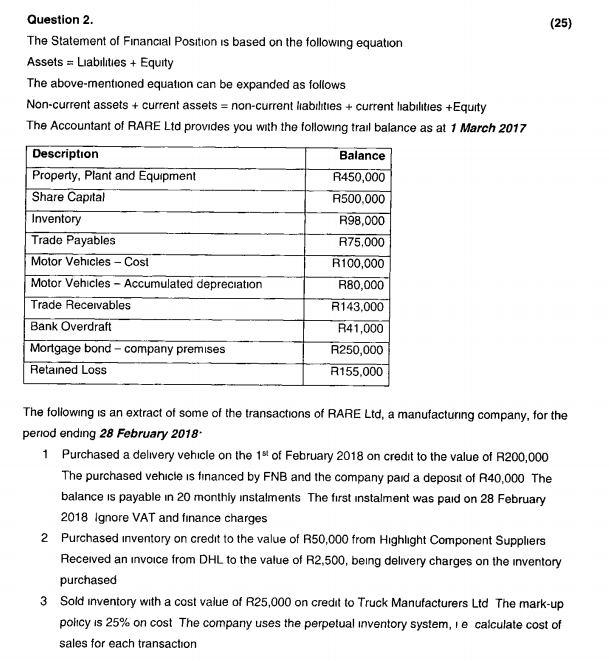

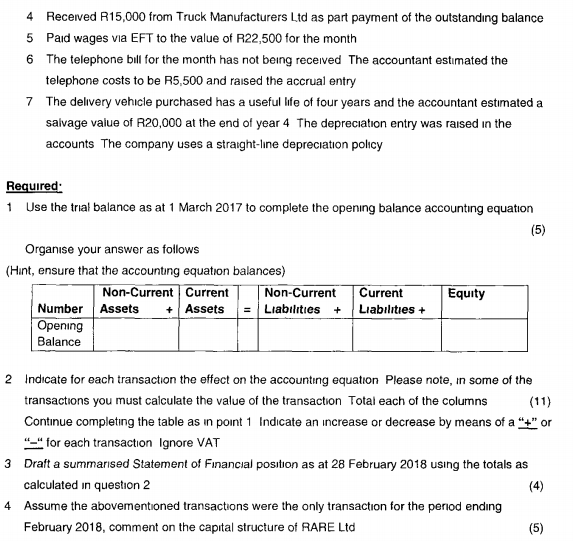

Question 2. (25) The Statement of Finanial Position is based on the following equation AssetsLiabilitiesEquity + The above-mentioned equation can be expanded as follows non-current lablities +current habilities +Equity Non-current assets current assets The Accountant of RARE Ltd provides you with the following tral balance as at 1 March 2017 Description Balance Property, Plant and Equipment R450,000 Share Capital R500,000 Inventory Trade Payables R98,000 R75.000 Motor Vehicles- Cost R100,000 Motor Vehicles Accumulated depreciation R80,000 Trade Recervables R143,000 Bank Overdraft R41,000 Mortgage bond - company premises R250,000 R155,000 Retained Loss The following Is an extract of some of the transactions of RARE Ltd, a manufacturing company, for the period ending 28 February 2018 1 Purchased a delivery vehicle on the 1 of February 2018 on credit to the value of R200,000 The purchased vehicle is financed by FNB and the company paid a deposit of R40,000 The balance is payable in 20 monthly instalments The first instalment was paid on 28 February 2018 lgnore VAT and finance charges Purchased inventory on credit to the value of R50,000 from Highlight Component Suppliers 2 Received an invoice from DHL to the value of R2,500, being delivery charges on the inventory purchased Sold inventory with a cost value of R25,000 on credit to Truck Manufacturers Ltd The mark-up policy is 25% on cost The company uses the perpelual inventory system, 3 C e calculate cost of sales for each transaction Received R15,000 from Truck Manufacturers Ltd as part payment of the outstanding balance 4 5 Paid wages Via EFT to the value of R22,500 for the month The telephone bill for the month has not being received The accountant estimated the 6 telephone costs to be R5,500 and raised the accrual entry The delivery vehicle purchased has a useful life of four years and the accountant estimated 7 a salvage value of R20,000 at the end of year 4 The depreciation entry was raised in the accounts The company uses a straight-ine depreciation policy Required Use the trial balance as at 1 March 2017 to complete the opening balance accounting equation (5) Organise your answer as follows (Hint, ensure that the accounting equation balances) Non-Current Current Current Equity Non-Current Number Assets Assets Liabilities Liabilities+ + + Opening Balance 2 Indicate for each transaction the effect on the accounting equation Please note, in some of the transactions you must calculate the value of the transaction Total each of the columns (11) Continue completing the table as in point 1 Indicate an increase or decrease by means of a "" or "for each transaction Ignore VAT 3 Draft a summarised Statement of Financial position as at 28 February 2018 using the totals as calculated in question 2 (4) 4 Assume the abovementioned transactions were the only transaction for the period ending February 2018, comment on the capital structure of RARE Ltd