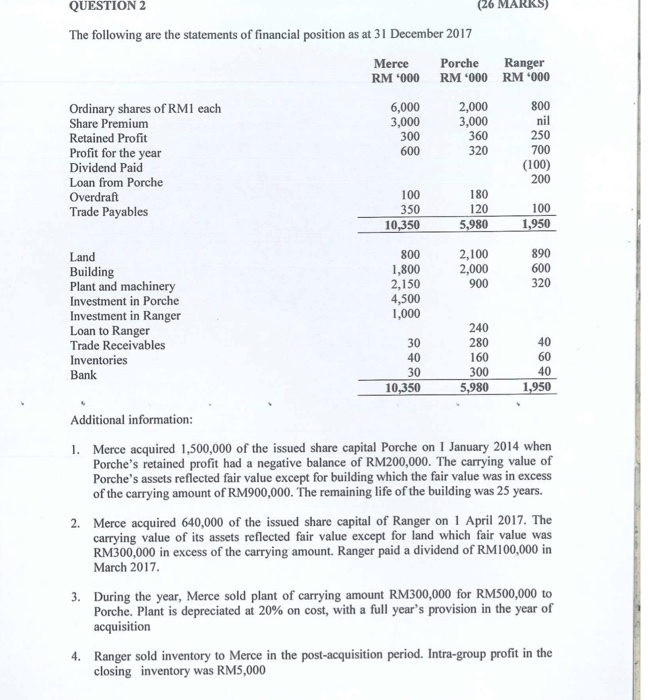

QUESTION 2 (26 MARKS) The following are the statements of financial position as at 31 December 2017 Merce RM 6000 Porche Ranger RM 9000 RM 6000 6,000 3,000 300 600 2,000 3,000 360 320 Ordinary shares of RMI each Share Premium Retained Profit Profit for the year Dividend Paid Loan from Porche Overdraft Trade Payables 800 nil 250 700 (100) 200 100 350 10,350 180 120 5,980 100 1,950 2,100 2,000 900 890 600 Land Building Plant and machinery Investment in Porche Investment in Ranger Loan to Ranger Trade Receivables Inventories Bank 800 1,800 2,150 4,500 1,000 240 280 30 160 300 5,980 10,350 1,950 Additional information: 1. Merce acquired 1,500,000 of the issued share capital Porche on 1 January 2014 when Porche's retained profit had a negative balance of RM200,000. The carrying value of Porche's assets reflected fair value except for building which the fair value was in excess of the carrying amount of RM900,000. The remaining life of the building was 25 years. 2. Merce acquired 640,000 of the issued share capital of Ranger on 1 April 2017. The carrying value of its assets reflected fair value except for land which fair value was RM300,000 in excess of the carrying amount. Ranger paid a dividend of RM100,000 in March 2017 3. During the year, Merce sold plant of carrying amount RM300,000 for RM500,000 to Porche. Plant is depreciated at 20% on cost, with a full year's provision in the year of acquisition 4. Ranger sold inventory to Merce in the post-acquisition period. Intra-group profit in the closing inventory was RM5,000 5. On 1 July 2017, Porche gave a 10% loan to Ranger. It gave a further RM40,000 on 30 December 2017 which has not been recognized by Ranger. Ranger has not accrued the interest on the loan. Required: Prepare the consolidated statement of financial position of Merce Group as at 31 December 2017. Show all relevant workings. (26 marks) QUESTION 2 (26 MARKS) The following are the statements of financial position as at 31 December 2017 Merce RM 6000 Porche Ranger RM 9000 RM 6000 6,000 3,000 300 600 2,000 3,000 360 320 Ordinary shares of RMI each Share Premium Retained Profit Profit for the year Dividend Paid Loan from Porche Overdraft Trade Payables 800 nil 250 700 (100) 200 100 350 10,350 180 120 5,980 100 1,950 2,100 2,000 900 890 600 Land Building Plant and machinery Investment in Porche Investment in Ranger Loan to Ranger Trade Receivables Inventories Bank 800 1,800 2,150 4,500 1,000 240 280 30 160 300 5,980 10,350 1,950 Additional information: 1. Merce acquired 1,500,000 of the issued share capital Porche on 1 January 2014 when Porche's retained profit had a negative balance of RM200,000. The carrying value of Porche's assets reflected fair value except for building which the fair value was in excess of the carrying amount of RM900,000. The remaining life of the building was 25 years. 2. Merce acquired 640,000 of the issued share capital of Ranger on 1 April 2017. The carrying value of its assets reflected fair value except for land which fair value was RM300,000 in excess of the carrying amount. Ranger paid a dividend of RM100,000 in March 2017 3. During the year, Merce sold plant of carrying amount RM300,000 for RM500,000 to Porche. Plant is depreciated at 20% on cost, with a full year's provision in the year of acquisition 4. Ranger sold inventory to Merce in the post-acquisition period. Intra-group profit in the closing inventory was RM5,000 5. On 1 July 2017, Porche gave a 10% loan to Ranger. It gave a further RM40,000 on 30 December 2017 which has not been recognized by Ranger. Ranger has not accrued the interest on the loan. Required: Prepare the consolidated statement of financial position of Merce Group as at 31 December 2017. Show all relevant workings. (26 marks)