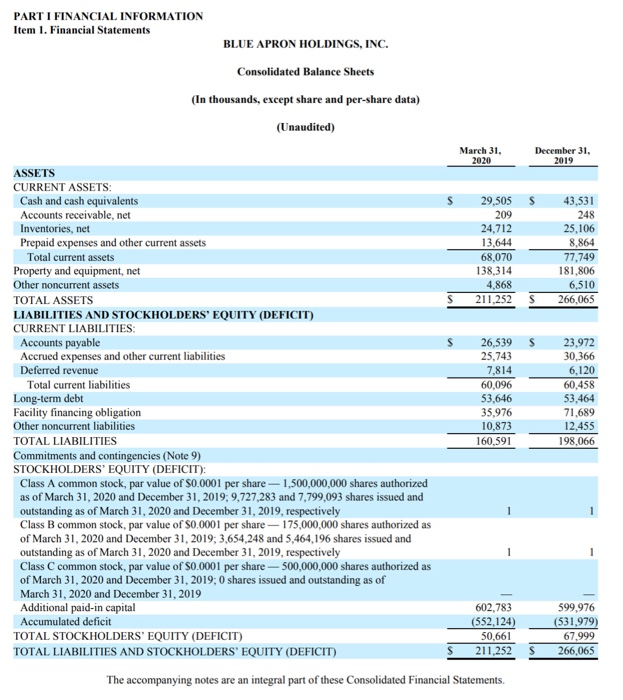

Question #2 - 2a. What is "above the line" and what is "below the line" in reference to reading/interpreting financial statements (provide me components using Blue Apron financials). 2b. Why are each important for the reader of the financial statements? 150 words total December 31, 2019 43,531 248 25,106 8.864 77,749 181,806 6,510 266,065 PART I FINANCIAL INFORMATION Item 1. Financial Statements BLUE APRON HOLDINGS, INC. Consolidated Balance Sheets (In thousands, except share and per-share data) (Unaudited) March 31, 2020 ASSETS CURRENT ASSETS Cash and cash equivalents 29,505 Accounts receivable, net 209 Inventories, net 24,712 Prepaid expenses and other current assets 13,644 Total current assets 68,070 Property and equipment, net 138,314 Other noncurrent assets 4,868 TOTAL ASSETS 211,252 LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) CURRENT LIABILITIES: Accounts payable 26,539 Accrued expenses and other current liabilities 25,743 Deferred revenue 7,814 Total current liabilities 60,096 Long-term debt 53,646 Facility financing obligation 35,976 Other noncurrent liabilities 10,873 TOTAL LIABILITIES 160,591 Commitments and contingencies (Note 9) STOCKHOLDERS' EQUITY (DEFICIT): Class A common stock, par value of $0.0001 per share - 1,500,000,000 shares authorized as of March 31, 2020 and December 31, 2019; 9,727,283 and 7,799,093 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively Class B common stock, par value of 0.0001 per share - 175,000,000 shares authorized as of March 31, 2020 and December 31, 2019: 3,654,248 and 5,464,196 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively Class C common stock, par value of $0.0001 per share 500,000,000 shares authorized as of March 31, 2020 and December 31, 2019; 0 shares issued and outstanding as of March 31, 2020 and December 31, 2019 Additional paid-in capital 602,783 Accumulated deficit (552,124) TOTAL STOCKHOLDERS' EQUITY (DEFICIT) 50,661 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) 211,252 The accompanying notes are an integral part of these Consolidated Financial Statements. 23,972 30,366 6,120 60,458 53,464 71,689 12.455 198,066 599,976 (531,979) 67.999 266,065