Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (30 marks) A- AAA Company accumulates the following data concerning a mixed cost, using miles as the activity level. January February March Miles

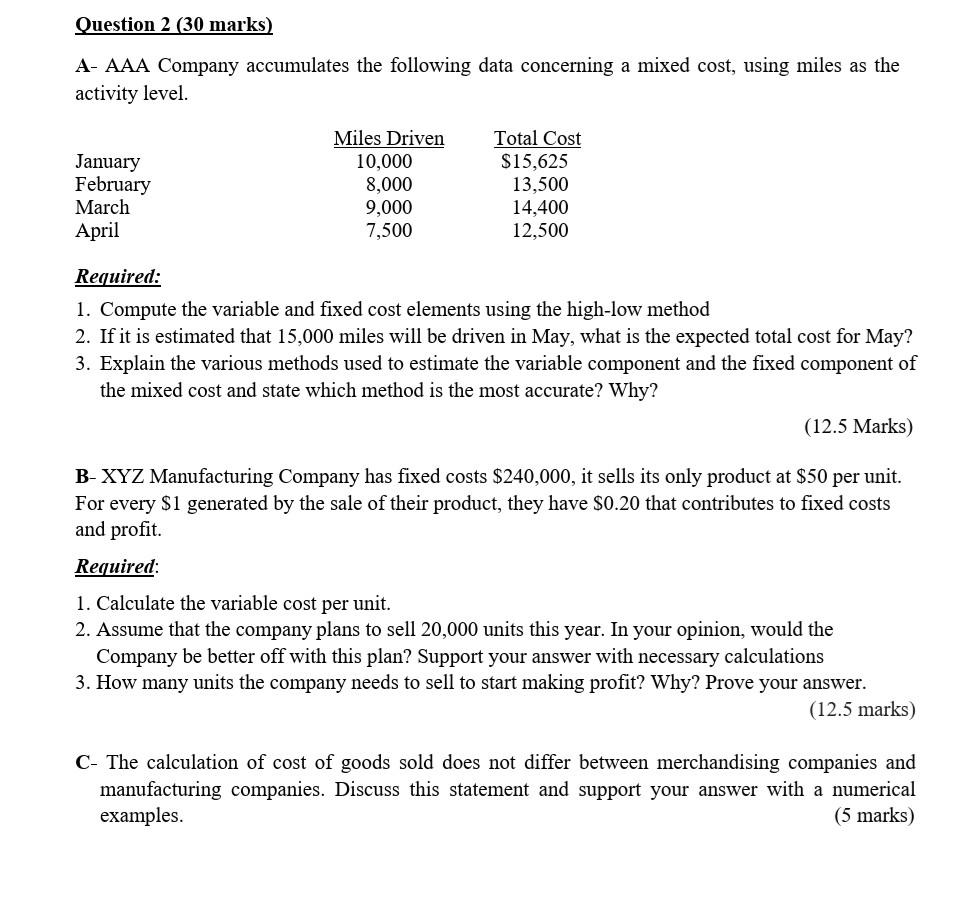

Question 2 (30 marks) A- AAA Company accumulates the following data concerning a mixed cost, using miles as the activity level. January February March Miles Driven 10,000 8,000 9,000 7,500 Total Cost $15,625 13,500 14,400 12,500 April Required: 1. Compute the variable and fixed cost elements using the high-low method 2. If it is estimated that 15,000 miles will be driven in May, what is the expected total cost for May? 3. Explain the various methods used to estimate the variable component and the fixed component of the mixed cost and state which method is the most accurate? Why? (12.5 Marks) B- XYZ Manufacturing Company has fixed costs $240,000, it sells its only product at $50 per unit. For every $1 generated by the sale of their product, they have $0.20 that contributes to fixed costs and profit. Required: 1. Calculate the variable cost per unit. 2. Assume that the company plans to sell 20,000 units this year. In your opinion, would the Company be better off with this plan? Support your answer with necessary calculations 3. How many units the company needs to sell to start making profit? Why? Prove your answer. (12.5 marks) C- The calculation of cost of goods sold does not differ between merchandising companies and manufacturing companies. Discuss this statement and support your answer with a numerical examples

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started