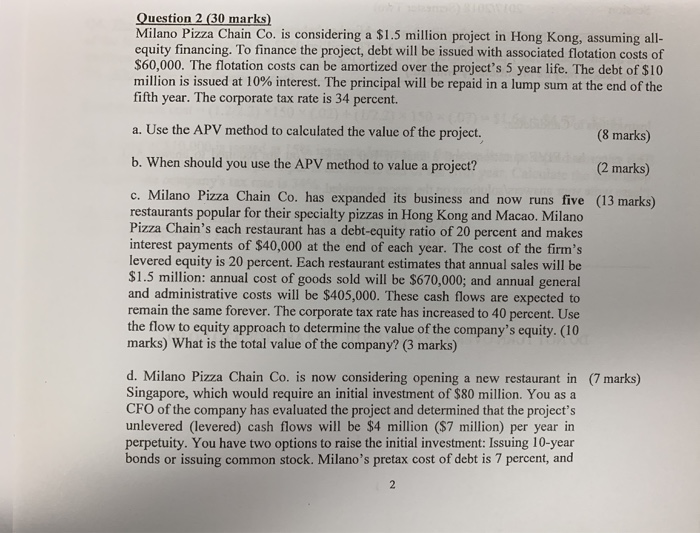

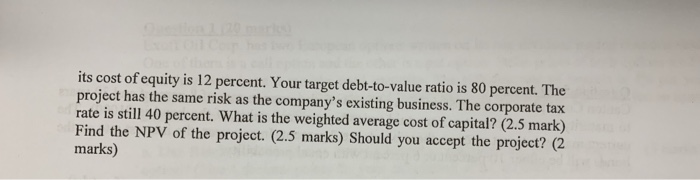

Question 2 (30 marks) Milano Pizza Chain Co. is considering a $1.5 million project in Hong Kong, assuming all- equity financing. To finance the project, debt will be issued with associated flotation costs of $60,000. The flotation costs can be amortized over the project's 5 year life. The debt of $10 million is issued at 10% interest. The principal will be repaid in a lump sum at the end of the fifth year. The corporate tax rate is 34 percent. a. Use the APV method to calculated the value of the project. (8 marks) (2 marks) (13 marks) b. When should you use the APV method to value a project? c. Milano Pizza Chain Co. has expanded its business and now runs five restaurants popular for their specialty pizzas in Hong Kong and Macao. Milano Pizza Chain's each restaurant has a debt-equity ratio of 20 percent and makes interest payments of $40,000 at the end of each year. The cost of the firm's levered equity is 20 percent. Each restaurant estimates that annual sales will be $1.5 million: annual cost of goods sold will be $670,000; and annual general and administrative costs will be $405,000. These cash flows are expected to remain the same forever. The corporate tax rate has increased to 40 percent. Use the flow to equity approach to determine the value of the company's equity. (10 marks) What is the total value of the company? (3 marks) d. Milano Pizza Chain Co. is now considering opening a new restaurant in Singapore, which would require an initial investment of $80 million. You as a CFO of the company has evaluated the project and determined that the project's unlevered (levered) cash flows will be $4 million ($7 million) per year in perpetuity. You have two options to raise the initial investment: Issuing 10-year bonds or issuing common stock. Milano's pretax cost of debt is 7 percent, and (7 marks) its cost of equity is 12 percent. Your target debt-to-value ratio is 80 percent. The project has the same risk as the company's existing business. The corporate tax rate is still 40 percent. What is the weighted average cost of capital? (2.5 mark) Find the NPV of the project. (2.5 marks) Should you accept the project? (2 marks) Question 2 (30 marks) Milano Pizza Chain Co. is considering a $1.5 million project in Hong Kong, assuming all- equity financing. To finance the project, debt will be issued with associated flotation costs of $60,000. The flotation costs can be amortized over the project's 5 year life. The debt of $10 million is issued at 10% interest. The principal will be repaid in a lump sum at the end of the fifth year. The corporate tax rate is 34 percent. a. Use the APV method to calculated the value of the project. (8 marks) (2 marks) (13 marks) b. When should you use the APV method to value a project? c. Milano Pizza Chain Co. has expanded its business and now runs five restaurants popular for their specialty pizzas in Hong Kong and Macao. Milano Pizza Chain's each restaurant has a debt-equity ratio of 20 percent and makes interest payments of $40,000 at the end of each year. The cost of the firm's levered equity is 20 percent. Each restaurant estimates that annual sales will be $1.5 million: annual cost of goods sold will be $670,000; and annual general and administrative costs will be $405,000. These cash flows are expected to remain the same forever. The corporate tax rate has increased to 40 percent. Use the flow to equity approach to determine the value of the company's equity. (10 marks) What is the total value of the company? (3 marks) d. Milano Pizza Chain Co. is now considering opening a new restaurant in Singapore, which would require an initial investment of $80 million. You as a CFO of the company has evaluated the project and determined that the project's unlevered (levered) cash flows will be $4 million ($7 million) per year in perpetuity. You have two options to raise the initial investment: Issuing 10-year bonds or issuing common stock. Milano's pretax cost of debt is 7 percent, and (7 marks) its cost of equity is 12 percent. Your target debt-to-value ratio is 80 percent. The project has the same risk as the company's existing business. The corporate tax rate is still 40 percent. What is the weighted average cost of capital? (2.5 mark) Find the NPV of the project. (2.5 marks) Should you accept the project? (2 marks)