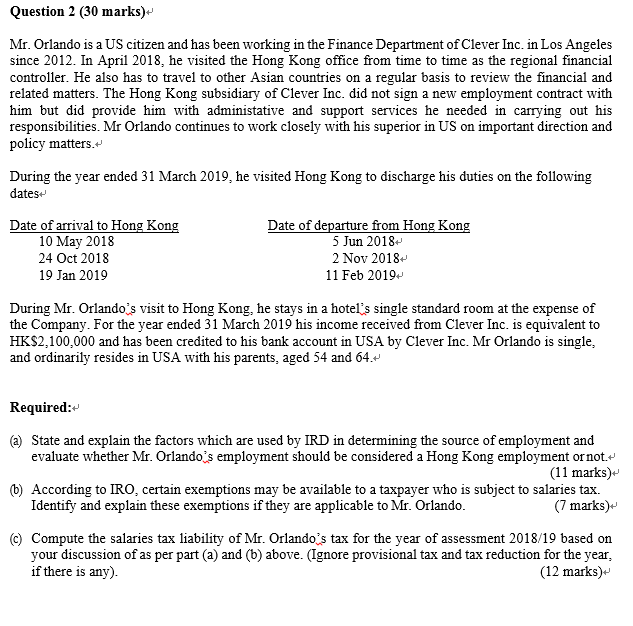

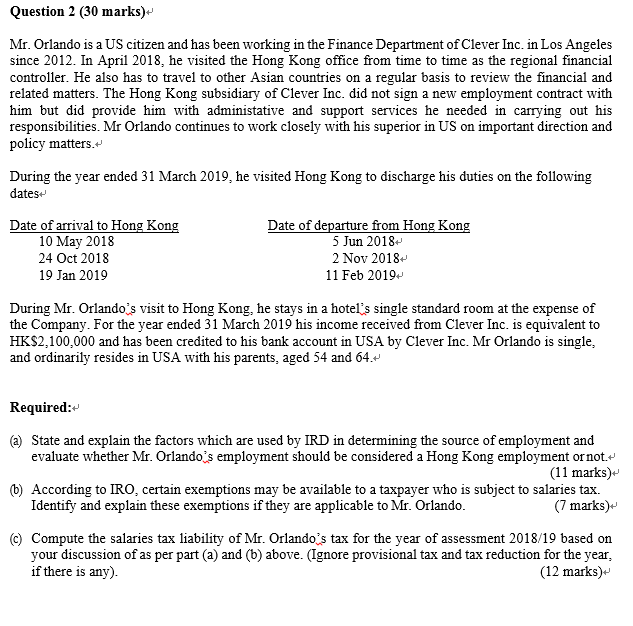

Question 2 (30 marks). Mr. Orlando is a US citizen and has been working in the Finance Department of Clever Inc. in Los Angeles since 2012. In April 2018, he visited the Hong Kong office from time to time as the regional financial controller. He also has to travel to other Asian countries on a regular basis to review the financial and related matters. The Hong Kong subsidiary of Clever Inc. did not sign a new employment contract with him but did provide him with administative and support services he needed in carrying out his responsibilities. Mr Orlando continues to work closely with his superior in US on important direction and policy matters. During the year ended 31 March 2019, he visited Hong Kong to discharge his duties on the following dates Date of arrival to Hong Kong 10 May 2018 Date of departure from Hong Kong 5 Jun 2018 2 Nov 2018 24 Oct 2018 19 Jan 2019 11 Feb 2019 During Mr. Orlando's visit to Hong Kong, he stays in a hotel's single standard room at the expense of the Company. For the year ended 31 March 2019 his income received from Clever Inc. is equivalent to HK$2,100,000 and has been credited to his bank account in USA by Clever Inc. Mr Orlando is single, and ordinarily resides in USA with his parents, aged 54 and 64. 2 Required: a)State and explain the factors which are used by IRD in determining the source of employment and evaluate whether Mr. Orlando's employment should be considered a Hong Kong employment ornot (11 marks) (b) According to IRO, certain exemptions may be available to a taxpayer who is subject to salaries tax (7 marks) Identify and explain these exemptions if they are applicable to Mr. Orlando (c) Compute the salaries tax liability of Mr. Orlando^s tax for the year of assessment 2018/19 based on your discussion of as per part (a) and (b) above. (Ignore provisional tax and tax reduction for the year if there is any) (12 marks) Question 2 (30 marks). Mr. Orlando is a US citizen and has been working in the Finance Department of Clever Inc. in Los Angeles since 2012. In April 2018, he visited the Hong Kong office from time to time as the regional financial controller. He also has to travel to other Asian countries on a regular basis to review the financial and related matters. The Hong Kong subsidiary of Clever Inc. did not sign a new employment contract with him but did provide him with administative and support services he needed in carrying out his responsibilities. Mr Orlando continues to work closely with his superior in US on important direction and policy matters. During the year ended 31 March 2019, he visited Hong Kong to discharge his duties on the following dates Date of arrival to Hong Kong 10 May 2018 Date of departure from Hong Kong 5 Jun 2018 2 Nov 2018 24 Oct 2018 19 Jan 2019 11 Feb 2019 During Mr. Orlando's visit to Hong Kong, he stays in a hotel's single standard room at the expense of the Company. For the year ended 31 March 2019 his income received from Clever Inc. is equivalent to HK$2,100,000 and has been credited to his bank account in USA by Clever Inc. Mr Orlando is single, and ordinarily resides in USA with his parents, aged 54 and 64. 2 Required: a)State and explain the factors which are used by IRD in determining the source of employment and evaluate whether Mr. Orlando's employment should be considered a Hong Kong employment ornot (11 marks) (b) According to IRO, certain exemptions may be available to a taxpayer who is subject to salaries tax (7 marks) Identify and explain these exemptions if they are applicable to Mr. Orlando (c) Compute the salaries tax liability of Mr. Orlando^s tax for the year of assessment 2018/19 based on your discussion of as per part (a) and (b) above. (Ignore provisional tax and tax reduction for the year if there is any) (12 marks)