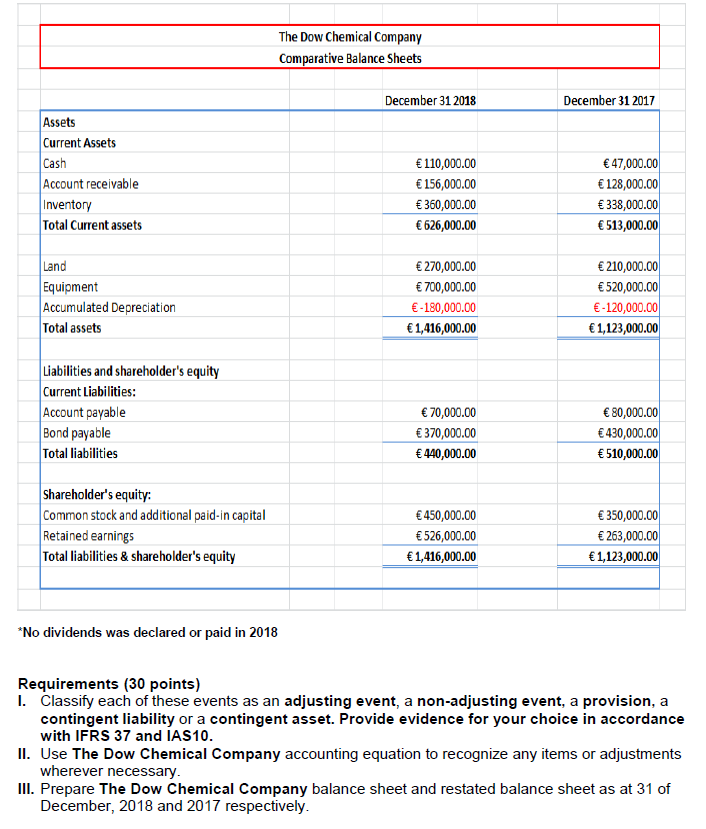

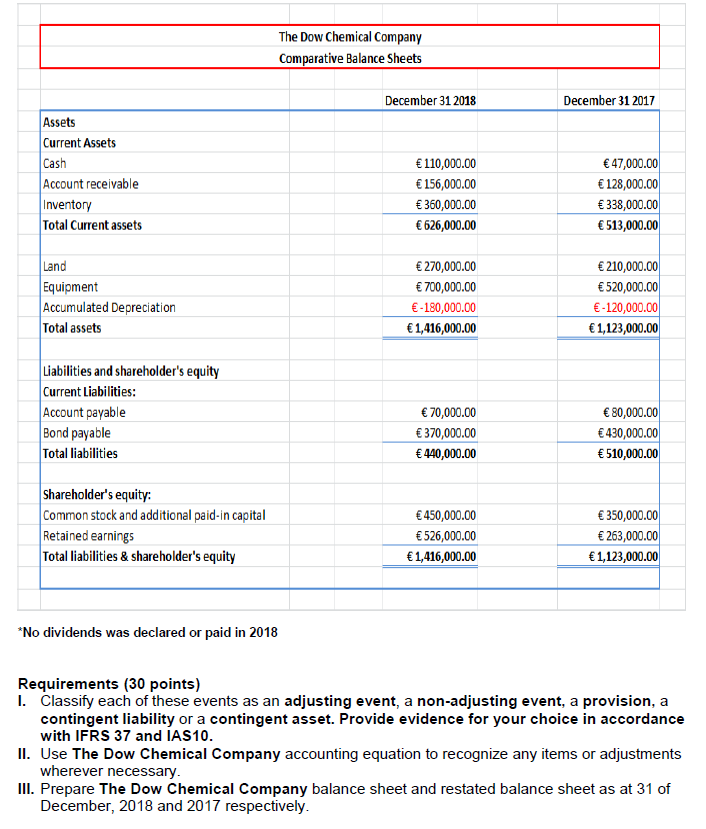

Question 2 (30 points) The Dow Chemical Company prepares its financial statement as at 31 of December each year. Some of the below events occurred after 31st of December, 2018 but before the financial statements as at 31st of December, 2018 were authorized for issue. Other events occur during the 2018 accounting period but the firm's accountants are not sure whether to make provision, disclose contingent liabilities or assets. a. A customer who owes an amount of 20,000 was declared bankrupt on January 1 2019. b. On the 21 of December, 2018 the current government announced a review of current tax rate from 0% to 20%. Therefore, the tax bill is expected to be enacted by January 21, 2019. c. Internal control audit uncovers material discrepancies between amount of payments to vendors and actual inventories of goods received. Further investigation reveals that about 30,000 was fraudulently transfer to a fictitious company. Two-third of this amount relates to 2018 and the remaining relates to 2019. Half of the amount relating to 2018 was allocated to goods sold in 2018. d. The Dow Chemical Company discovers that it main chemical filters were installed incorrectly. This has cost the company 20% of its inventory. The company is suing the original contractor for this amount plus an estimated amount of 5,000 to reinstall the filter correctly. The firm corporate and legal department advised that it is highly probable the firm will win the case. e. The company acquires another company on the 2nd of January, 2019. f. The company's Equipment shown as at 31st of December was disposed for 500,000. g. As a result of legal damages and environmental rectification costs The Dow Chemical Company had to pay in the last five years. The company have decided at the beginning 2017 to move its chemical plants from United States of America to The Republic of Madagascar. Unlike United States, Madagascar has no comprehensive regulations requiring companies to rectify their environmental damages. The total costs of environmental damages are estimated to be 15,000 in 2018 and 10,000 in 2019. h. As from 2018 The Dow Chemical Company sells its chemical equipment with a 3 year warranty and estimates that there is a 25% chance that warranty claim will cost 300,000. However, there is a 40% chance that the cost will be 200,000 and 35% chance that the cost will be 100,000. i. On July 1 2018 The Dow Chemical Company signed a 5 years' non-cancellable lease agreement for an office building. After just few months of exponential growth, the building becomes too small. Therefore, the firm management decided to move to a much spacious office building. The original lease payment on the old building was 725 pay year and the building can neither be sublet nor used for any other purpose. The rate of interest implicit in this lease is 5.79 percent. The Dow Chemical Company Comparative Balance Sheets December 31 2018 December 31 2017 Assets Current Assets Cash Account receivable Inventory Total Current assets 110,000.00 156,000.00 360,000.00 626,000.00 47,000.00 128,000.00 338,000.00 513,000.00 Land Equipment Accumulated Depreciation Total assets 270,000.00 700,000.00 -180,000.00 1,416,000.00 210,000.00 520,000.00 -120,000.00 1,123,000.00 Liabilities and shareholder's equity Current Liabilities: Account payable Bond payable Total liabilities 70,000.00 370,000.00 440,000.00 80,000.00 430,000.00 510,000.00 Shareholder's equity: Common stock and additional paid-in capital Retained earnings Total liabilities & shareholder's equity 450,000.00 526,000.00 1,416,000.00 350,000.00 263,000.00 1,123,000.00 *No dividends was declared or paid in 2018 Requirements (30 points) 1. Classify each of these events as an adjusting event, a non-adjusting event, a provision, a contingent liability or a contingent asset. Provide evidence for your choice in accordance with IFRS 37 and IAS10. II. Use The Dow Chemical Company accounting equation to recognize any items or adjustments wherever necessary. III. Prepare The Dow Chemical Company balance sheet and restated balance sheet as at 31 of December, 2018 and 2017 respectively. Question 2 (30 points) The Dow Chemical Company prepares its financial statement as at 31 of December each year. Some of the below events occurred after 31st of December, 2018 but before the financial statements as at 31st of December, 2018 were authorized for issue. Other events occur during the 2018 accounting period but the firm's accountants are not sure whether to make provision, disclose contingent liabilities or assets. a. A customer who owes an amount of 20,000 was declared bankrupt on January 1 2019. b. On the 21 of December, 2018 the current government announced a review of current tax rate from 0% to 20%. Therefore, the tax bill is expected to be enacted by January 21, 2019. c. Internal control audit uncovers material discrepancies between amount of payments to vendors and actual inventories of goods received. Further investigation reveals that about 30,000 was fraudulently transfer to a fictitious company. Two-third of this amount relates to 2018 and the remaining relates to 2019. Half of the amount relating to 2018 was allocated to goods sold in 2018. d. The Dow Chemical Company discovers that it main chemical filters were installed incorrectly. This has cost the company 20% of its inventory. The company is suing the original contractor for this amount plus an estimated amount of 5,000 to reinstall the filter correctly. The firm corporate and legal department advised that it is highly probable the firm will win the case. e. The company acquires another company on the 2nd of January, 2019. f. The company's Equipment shown as at 31st of December was disposed for 500,000. g. As a result of legal damages and environmental rectification costs The Dow Chemical Company had to pay in the last five years. The company have decided at the beginning 2017 to move its chemical plants from United States of America to The Republic of Madagascar. Unlike United States, Madagascar has no comprehensive regulations requiring companies to rectify their environmental damages. The total costs of environmental damages are estimated to be 15,000 in 2018 and 10,000 in 2019. h. As from 2018 The Dow Chemical Company sells its chemical equipment with a 3 year warranty and estimates that there is a 25% chance that warranty claim will cost 300,000. However, there is a 40% chance that the cost will be 200,000 and 35% chance that the cost will be 100,000. i. On July 1 2018 The Dow Chemical Company signed a 5 years' non-cancellable lease agreement for an office building. After just few months of exponential growth, the building becomes too small. Therefore, the firm management decided to move to a much spacious office building. The original lease payment on the old building was 725 pay year and the building can neither be sublet nor used for any other purpose. The rate of interest implicit in this lease is 5.79 percent. The Dow Chemical Company Comparative Balance Sheets December 31 2018 December 31 2017 Assets Current Assets Cash Account receivable Inventory Total Current assets 110,000.00 156,000.00 360,000.00 626,000.00 47,000.00 128,000.00 338,000.00 513,000.00 Land Equipment Accumulated Depreciation Total assets 270,000.00 700,000.00 -180,000.00 1,416,000.00 210,000.00 520,000.00 -120,000.00 1,123,000.00 Liabilities and shareholder's equity Current Liabilities: Account payable Bond payable Total liabilities 70,000.00 370,000.00 440,000.00 80,000.00 430,000.00 510,000.00 Shareholder's equity: Common stock and additional paid-in capital Retained earnings Total liabilities & shareholder's equity 450,000.00 526,000.00 1,416,000.00 350,000.00 263,000.00 1,123,000.00 *No dividends was declared or paid in 2018 Requirements (30 points) 1. Classify each of these events as an adjusting event, a non-adjusting event, a provision, a contingent liability or a contingent asset. Provide evidence for your choice in accordance with IFRS 37 and IAS10. II. Use The Dow Chemical Company accounting equation to recognize any items or adjustments wherever necessary. III. Prepare The Dow Chemical Company balance sheet and restated balance sheet as at 31 of December, 2018 and 2017 respectively