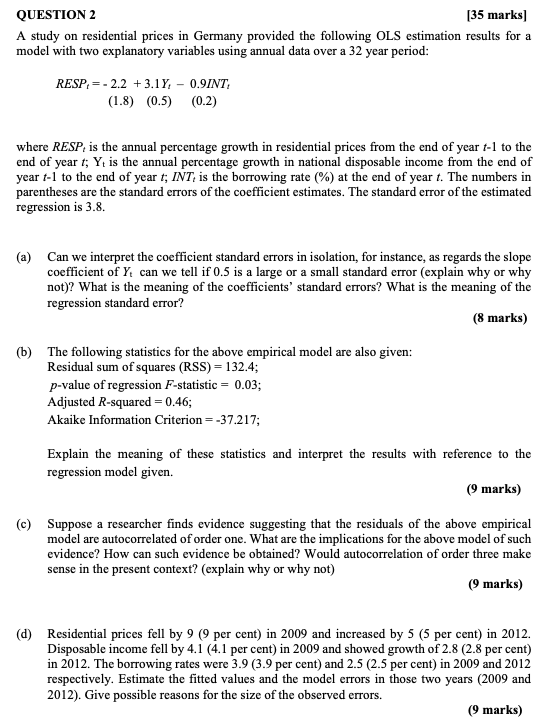

QUESTION 2 [35 marks] A study on residential prices in Germany provided the following OLS estimation results for a model with two explanatory variables using annual data over a 32 year period: RESP, = - 2.2 + 3.1Y, - 0.9INT, (1.8) (0.5) (0.2) where RESP, is the annual percentage growth in residential prices from the end of year f-1 to the end of year f; Yt is the annual percentage growth in national disposable income from the end of year f-1 to the end of year t; INT, is the borrowing rate (%) at the end of year f. The numbers in parentheses are the standard errors of the coefficient estimates. The standard error of the estimated regression is 3.8. (a) Can we interpret the coefficient standard errors in isolation, for instance, as regards the slope coefficient of It can we tell if 0.5 is a large or a small standard error (explain why or why not)? What is the meaning of the coefficients' standard errors? What is the meaning of the regression standard error? (8 marks) (b) The following statistics for the above empirical model are also given: Residual sum of squares (RSS) = 132.4; p-value of regression F-statistic = 0.03; Adjusted R-squared = 0.46; Akaike Information Criterion = -37.217; Explain the meaning of these statistics and interpret the results with reference to the regression model given. (9 marks) (c) Suppose a researcher finds evidence suggesting that the residuals of the above empirical model are autocorrelated of order one. What are the implications for the above model of such evidence? How can such evidence be obtained? Would autocorrelation of order three make sense in the present context? (explain why or why not) (9 marks) (d) Residential prices fell by 9 (9 per cent) in 2009 and increased by 5 (5 per cent) in 2012. Disposable income fell by 4.1 (4.1 per cent) in 2009 and showed growth of 2.8 (2.8 per cent) in 2012. The borrowing rates were 3.9 (3.9 per cent) and 2.5 (2.5 per cent) in 2009 and 2012 respectively. Estimate the fitted values and the model errors in those two years (2009 and 2012). Give possible reasons for the size of the observed errors. (9 marks)