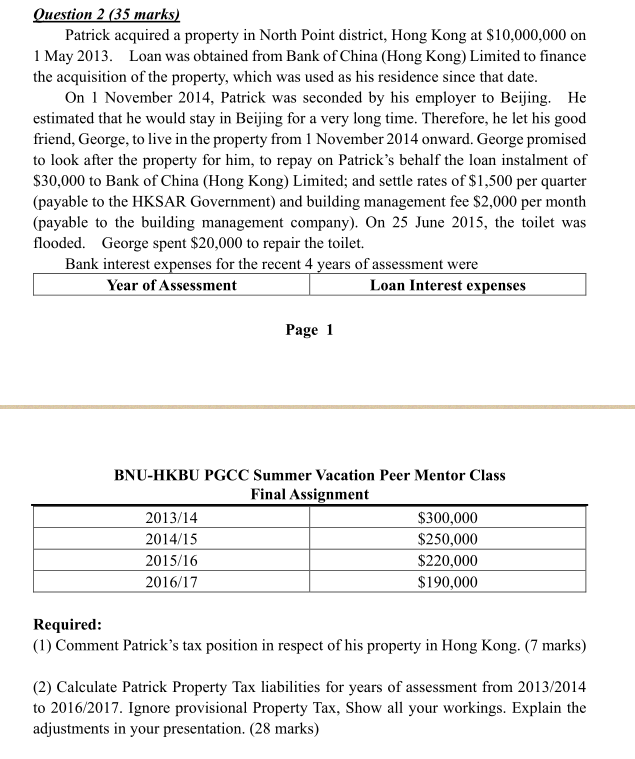

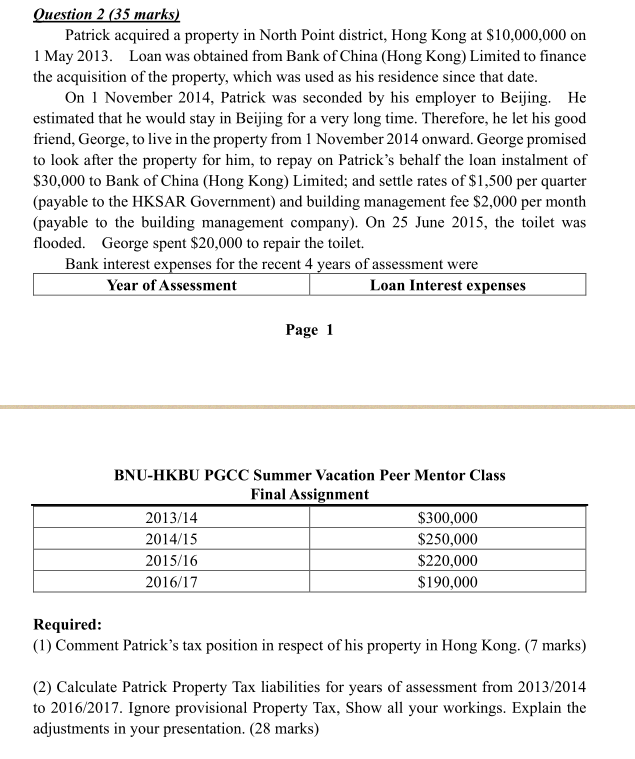

Question 2 (35 marks) Patrick acquired a property in North Point district, Hong Kong at $10,000,000 on 1 May 2013. Loan was obtained from Bank of China (Hong Kong) Limited to finance the acquisition of the property, which was used as his residence since that date. On 1 November 2014, Patrick was seconded by his employer to Beijing. He estimated that he would stay in Beijing for a very long time. Therefore, he let his good friend, George, to live in the property from 1 November 2014 onward. George promised to look after the property for him, to repay on Patrick's behalf the loan instalment of $30,000 to Bank of China (Hong Kong) Limited; and settle rates of $1,500 per quarter (payable to the HKSAR Government) and building management fee $2,000 per month (payable to the building management company). On 25 June 2015, the toilet was flooded. George spent $20,000 to repair the toilet. Bank interest expenses for the recent 4 years of assessment were Year of Assessment Loan Interest expenses Page 1 BNU-HKBU PGCC Summer Vacation Peer Mentor Class Final Assignment 2013/14 $300,000 2014/15 $250,000 2015/16 $220,000 2016/17 $190,000 Required: (1) Comment Patrick's tax position in respect of his property in Hong Kong. (7 marks) (2) Calculate Patrick Property Tax liabilities for years of assessment from 2013/2014 to 2016/2017. Ignore provisional Property Tax, Show all your workings. Explain the adjustments in your presentation. (28 marks) Question 2 (35 marks) Patrick acquired a property in North Point district, Hong Kong at $10,000,000 on 1 May 2013. Loan was obtained from Bank of China (Hong Kong) Limited to finance the acquisition of the property, which was used as his residence since that date. On 1 November 2014, Patrick was seconded by his employer to Beijing. He estimated that he would stay in Beijing for a very long time. Therefore, he let his good friend, George, to live in the property from 1 November 2014 onward. George promised to look after the property for him, to repay on Patrick's behalf the loan instalment of $30,000 to Bank of China (Hong Kong) Limited; and settle rates of $1,500 per quarter (payable to the HKSAR Government) and building management fee $2,000 per month (payable to the building management company). On 25 June 2015, the toilet was flooded. George spent $20,000 to repair the toilet. Bank interest expenses for the recent 4 years of assessment were Year of Assessment Loan Interest expenses Page 1 BNU-HKBU PGCC Summer Vacation Peer Mentor Class Final Assignment 2013/14 $300,000 2014/15 $250,000 2015/16 $220,000 2016/17 $190,000 Required: (1) Comment Patrick's tax position in respect of his property in Hong Kong. (7 marks) (2) Calculate Patrick Property Tax liabilities for years of assessment from 2013/2014 to 2016/2017. Ignore provisional Property Tax, Show all your workings. Explain the adjustments in your presentation. (28 marks)