Answered step by step

Verified Expert Solution

Question

1 Approved Answer

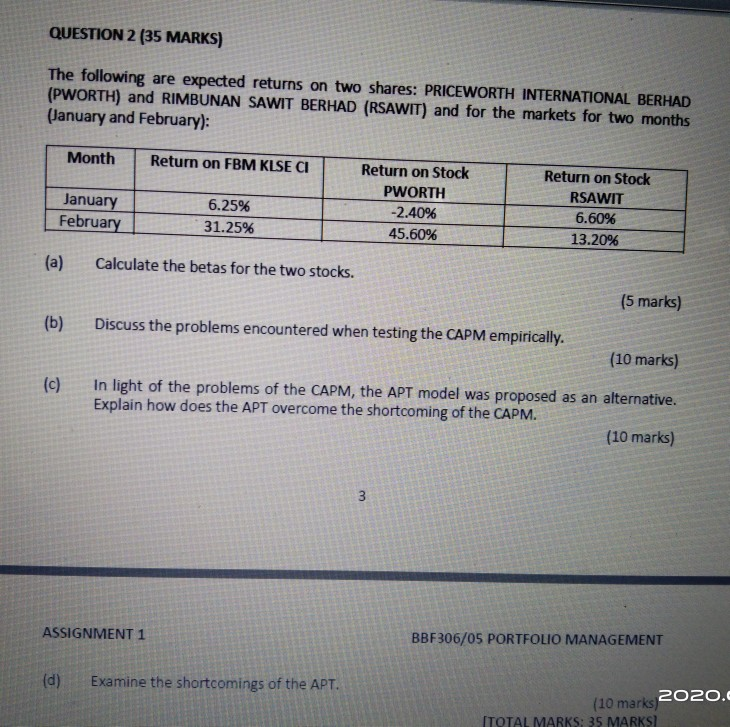

QUESTION 2 (35 MARKS) The following are expected returns on two shares: PRICEWORTH INTERNATIONAL BERHAD (PWORTH) and RIMBUNAN SAWIT BERHAD (RSAWIT) and for the markets

QUESTION 2 (35 MARKS) The following are expected returns on two shares: PRICEWORTH INTERNATIONAL BERHAD (PWORTH) and RIMBUNAN SAWIT BERHAD (RSAWIT) and for the markets for two months (January and February): Month Return on FBM KLSE CI Return on Stock PWORTH -2.40% 45.60% Return on Stock RSAWIT 6.60% 13.20% January February 6.25% * 31.25% (a) Calculate the betas for the two stocks. (5 marks) (b) Discuss the problems encountered when testing the CAPM empirically. (10 marks) In light of the problems of the CAPM, the APT model was proposed as an alternative. Explain how does the APT overcome the shortcoming of the CAPM. (10 marks) ASSIGNMENT 1 BBF306/05 PORTFOLIO MANAGEMENT (d) Examine the shortcomings of the APT. (10 marks 2020 TOTAL MARKS: 35 MARKSI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started