Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 [35 points] A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.20 times

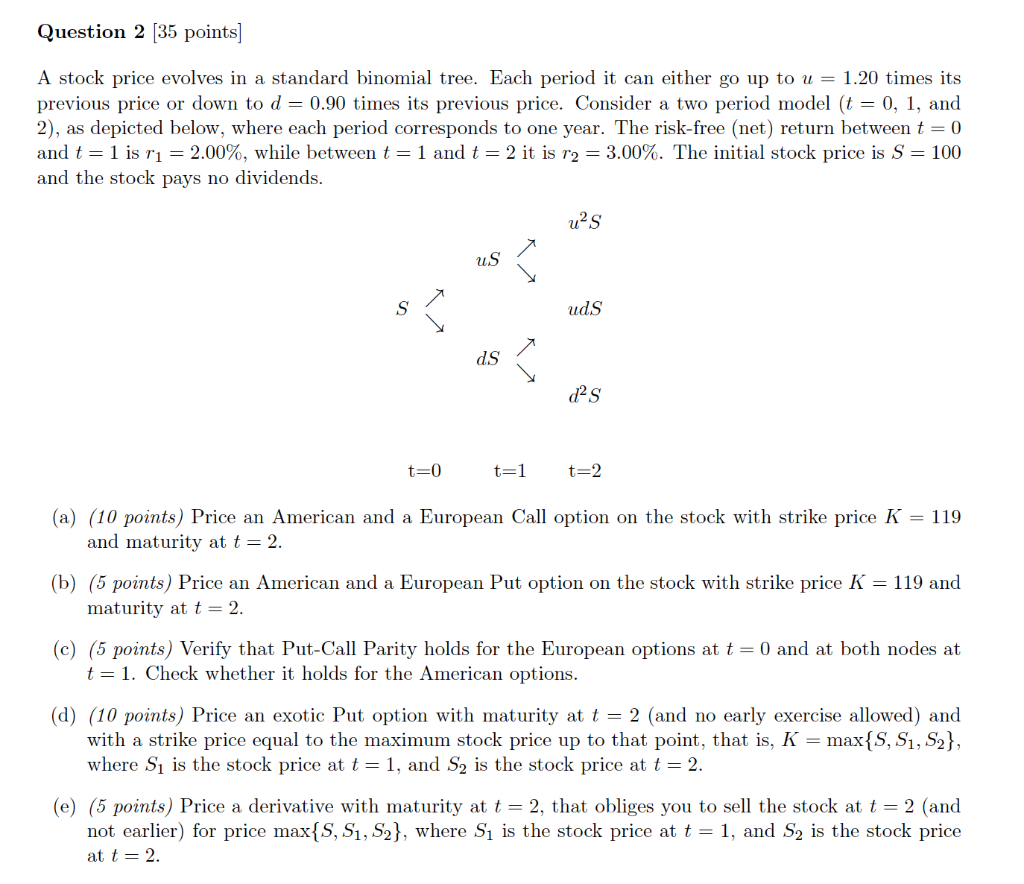

Question 2 [35 points] A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.20 times its previous price or down to d = 0.90 times its previous price. Consider a two period model (t = 0, 1, and 2), as depicted below, where each period corresponds to one year. The risk-free (net) return between t = 0 and t = 1 is r = 2.00%, while between t = 1 and t = 2 it is r2 = 3.00%. The initial stock price is S = 100 and the stock pays no dividends. uS us S ud.S d s t=0 t=1 t=2 (a) (10 points) Price an American and a European Call option on the stock with strike price K = 119 and maturity at t = 2. (b) (5 points) Price an American and a European Put option on the stock with strike price K = 119 and maturity at t = 2. (c) (5 points) Verify that Put-Call Parity holds for the European options at t = 0 and at both nodes at t = 1. Check whether it holds for the American options. (d) (10 points) Price an exotic Put option with maturity at t = 2 (and no early exercise allowed) and with a strike price equal to the maximum stock price up to that point, that is, K = max{S, S, S}, where S is the stock price at t = 1, and S is the stock price at t = 2. (e) (5 points) Price a derivative with maturity at t = 2, that obliges you to sell the stock at t = 2 (and not earlier) for price max{S, S, S2}, where S is the stock price at t = 1, and S is the stock price at t = 2. ds Question 2 [35 points] A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.20 times its previous price or down to d = 0.90 times its previous price. Consider a two period model (t = 0, 1, and 2), as depicted below, where each period corresponds to one year. The risk-free (net) return between t = 0 and t = 1 is r = 2.00%, while between t = 1 and t = 2 it is r2 = 3.00%. The initial stock price is S = 100 and the stock pays no dividends. uS us S ud.S d s t=0 t=1 t=2 (a) (10 points) Price an American and a European Call option on the stock with strike price K = 119 and maturity at t = 2. (b) (5 points) Price an American and a European Put option on the stock with strike price K = 119 and maturity at t = 2. (c) (5 points) Verify that Put-Call Parity holds for the European options at t = 0 and at both nodes at t = 1. Check whether it holds for the American options. (d) (10 points) Price an exotic Put option with maturity at t = 2 (and no early exercise allowed) and with a strike price equal to the maximum stock price up to that point, that is, K = max{S, S, S}, where S is the stock price at t = 1, and S is the stock price at t = 2. (e) (5 points) Price a derivative with maturity at t = 2, that obliges you to sell the stock at t = 2 (and not earlier) for price max{S, S, S2}, where S is the stock price at t = 1, and S is the stock price at t = 2. ds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started