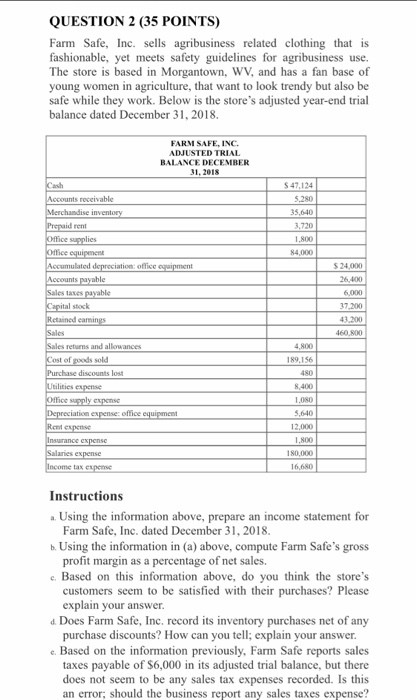

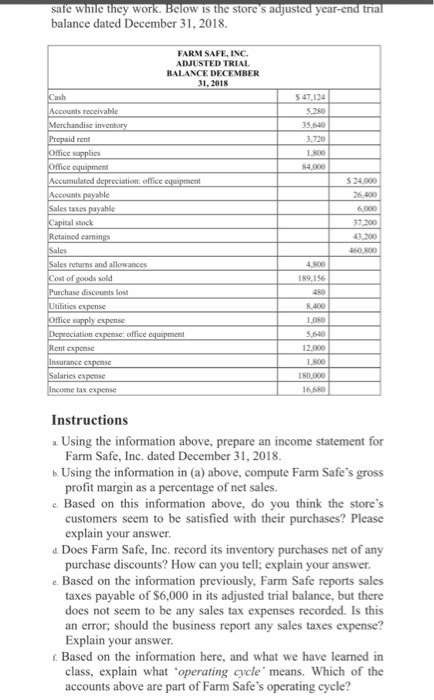

QUESTION 2 (35 POINTS) Farm Safe, Inc. sells agribusiness related clothing that is fashionable, yet meets safety guidelines for agribusiness use. The store is based in Morgantown, WV, and has a fan base of young women in agriculture, that want to look trendy but also be safe while they work. Below is the store's adjusted year-end trial balance dated December 31, 2018. FARM SAFE, INC. ADJUSTED TRIAL BALANCE DECEMBER 31. 2018 Accounts receive Merchandise inventory Prepaid rent Office supplies Office equipment Accumulated depreciation office equipment Accounts payable Sales taxes payable Capital stock Retained earnings Sales Sales returns and allowances Cost of goods sold Purchase discounts lost Utilities en pense Office supply expense Depreciation expense office equipment Rowen Insurance expense Salaries expense Income tax per 189 156 LOND 1.800 180.000 Instructions Using the information above, prepare an income statement for Farm Safe, Inc. dated December 31, 2018 Using the information in (a) above, compute Farm Safe's gross profit margin as a percentage of net sales. c. Based on this information above, do you think the store's customers seem to be satisfied with their purchases? Please explain your answer. Does Farm Safe, Inc. record its inventory purchases net of any purchase discounts? How can you tell; explain your answer. e. Based on the information previously, Farm Safe reports sales taxes payable of $6,000 in its adjusted trial balance, but there does not seem to be any sales tax expenses recorded. Is this an error, should the business report any sales taxes expense? sale while they work. Below is the stores adjusted year-end trial balance dated December 31, 2018. FARM SAFE.INC ADJUSTED TRIAL BALANCE DECEMBER 31, 2018 1560 2600 17200 41200 Accounts receive Merchandic Prepaid rent Office wpis Office qui Assud de office Ace Sales and he Capital Mack Retained carings Sales Sales returns and allowances Cost of ads sold Purchase discounts lost Utilities expense Office supply expense Depreciation expense office equipment Rent expense Insurance expense Salaries expense Income tax expense 4.800 1080 5.640 180.000 16.680 Instructions 1. Using the information above, prepare an income statement for Farm Safe, Inc. dated December 31, 2018. Using the information in (a) above, compute Farm Safe's gross profit margin as a percentage of net sales. c. Based on this information above, do you think the store's customers seem to be satisfied with their purchases? Please explain your answer. Does Farm Safe, Inc. record its inventory purchases net of any purchase discounts? How can you tell: explain your answer. e. Based on the information previously, Farm Safe reports sales taxes payable of $6,000 in its adjusted trial balance, but there does not seem to be any sales tax expenses recorded. Is this an error, should the business report any sales taxes expense? Explain your answer. Based on the information here, and what we have learned in class, explain what operating cycle' means. Which of the accounts above are part of Farm Safe's operating cycle