Answered step by step

Verified Expert Solution

Question

1 Approved Answer

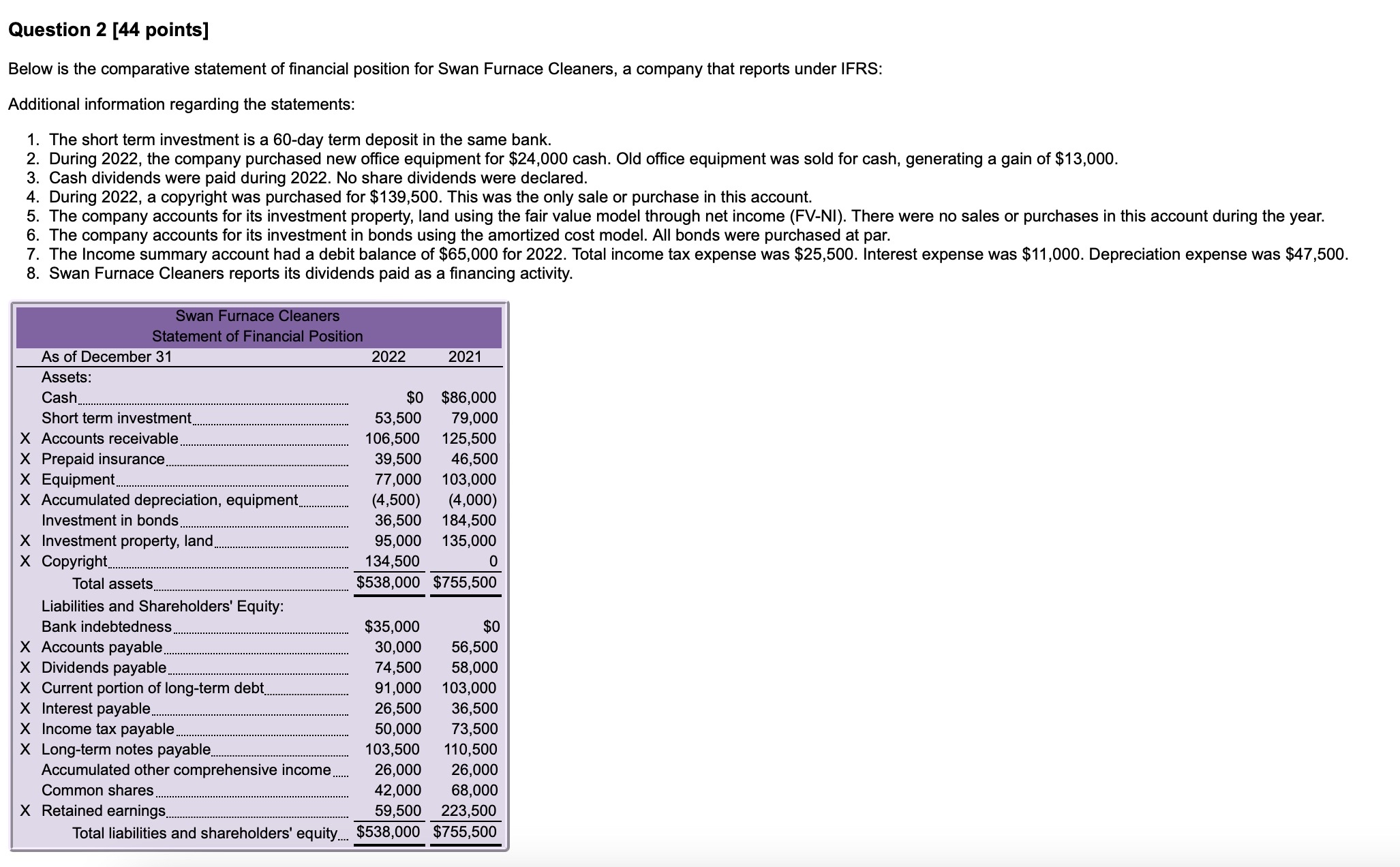

Question 2 [ 4 4 points ] Below is the comparative statement of financial position for Swan Furnace Cleaners, a company that reports under IFRS:

Question points

Below is the comparative statement of financial position for Swan Furnace Cleaners, a company that reports under IFRS:

Additional information regarding the statements:

The short term investment is a day term deposit in the same bank.

During the company purchased new office equipment for $ cash. Old office equipment was sold for cash, generating a gain of $

Cash dividends were paid during No share dividends were declared.

During a copyright was purchased for $ This was the only sale or purchase in this account.

The company accounts for its investment property, land using the fair value model through net income FVNI There were no sales or purchases in this account during the year.

The company accounts for its investment in bonds using the amortized cost model. All bonds were purchased at par.

The Income summary account had a debit balance of $ for Total income tax expense was $ Interest expense was $ Depreciation expense was $

Swan Furnace Cleaners reports its dividends paid as a financing activity.

tabletableSwan Furnace CleanersStatement of Financial PositionAs of December Assets:,,Cash.,$$Short term investment...,XAccounts receivable.,XPrepaid insurance.,XEquipment.,XAccumulated depreciation, equipment.............,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started