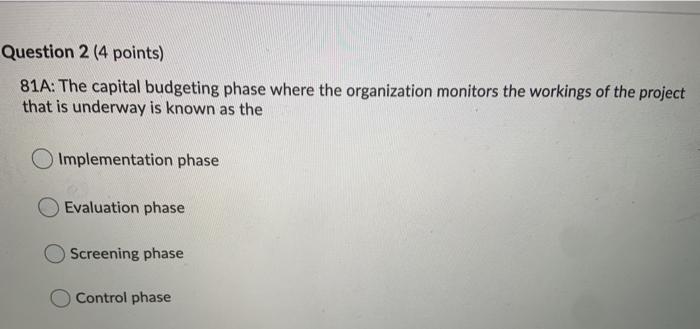

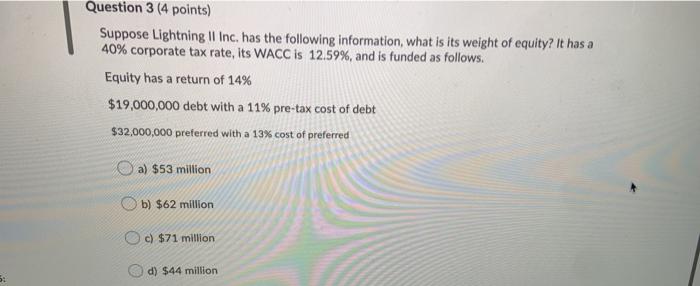

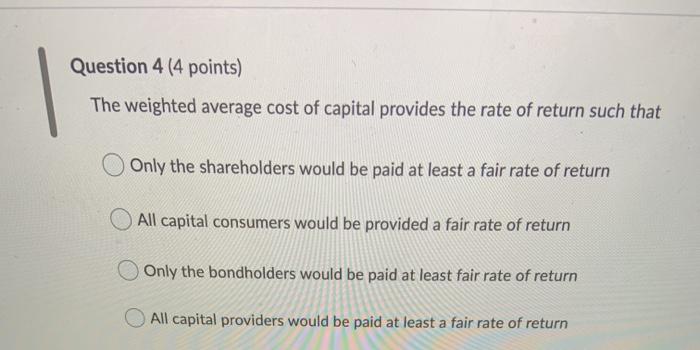

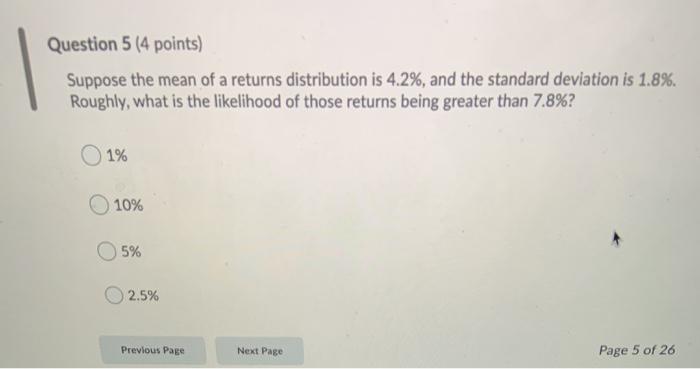

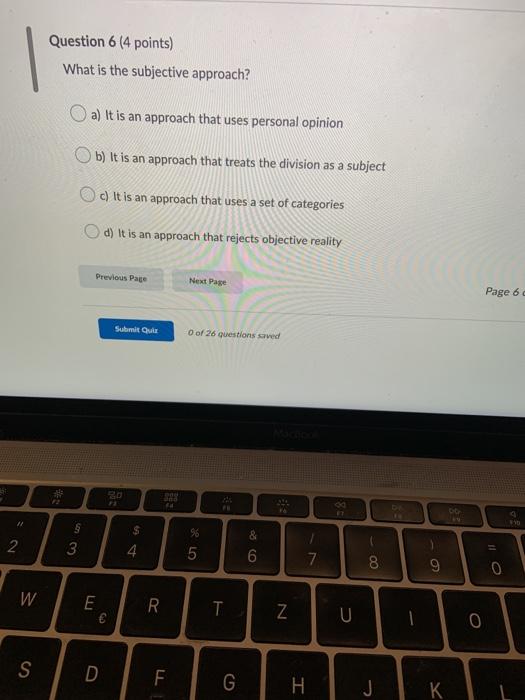

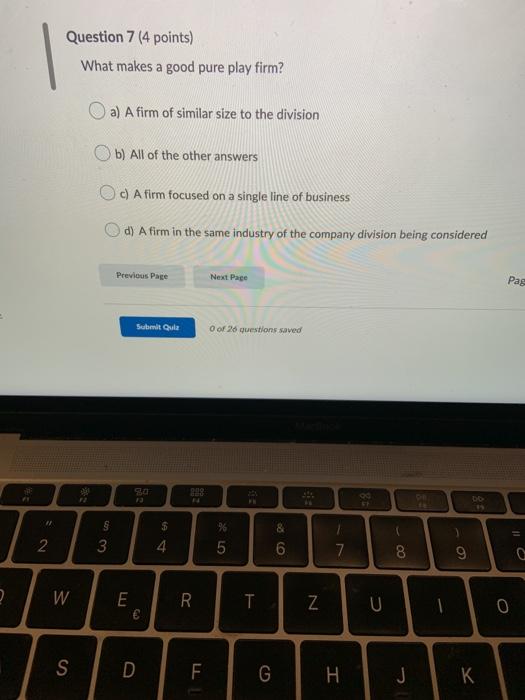

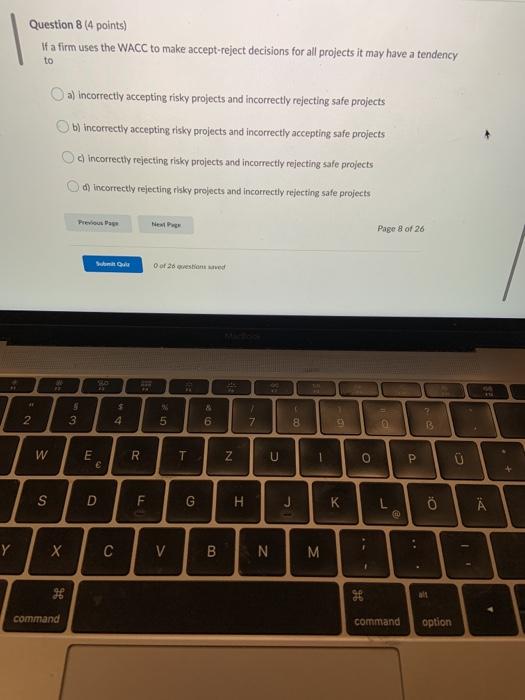

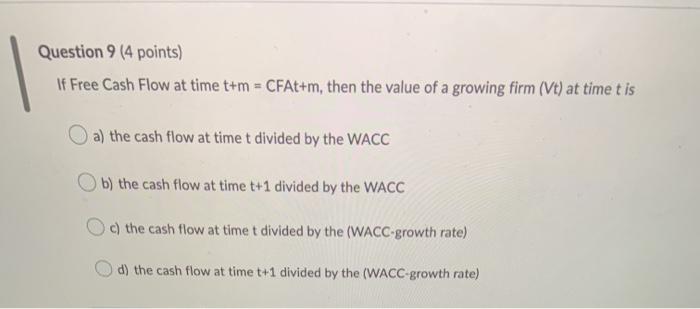

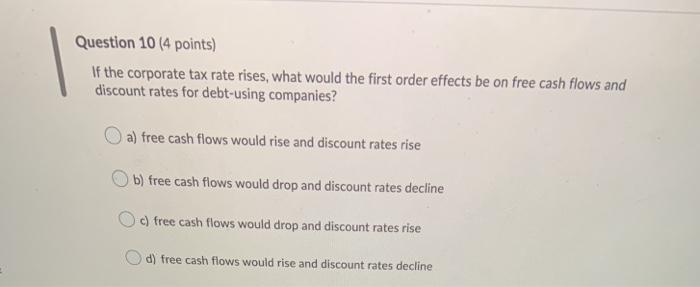

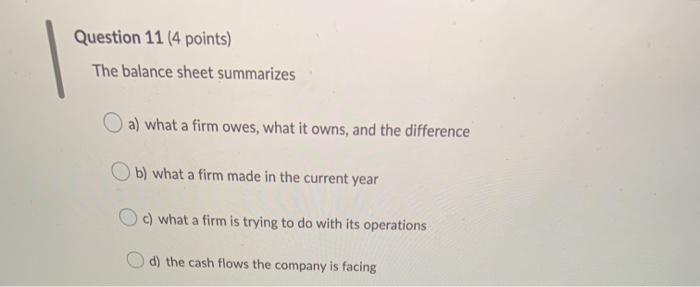

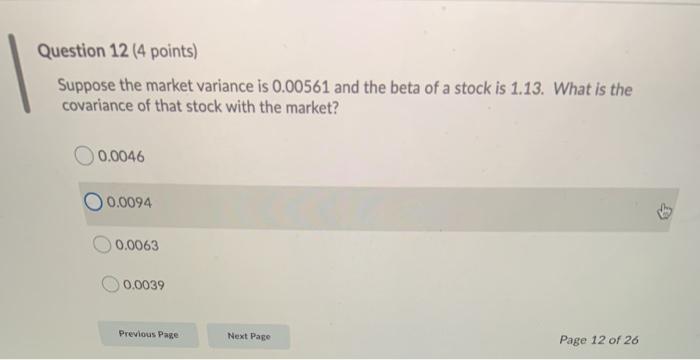

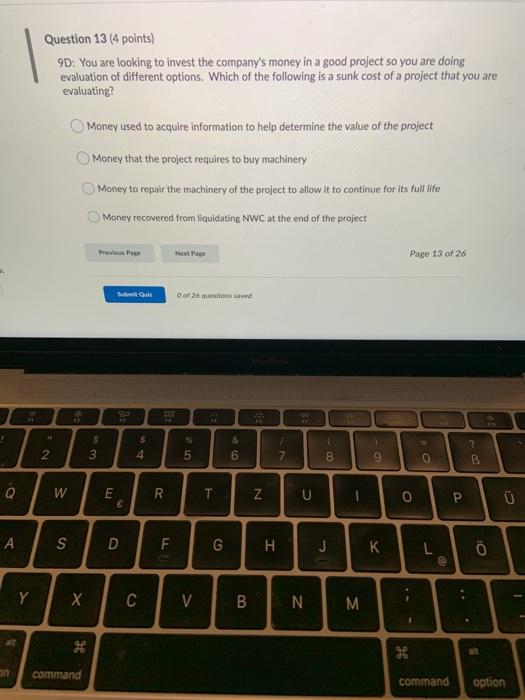

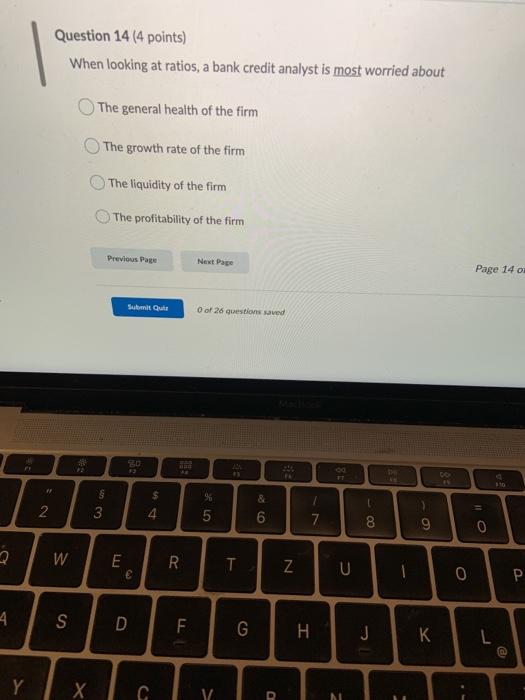

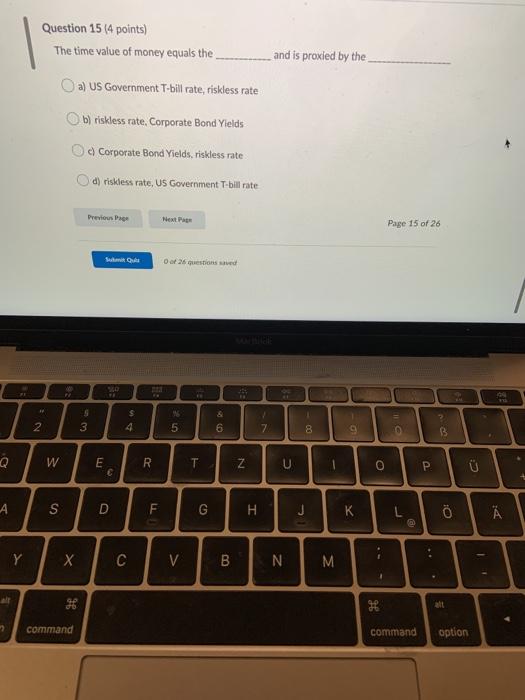

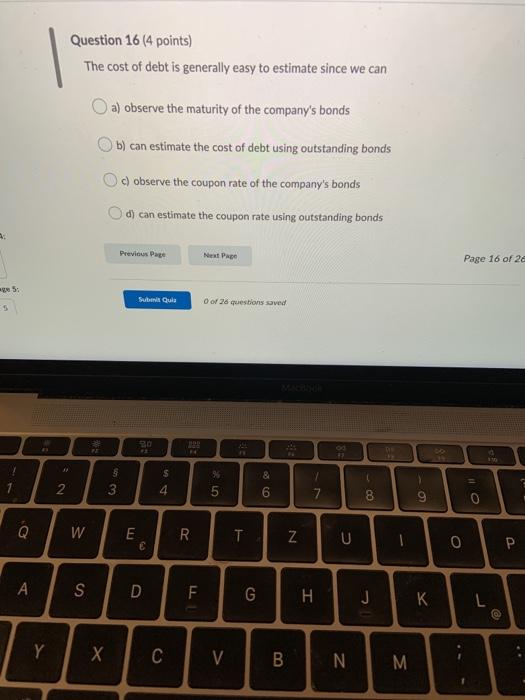

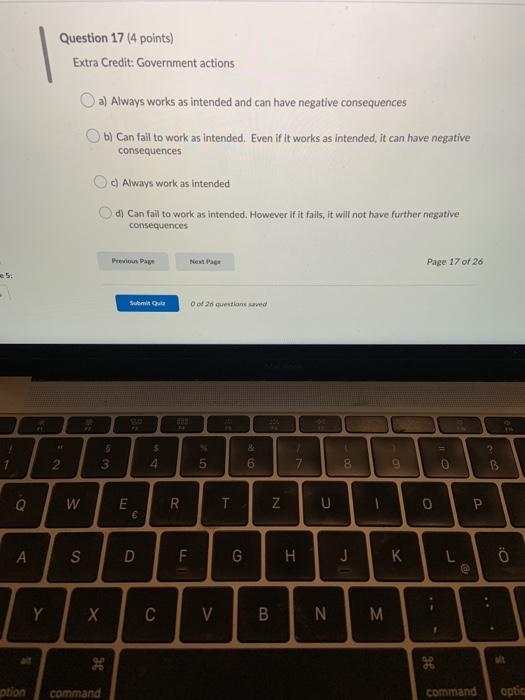

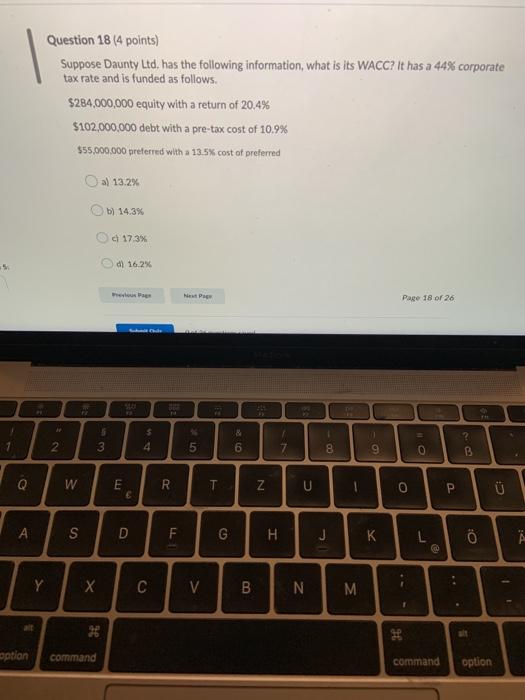

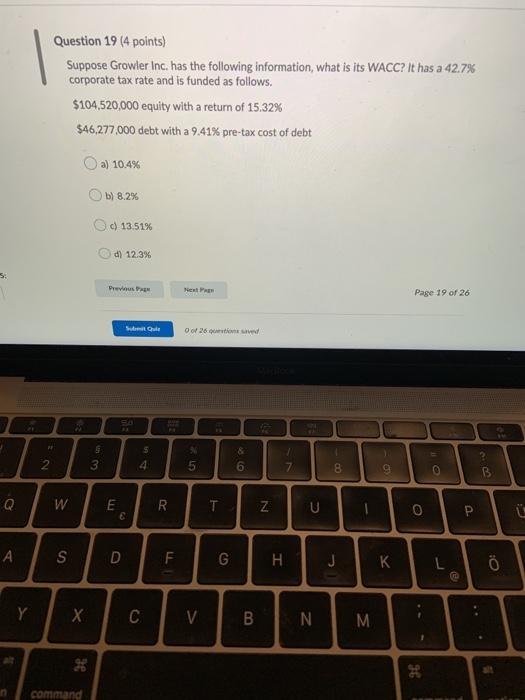

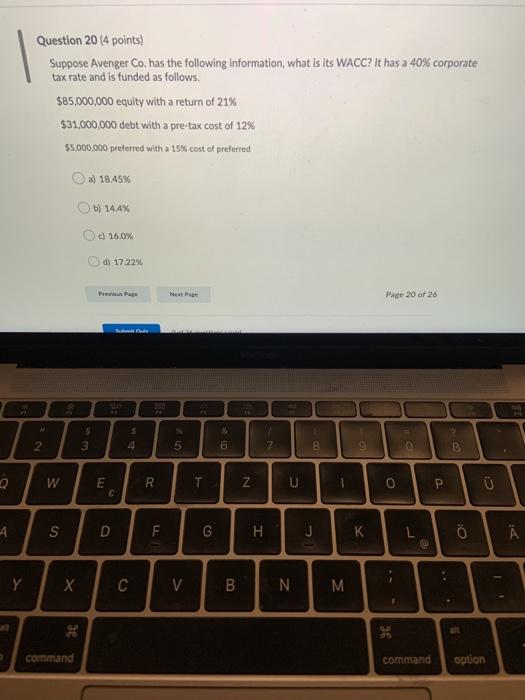

Question 2 (4 points) 81A: The capital budgeting phase where the organization monitors the workings of the project that is underway is known as the Implementation phase Evaluation phase Screening phase Control phase Question 3 (4 points) Suppose Lightning II Inc. has the following information, what is its weight of equity? It has a 40% corporate tax rate, its WACC is 12.59%, and is funded as follows. Equity has a return of 14% $19,000,000 debt with a 11% pre-tax cost of debt $32,000,000 preferred with a 13% cost of preferred a) $53 million b) $62 million c) $71 million d) $44 million Question 4 (4 points) The weighted average cost of capital provides the rate of return such that Only the shareholders would be paid at least a fair rate of return All capital consumers would be provided a fair rate of return Only the bondholders would be paid at least fair rate of return All capital providers would be paid at least a fair rate of return Question 5 (4 points) Suppose the mean of a returns distribution is 4.2%, and the standard deviation is 1.8%. Roughly, what is the likelihood of those returns being greater than 7.8%? 1% 10% 5% 2.5% Previous Page Next Page Page 5 of 26 Question 6 (4 points) What is the subjective approach? a) It is an approach that uses personal opinion b) It is an approach that treats the division as a subject c) It is an approach that uses a set of categories d) It is an approach that rejects objective reality Previous Page Next Page Page 6 Sulmit Que O of 26 questions saved 11 30 3 2 $ 4 % 5 3 CO 7 00 8 9 0 W E R N T U 0 S D F G H J L Question 7 (4 points) What makes a good pure play firm? a) A firm of similar size to the division b) All of the other answers c) A firm focused on a single line of business dy A firm in the same industry of the company division being considered Previous Page Next Page Pas Submit Qula O of 26 questions saved sa 90 12 Do 26 & 2 3 4 6 7 8 9 W E R T Z U 0 S D F G . J K Question 8 (4 points) Ma firm uses the WACC to make accept-reject decisions for all projects it may have a tendency to a) Incorrectly accepting risky projects and incorrectly rejecting safe projects b) incorrectly accepting risky projects and incorrectly accepting safe projects c) incorrectly rejecting risky projects and incorrectly rejecting safe projects d) incorrectly rejecting risky projects and incorrectly rejecting sate projects Previous Next Page Page 8 of 26 Suhamil Que O of 20 stane ved S 3 & 6 2 4 5 7 8 B W E E R T Z N U U S D F G H J PE t Y X C V 09 B N M 36 all command command option Question 9 (4 points) If Free Cash Flow at time t+m = CFAt+m, then the value of a growing firm (Vt) at time t is a) the cash flow at time t divided by the WACC b) the cash flow at time t+1 divided by the WACC c) the cash flow at time t divided by the (WACC-growth rate) d) the cash flow at time t+1 divided by the (WACC-growth rate) Question 10 (4 points) If the corporate tax rate rises, what would the first order effects be on free cash flows and discount rates for debt-using companies? a) free cash flows would rise and discount rates rise b) free cash flows would drop and discount rates decline Oc) free cash flows would drop and discount rates rise d) free cash flows would rise and discount rates decline Question 11 (4 points) The balance sheet summarizes a) what a firm owes, what it owns, and the difference b) what a firm made in the current year c) what a firm is trying to do with its operations d) the cash flows the company is facing Question 12 (4 points) Suppose the market variance is 0.00561 and the beta of a stock is 1.13. What is the covariance of that stock with the market? 0.0046 0.0094 0.0063 0.0039 Previous Page Next Page Page 12 of 26 Question 13 (4 points) 9D: You are looking to invest the company's money in a good project so you are doing evaluation of different options. Which of the following is a sunk cost of a project that you are evaluating? Money used to acquire information to help determine the value of the project Money that the project requires to buy machinery Money to repair the machinery of the project to allow it to continue for its full life Money recovered from liquidating NWC at the end of the project Page 13 of 26 Of 2 questo saved 32 5 3 $ 4 2 5 & 6 7 8 ? B 9 Q W E R T N U 0 P S D F F G H J K @ Y X C V B B N. M an command command option Question 14 (4 points) When looking at ratios, a bank credit analyst is most worried about The general health of the firm The growth rate of the firm The liquidity of the firm The profitability of the firm Previous Page Next Page Page 14 Summit Que O of 26 questions saved 110 $ 2 3 4 96 5 6 7 L 8 0 W E R T Z U 0 4. S D F G H J @ Y C V D M Question 15 (4 points) The time value of money equals the and is proxied by the a) US Government T-bill rate, riskless rate b) riskless rate. Corporate Bond Yields Corporate Bond Yields, riskless rate d) riskless rate, US Government T-bill rate Previous Next Page Page 15 of 26 0026questions saved S 3 $ 4 1 7 2 5 6 06 9 3 W E R T Z 0 P A S D F G H J K A @ Y Y X C V B Z M # 7 command command option Question 16 (4 points) The cost of debt is generally easy to estimate since we can a) observe the maturity of the company's bonds b) can estimate the cost of debt using outstanding bonds observe the coupon rate of the company's bonds d) can estimate the coupon rate using outstanding bonds Previous Page Next Page Page 16 of 2 Sub Quia 0 of 28 questions saved CS S & . 2 3 4 5 7 00 Q W E R T Z N U 0 A S D F G H J L ai Y X C V B NM Question 17 (4 points) Extra Credit: Government actions a) Always works as intended and can have negative consequences b) Can fail to work as intended. Even if it works as intended, it can have negative consequences O Always work as intended d) Can fall to work as intended. However if it falls, it will not have further negative consequences Previous Next Page Page 17 of 26 Sumir Qula O of 26 questions 5 3 5 4 & 6 ? B 2 5 8 Q W R T N U O 6 S D F G H J @ Y C V B N M ge 8 ption command command optio Question 18 (4 points) Suppose Daunty Ltd. has the following information, what is its WACC? It has a 44% corporate tax rate and is funded as follows $284,000,000 equity with a return of 20.4% $102,000,000 debt with a pre-tax cost of 10.9% $55.000.000 preferred with a 13.5% cost of preferred a) 13.2% b) 14.3% 0173% d) 16.2% Page 18 of 26 BE TE s 4 & 6 2 3 5 7 8 9 ? B Q W E R T N U 0 P S D F G H J K @ Y C V B N N M alt se H5 option command command option Question 19 (4 points) Suppose Growler Inc. has the following information, what is its WACC? It has a 42.7% corporate tax rate and is funded as follows. $104,520,000 equity with a return of 15.32% $46,277,000 debt with a 9.41% pre-tax cost of debt a) 10.4% b) 8.2% c) 13.51% d) 12.3% Preus Pag Newt Page 19 of 26 0 of 26 Sa & 3 $ 4 ? 2 5 6 7 8 W E E R T Z N U 0 A S D F G H J K Y C V B N M LIN se command Question 20 (4 points) Suppose Avenger Co. has the following information, what is its WACC? It has a 40% corporate tax rate and is funded as follows $85,000,000 equity with a return of 21% $31.000.000 debt with a pre-tax cost of 12% $5,000,000 preferred with a 15% cost of preferred a) 18.45% 1 14.4% c) 16.0% d) 17.22% Het Page 20 of 26 $ 2 3 4 5 7 8 W R E T Z N A S D F G . J K Y X C V 00 N M command command option