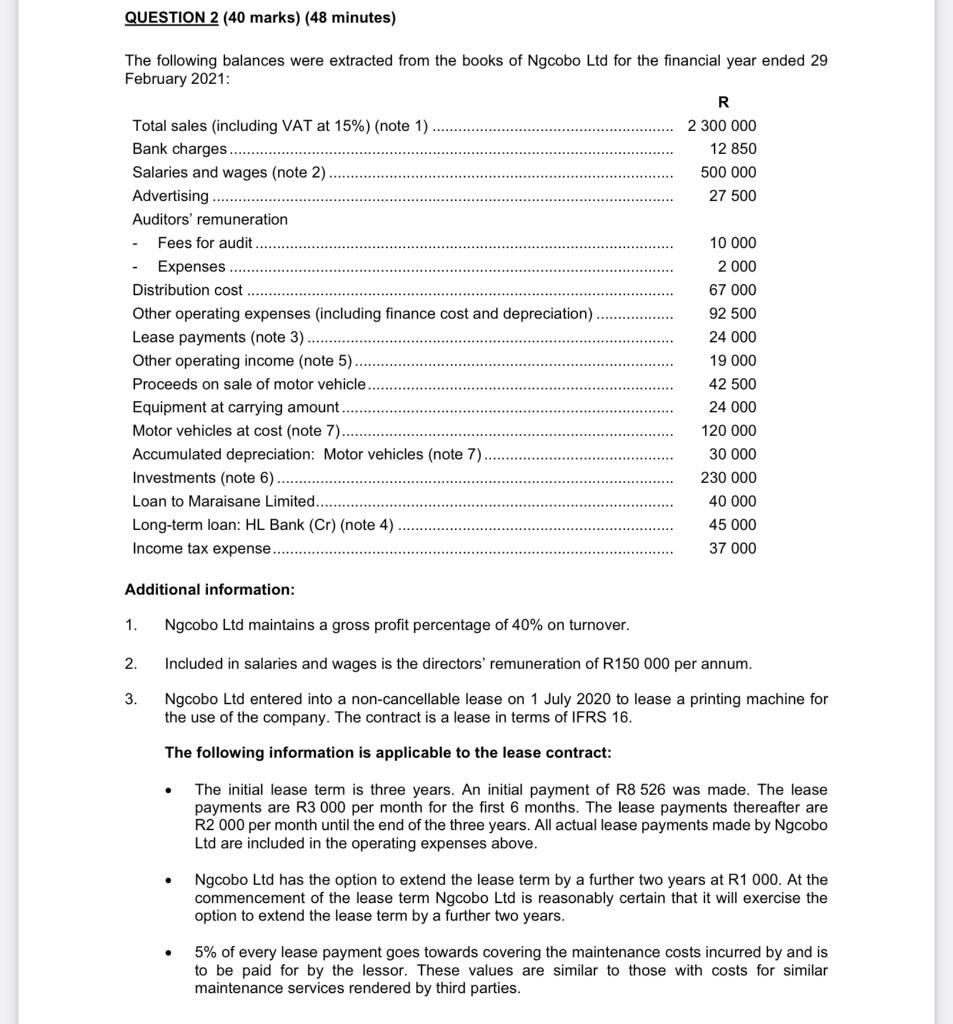

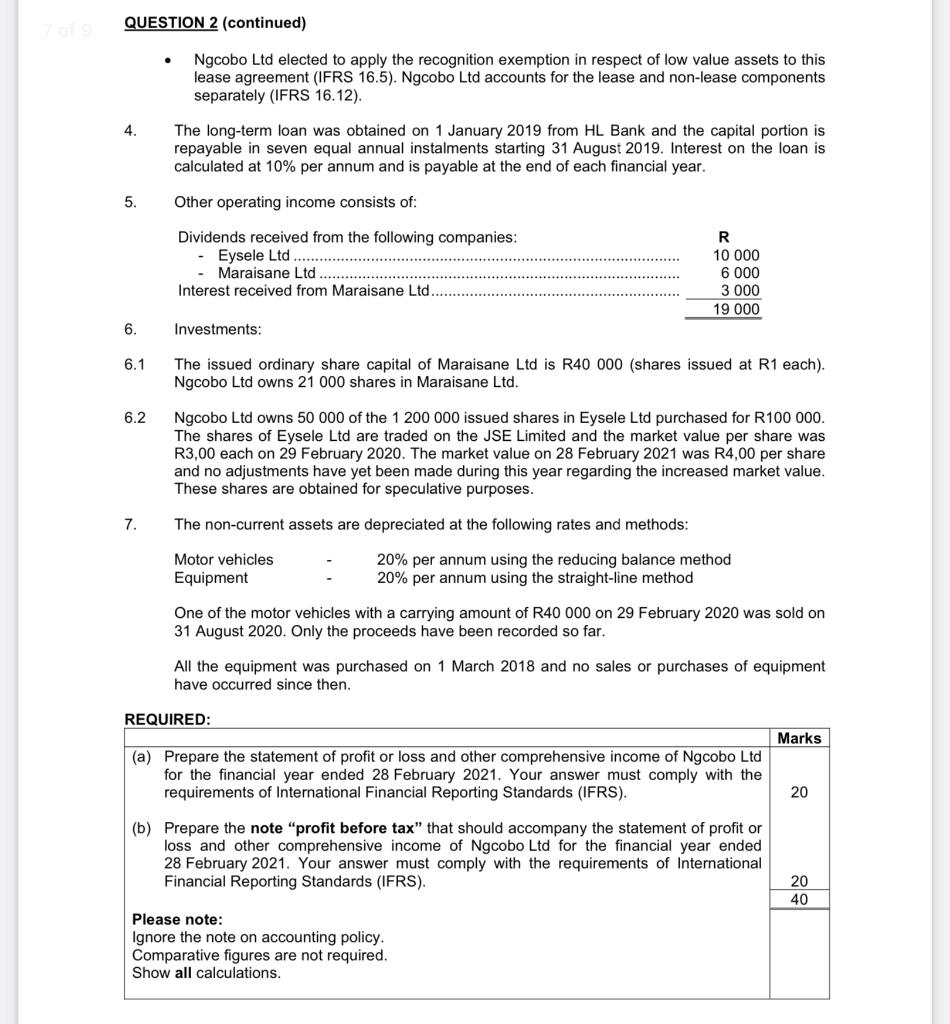

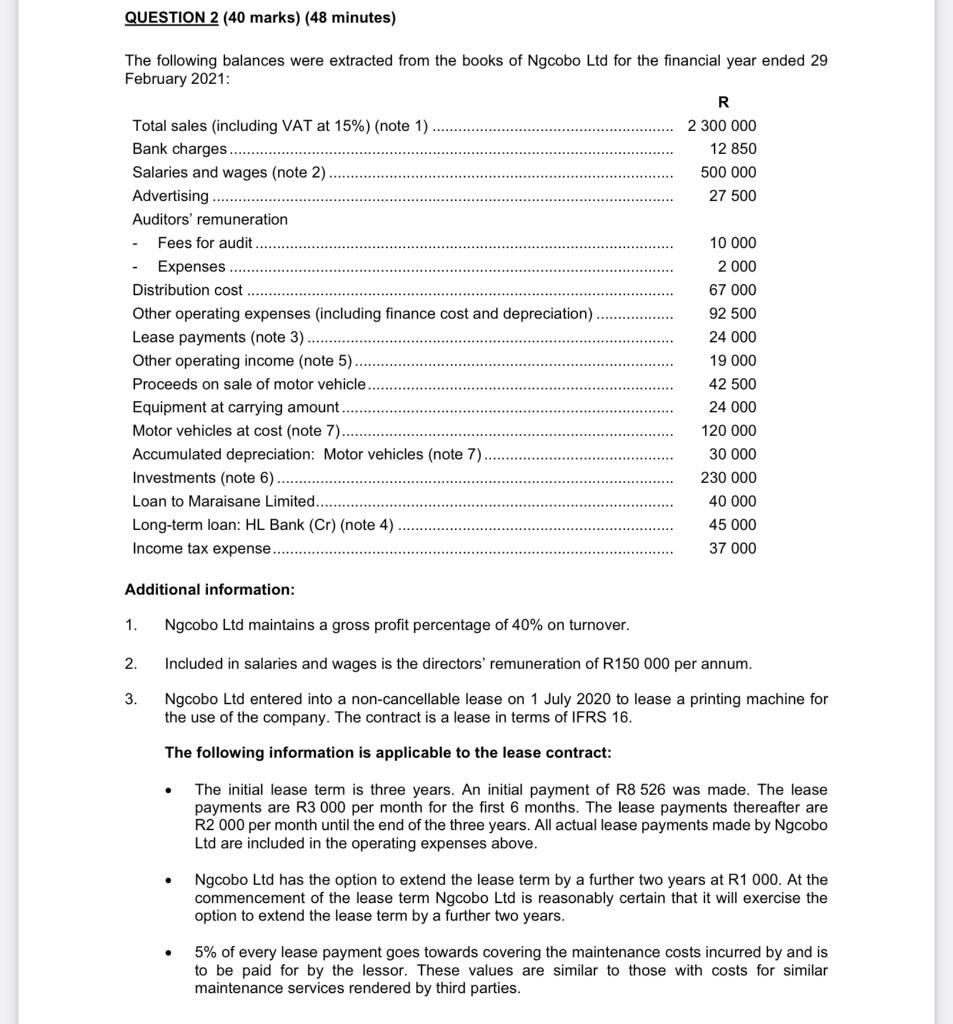

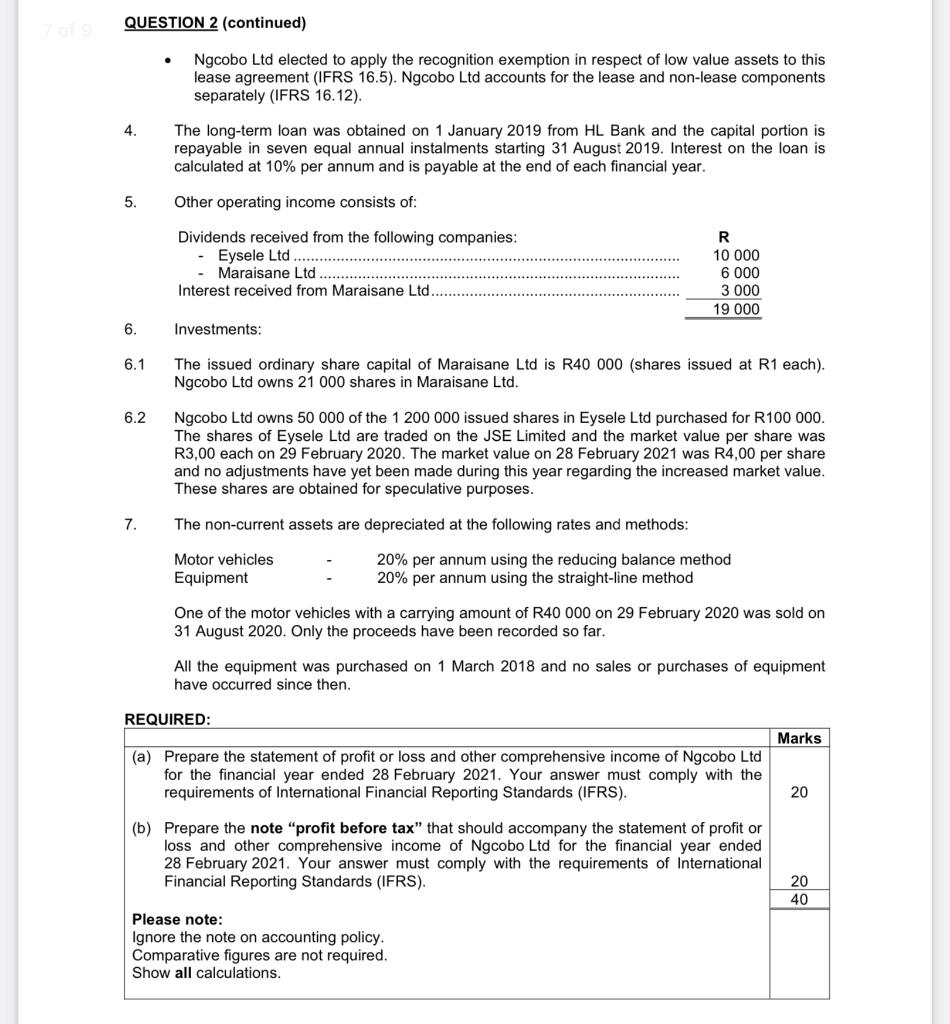

QUESTION 2 (40 marks) (48 minutes) The following balances were extracted from the books of Ngcobo Ltd for the financial year ended 29 February 2021: R Total sales (including VAT at 15%) (note 1) 2 300 000 Bank charges..... 12 850 Salaries and wages (note 2). 500 000 27 500 Advertising...... Auditors' remuneration - Fees for audit 10 000 Expenses 2 000 Distribution cost 67 000 Other operating expenses (including finance cost and depreciation) 92 500 Lease payments (note 3) 24 000 Other operating income (note 5). 19 000 Proceeds on sale of motor vehicle 42 500 Equipment at carrying amount. 24 000 Motor vehicles at cost (note 7) 120 000 Accumulated depreciation: Motor vehicles (note 7) 30 000 Investments (note 6) 230 000 Loan to Maraisane Limited. 40 000 Long-term loan: HL Bank (Cr) (note 4) 45 000 Income tax expense. 37 000 Additional information: 1. Ngcobo Ltd maintains a gross profit percentage of 40% on turnover. 2. Included in salaries and wages is the directors' remuneration of R150 000 per annum. 3. Ngcobo Ltd entered into a non-cancellable lease on 1 July 2020 to lease a printing machine for the use of the company. The contract is a lease in terms of IFRS 16. The following information is applicable to the lease contract: The initial lease term is three years. An initial payment of R8 526 was made. The lease payments are R3 000 per month for the first 6 months. The lease payments thereafter are R2 000 per month until the end of the three years. All actual lease payments made by Ngcobo Ltd are included in the operating expenses above. Ngcobo Ltd has the option to extend the lease term by a further two years at R1 000. At the commencement of the lease term Ngcobo Ltd is reasonably certain that it will exercise the option to extend the lease term by a further two years. 5% of every lease payment goes towards covering the maintenance costs incurred by and is to be paid for by the lessor. These values are similar to those with costs for similar maintenance services rendered by third parties. QUESTION 2 (continued) Ngcobo Ltd elected to apply the recognition exemption in respect of low value assets to this lease agreement (IFRS 16.5). Ngcobo Ltd accounts for the lease and non-lease components separately (IFRS 16.12). 4. The long-term loan was obtained on 1 January 2019 from HL Bank and the capital portion is repayable in seven equal annual instalments starting 31 August 2019. Interest on the loan is calculated at 10% per annum and is payable at the end of each financial year. 5. Other operating income consists of: Dividends received from the following companies: Eysele Ltd....... R 10 000 6 000 Maraisane Ltd Interest received from Maraisane Ltd. 3 000 19 000 6. Investments: 6.1 The issued ordinary share capital of Maraisane Ltd is R40 000 (shares issued at R1 each). Ngcobo Ltd owns 21 000 shares in Maraisane Ltd. 6.2 Ngcobo Ltd owns 50 000 of the 1 200 000 issued shares in Eysele Ltd purchased for R100 000. The shares of Eysele Ltd are traded on the JSE Limited and the market value per share was R3,00 each on 29 February 2020. The market value on 28 February 2021 was R4,00 per share and no adjustments have yet been made during this year regarding the increased market value. These shares are obtained for speculative purposes. 7. The non-current assets are depreciated at the following rates and methods: Motor vehicles 20% per annum using the reducing balance method 20% per annum using the straight-line method Equipment One of the motor vehicles with a carrying amount of R40 000 on 29 February 2020 was sold on 31 August 2020. Only the proceeds have been recorded so far. All the equipment was purchased on 1 March 2018 and no sales or purchases of equipment have occurred since then. REQUIRED: Marks (a) Prepare the statement of profit or loss and other comprehensive income of Ngcobo Ltd for the financial year ended 28 February 2021. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 20 (b) Prepare the note "profit before tax" that should accompany the statement of profit or loss and other comprehensive income of Ngcobo Ltd for the financial year ended 28 February 2021. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 20 40 Please note: Ignore the note on accounting policy. Comparative figures are not required. Show all calculations. QUESTION 2 (40 marks) (48 minutes) The following balances were extracted from the books of Ngcobo Ltd for the financial year ended 29 February 2021: R Total sales (including VAT at 15%) (note 1) 2 300 000 Bank charges..... 12 850 Salaries and wages (note 2). 500 000 27 500 Advertising...... Auditors' remuneration - Fees for audit 10 000 Expenses 2 000 Distribution cost 67 000 Other operating expenses (including finance cost and depreciation) 92 500 Lease payments (note 3) 24 000 Other operating income (note 5). 19 000 Proceeds on sale of motor vehicle 42 500 Equipment at carrying amount. 24 000 Motor vehicles at cost (note 7) 120 000 Accumulated depreciation: Motor vehicles (note 7) 30 000 Investments (note 6) 230 000 Loan to Maraisane Limited. 40 000 Long-term loan: HL Bank (Cr) (note 4) 45 000 Income tax expense. 37 000 Additional information: 1. Ngcobo Ltd maintains a gross profit percentage of 40% on turnover. 2. Included in salaries and wages is the directors' remuneration of R150 000 per annum. 3. Ngcobo Ltd entered into a non-cancellable lease on 1 July 2020 to lease a printing machine for the use of the company. The contract is a lease in terms of IFRS 16. The following information is applicable to the lease contract: The initial lease term is three years. An initial payment of R8 526 was made. The lease payments are R3 000 per month for the first 6 months. The lease payments thereafter are R2 000 per month until the end of the three years. All actual lease payments made by Ngcobo Ltd are included in the operating expenses above. Ngcobo Ltd has the option to extend the lease term by a further two years at R1 000. At the commencement of the lease term Ngcobo Ltd is reasonably certain that it will exercise the option to extend the lease term by a further two years. 5% of every lease payment goes towards covering the maintenance costs incurred by and is to be paid for by the lessor. These values are similar to those with costs for similar maintenance services rendered by third parties. QUESTION 2 (continued) Ngcobo Ltd elected to apply the recognition exemption in respect of low value assets to this lease agreement (IFRS 16.5). Ngcobo Ltd accounts for the lease and non-lease components separately (IFRS 16.12). 4. The long-term loan was obtained on 1 January 2019 from HL Bank and the capital portion is repayable in seven equal annual instalments starting 31 August 2019. Interest on the loan is calculated at 10% per annum and is payable at the end of each financial year. 5. Other operating income consists of: Dividends received from the following companies: Eysele Ltd....... R 10 000 6 000 Maraisane Ltd Interest received from Maraisane Ltd. 3 000 19 000 6. Investments: 6.1 The issued ordinary share capital of Maraisane Ltd is R40 000 (shares issued at R1 each). Ngcobo Ltd owns 21 000 shares in Maraisane Ltd. 6.2 Ngcobo Ltd owns 50 000 of the 1 200 000 issued shares in Eysele Ltd purchased for R100 000. The shares of Eysele Ltd are traded on the JSE Limited and the market value per share was R3,00 each on 29 February 2020. The market value on 28 February 2021 was R4,00 per share and no adjustments have yet been made during this year regarding the increased market value. These shares are obtained for speculative purposes. 7. The non-current assets are depreciated at the following rates and methods: Motor vehicles 20% per annum using the reducing balance method 20% per annum using the straight-line method Equipment One of the motor vehicles with a carrying amount of R40 000 on 29 February 2020 was sold on 31 August 2020. Only the proceeds have been recorded so far. All the equipment was purchased on 1 March 2018 and no sales or purchases of equipment have occurred since then. REQUIRED: Marks (a) Prepare the statement of profit or loss and other comprehensive income of Ngcobo Ltd for the financial year ended 28 February 2021. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 20 (b) Prepare the note "profit before tax" that should accompany the statement of profit or loss and other comprehensive income of Ngcobo Ltd for the financial year ended 28 February 2021. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 20 40 Please note: Ignore the note on accounting policy. Comparative figures are not required. Show all calculations