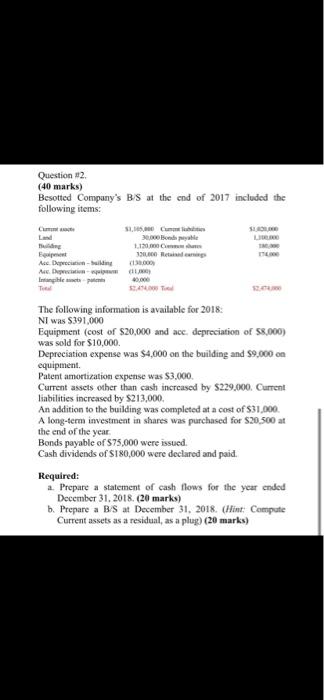

Question 2 (40 marks) Besotted Company's BS at the end of 2017 included the following items: SOLO dele 1.100 La Thing opet A. De- A. Din The following information is available for 2018 NI was $391,000 Equipment (cost of $20,000 and acc. depreciation of $8,000) was sold for $10,000 Depreciation expense was $4,000 on the building and $9,000 on equipment Patent amortization expense was $3.000 Current assets other than cash increased by $229,000. Current liabilities increased by S213,000 An addition to the building was completed at a cost of $31,000 A long-term investment in shares was purchased for $20.500 at the end of the year Bonds payable of $75,000 were issued Cash dividends of S180,000 were declared and paid. Required: a. Prepare a statement of cash flows for the year ended December 31, 2018. (20 marks) b. Prepare a BS at December 31, 2018. (Hint: Compute Current assets as a residual, as a plug) (20 marks) Question #2. (40 marks) Besotted Company's B/S at the end of 2017 included the following items: Current assets $1,105,000 Current liabilities Land 30,000 Bonds payable Building 1.120,000 Common shares Equipment 320,000 Retained earnings Acc. Depreciation - building (130,000) Acc. Depreciation - equipment (11,000) Intangible assets - patents 40,000 Total $2,474,000 Total $1,020,000 1.100,000 180,000 174,000 $2,474,000 The following information is available for 2018: NI was $391,000 Equipment (cost of $20,000 and acc. depreciation of $8,000) was sold for $10,000. Depreciation expense was $4,000 on the building and $9,000 on equipment Patent amortization expense was $3,000. Current assets other than cash increased by $229,000. Current liabilities increased by $213,000. An addition to the building was completed at a cost of $31,000. A long-term investment in shares was purchased for $20,500 at the end of the year. Bonds payable of $75,000 were issued. Cash dividends of $180,000 were declared and paid. Required: a. Prepare a statement of cash flows for the year ended December 31, 2018. (20 marks) b. Prepare a B/S at December 31, 2018. (Hint: Compute Current assets as a residual, as a plug) (20 marks)