Answered step by step

Verified Expert Solution

Question

1 Approved Answer

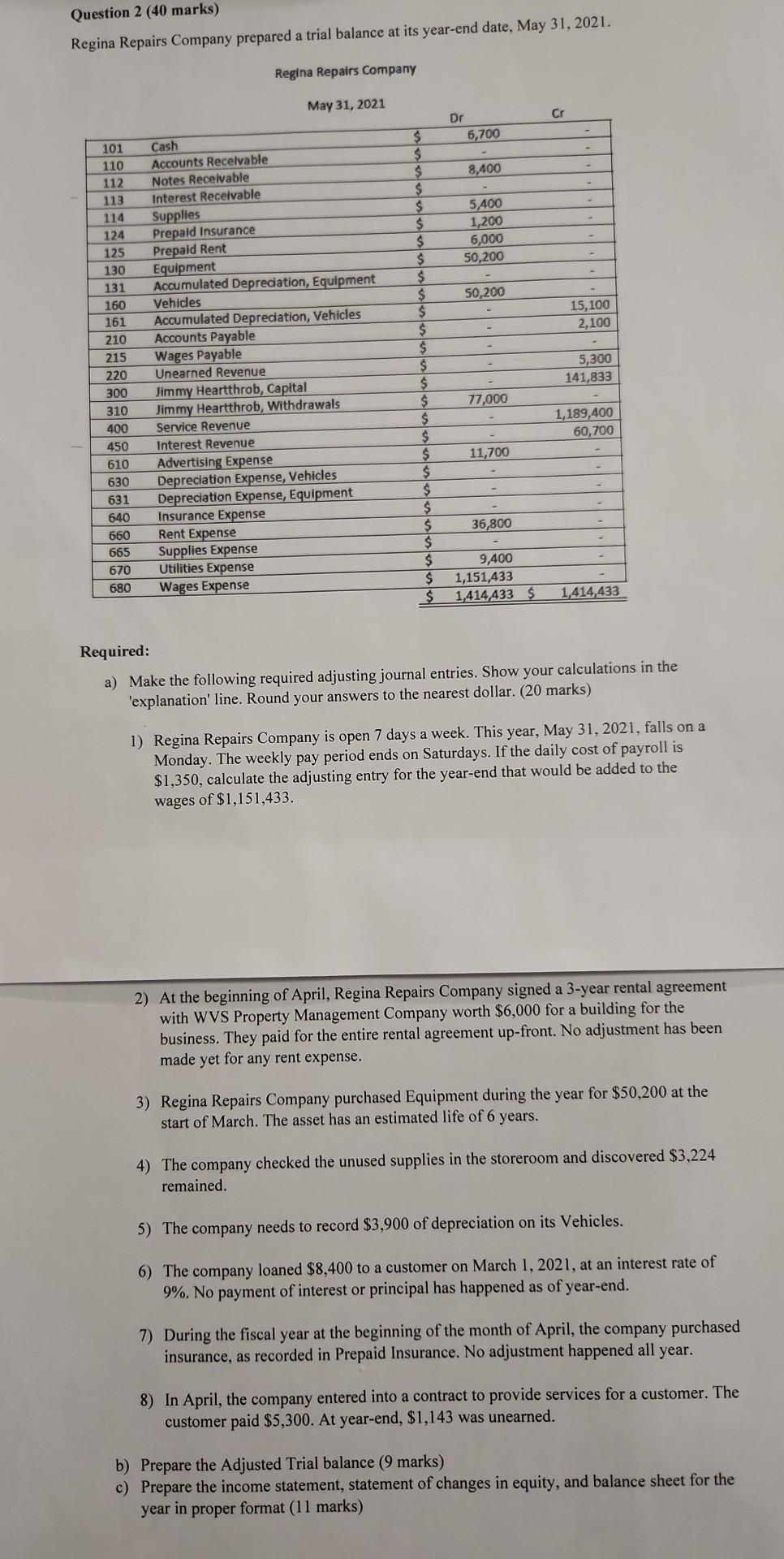

Question 2 (40 marks) Regina Repairs Company prepared a trial balance at its year-end date, May 31, 2021. Regina Repairs Company Required: a) Make the

Question 2 (40 marks) Regina Repairs Company prepared a trial balance at its year-end date, May 31, 2021. Regina Repairs Company Required: a) Make the following required adjusting journal entries. Show your calculations in the 'explanation' line. Round your answers to the nearest dollar. (20 marks) 1) Regina Repairs Company is open 7 days a week. This year, May 31, 2021, falls on a Monday. The weekly pay period ends on Saturdays. If the daily cost of payroll is $1,350, calculate the adjusting entry for the year-end that would be added to the wages of $1,151,433. 2) At the beginning of April, Regina Repairs Company signed a 3-year rental agreement with WVS Property Management Company worth $6,000 for a building for the business. They paid for the entire rental agreement up-front. No adjustment has been made yet for any rent expense. 3) Regina Repairs Company purchased Equipment during the year for $50,200 at the start of March. The asset has an estimated life of 6 years. 4) The company checked the unused supplies in the storeroom and discovered $3,224 remained. 5) The company needs to record $3,900 of depreciation on its Vehicles. 6) The company loaned $8,400 to a customer on March 1, 2021, at an interest rate of 9%. No payment of interest or principal has happened as of year-end. 7) During the fiscal year at the beginning of the month of April, the company purchased insurance, as recorded in Prepaid Insurance. No adjustment happened all year. 8) In April, the company entered into a contract to provide services for a customer. The customer paid $5,300. At year-end, $1,143 was unearned. b) Prepare the Adjusted Trial balance ( 9 marks) c) Prepare the income statement, statement of changes in equity, and balance sheet for the year in proper format (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started