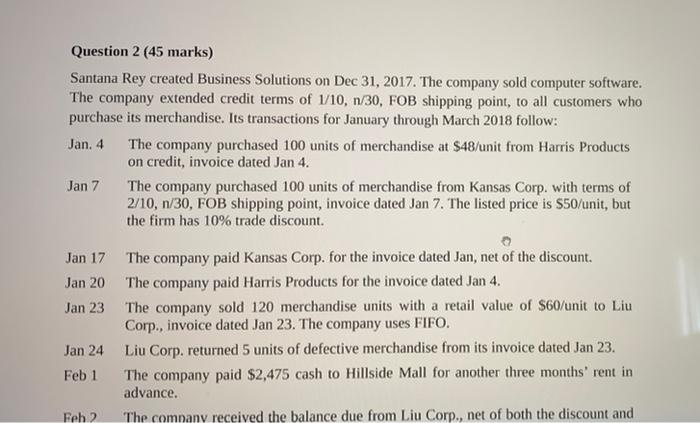

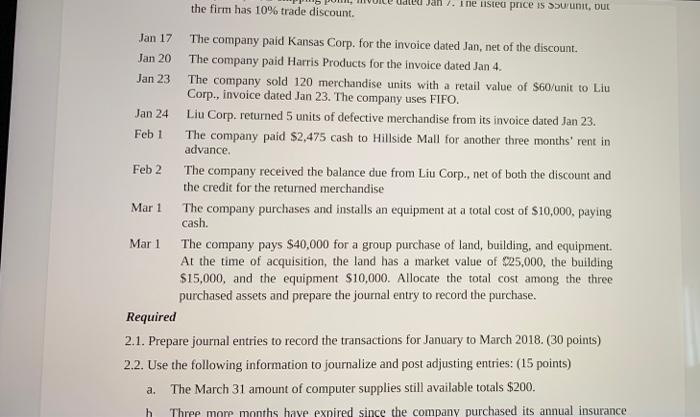

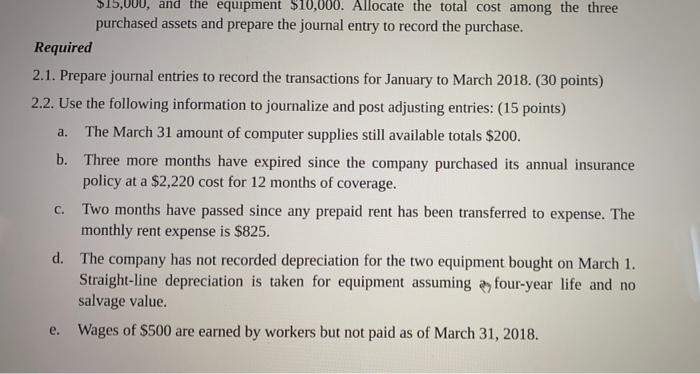

Question 2 (45 marks) Santana Rey created Business Solutions on Dec 31, 2017. The company sold computer software. The company extended credit terms of 1/10, n/30, FOB shipping point, to all customers who purchase its merchandise. Its transactions for January through March 2018 follow: Jan. 4 The company purchased 100 units of merchandise at $48/unit from Harris Products on credit, invoice dated Jan 4. Jan 7 The company purchased 100 units of merchandise from Kansas Corp. with terms of 2/10, n/30, FOB shipping point, invoice dated Jan 7. The listed price is $50/unit, but the firm has 10% trade discount. Jan 17 The company paid Kansas Corp. for the invoice dated Jan, net of the discount. Jan 20 The company paid Harris Products for the invoice dated Jan 4. Jan 23 The company sold 120 merchandise units with a retail value of $60/unit to Liu Corp., invoice dated Jan 23. The company uses FIFO. Jan 24 Liu Corp. returned 5 units of defective merchandise from its invoice dated Jan 23. Feb 1 The company paid $2,475 cash to Hillside Mall for another three months' rent in advance. Feb 2 The company received the balance due from Liu Corp., net of both the discount and the firm has 10% trade discount. an /. I ne listed price is Suunit, but Jan 17 Jan 20 Jan 23 Jan 24 Feb 1 The company paid Kansas Corp. for the invoice dated Jan, net of the discount. The company paid Harris Products for the invoice dated Jan 4. The company sold 120 merchandise units with a retail value of S60/unit to Llu Corp., invoice dated Jan 23. The company uses FIFO. Liu Corp. returned 5 units of defective merchandise from its invoice dated Jan 23. The company paid $2,475 cash to Hillside Mall for another three months' rent in advance Feb 2 The company received the balance due from Liu Corp., net of both the discount and the credit for the returned merchandise Mar 1 The company purchases and installs an equipment at a total cost of $10,000, paying cash. Mar 1 The company pays $40,000 for a group purchase of land, building, and equipment. At the time of acquisition, the land has a market value of $25,000, the building $15,000, and the equipment S10,000. Allocate the total cost among the three purchased assets and prepare the journal entry to record the purchase. Required 2.1. Prepare journal entries to record the transactions for January to March 2018. (30 points) 2.2. Use the following information to journalize and post adjusting entries: (15 points) The March 31 amount of computer supplies still available totals $200. Three more months have expired since the company purchased its annual insurance a. h a. JUU, and the equipment $10,000. Allocate the total cost among the three purchased assets and prepare the journal entry to record the purchase. Required 2.1. Prepare journal entries to record the transactions for January to March 2018. (30 points) 2.2. Use the following information to journalize and post adjusting entries: (15 points) The March 31 amount of computer supplies still available totals $200. b. Three more months have expired since the company purchased its annual insurance policy at a $2,220 cost for 12 months of coverage. C. Two months have passed since any prepaid rent has been transferred to expense. The monthly rent expense is $825. d. The company has not recorded depreciation for the two equipment bought on March 1. Straight-line depreciation is taken for equipment assuming a four-year life and no salvage value. e. Wages of $500 are earned by workers but not paid as of March 31, 2018