Answered step by step

Verified Expert Solution

Question

1 Approved Answer

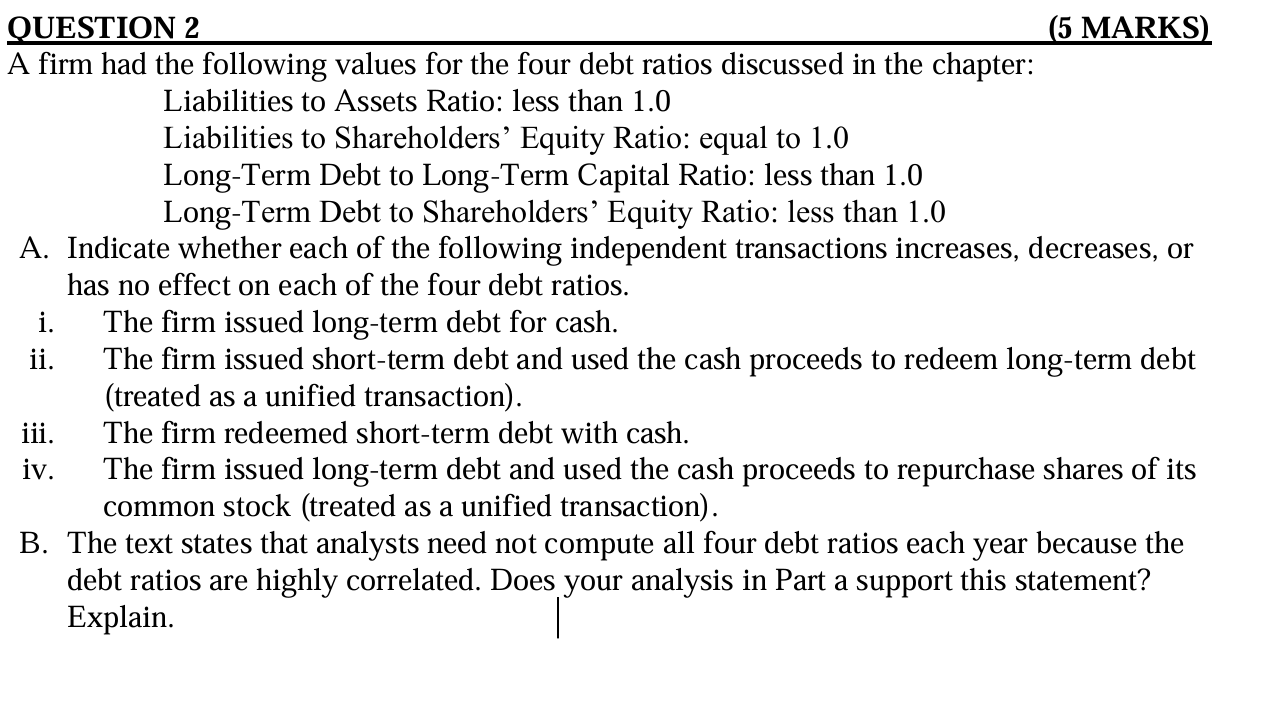

QUESTION 2 ( 5 MARKS ) A firm had the following values for the four debt ratios discussed in the chapter: Liabilities to Assets Ratio:

QUESTION

MARKS

A firm had the following values for the four debt ratios discussed in the chapter:

Liabilities to Assets Ratio: less than

Liabilities to Shareholders' Equity Ratio: equal to

LongTerm Debt to LongTerm Capital Ratio: less than

LongTerm Debt to Shareholders' Equity Ratio: less than

A Indicate whether each of the following independent transactions increases, decreases, or

has no effect on each of the four debt ratios.

i The firm issued longterm debt for cash.

ii The firm issued shortterm debt and used the cash proceeds to redeem longterm debt

treated as a unified transaction

iii. The firm redeemed shortterm debt with cash.

iv The firm issued longterm debt and used the cash proceeds to repurchase shares of its

common stock treated as a unified transaction

B The text states that analysts need not compute all four debt ratios each year because the

debt ratios are highly correlated. Does your analysis in Part a support this statement?

Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started