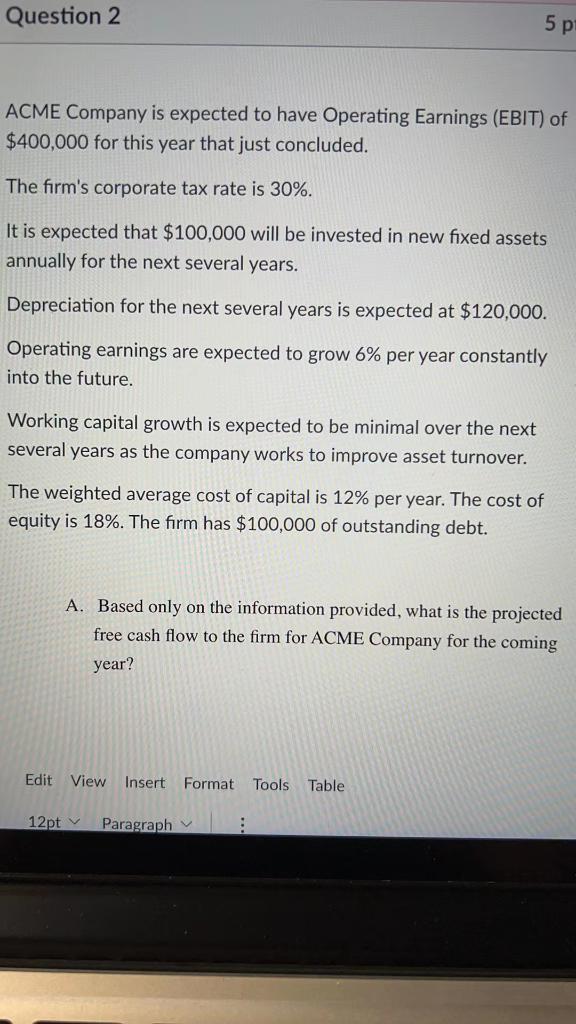

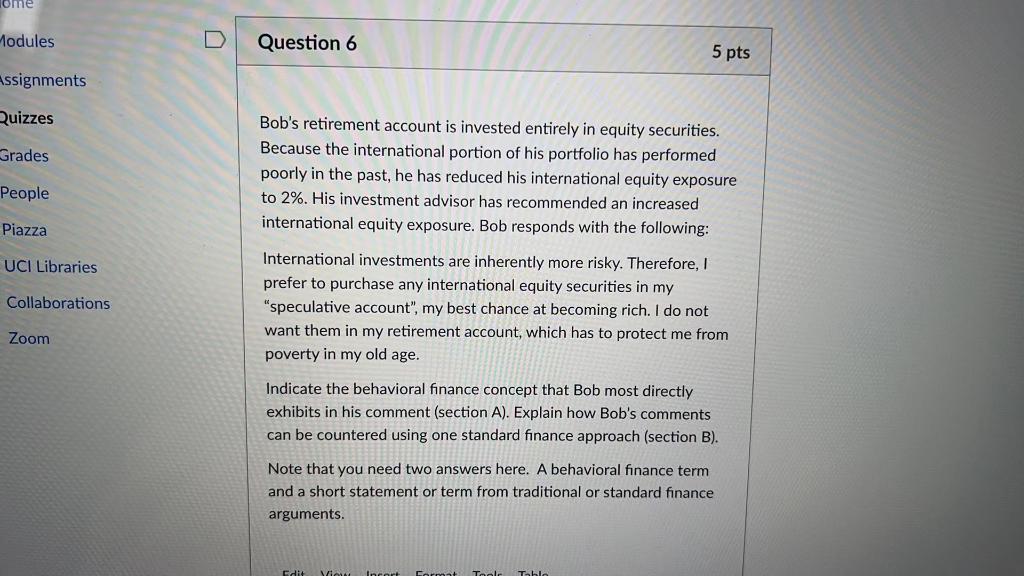

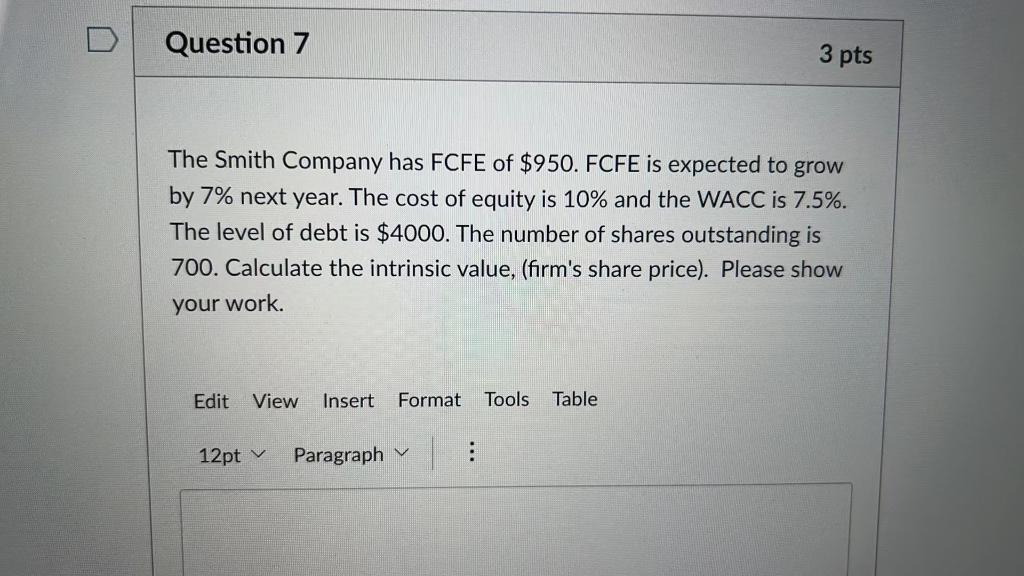

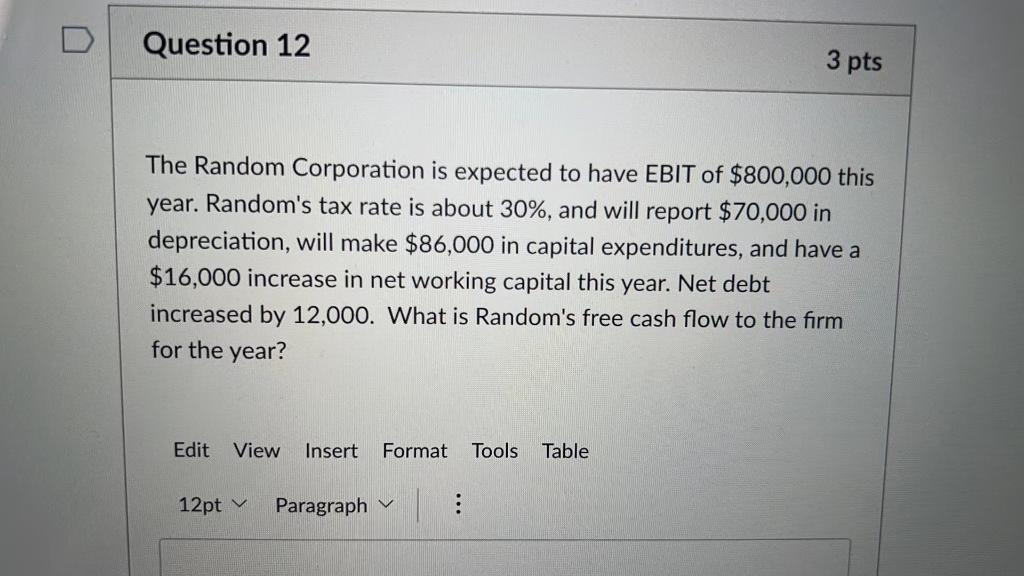

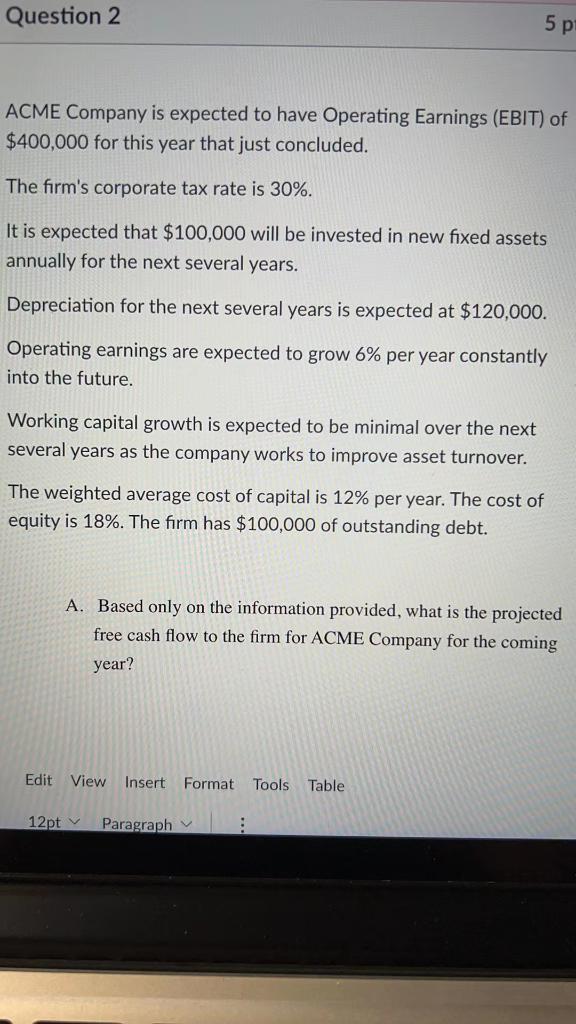

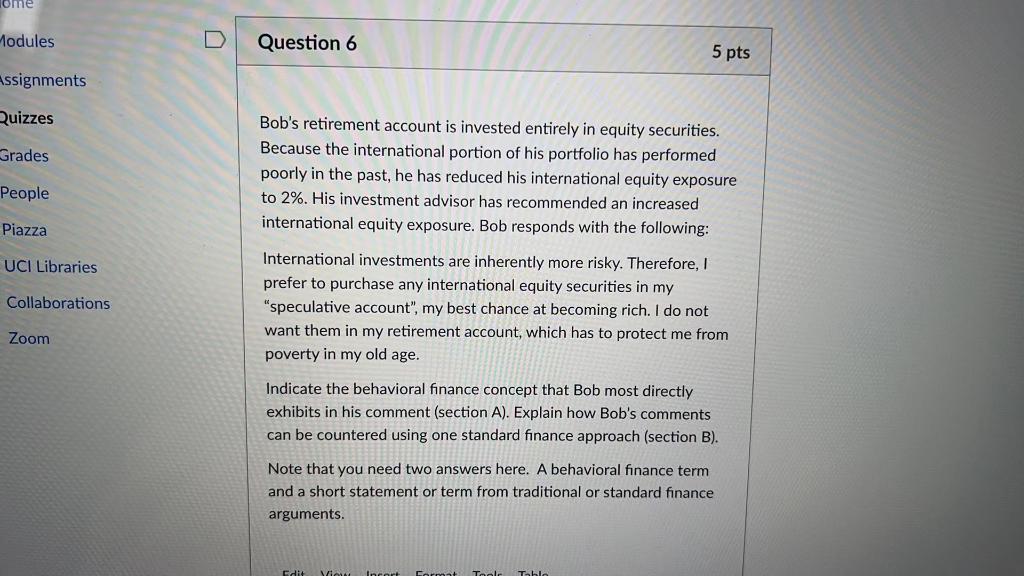

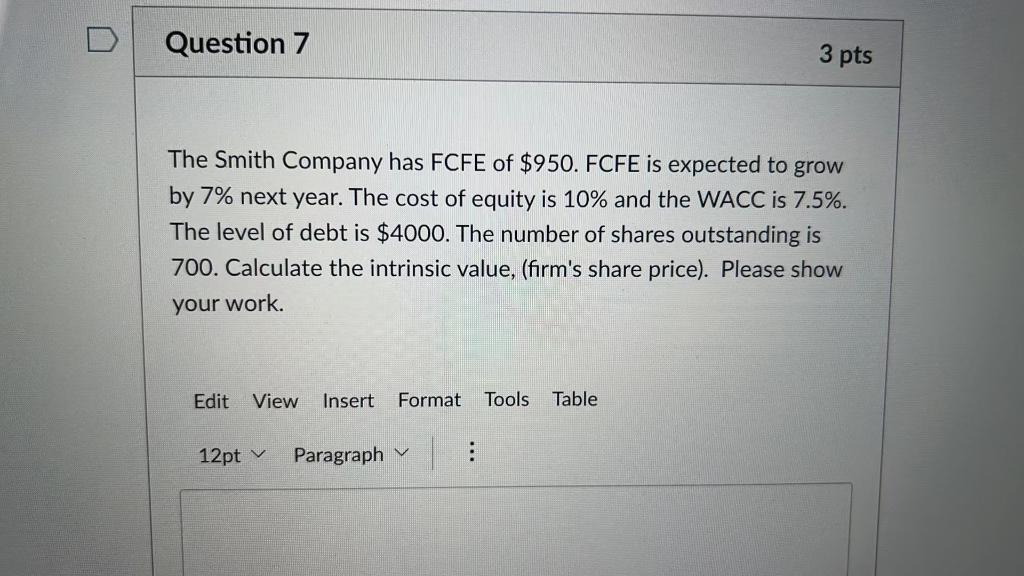

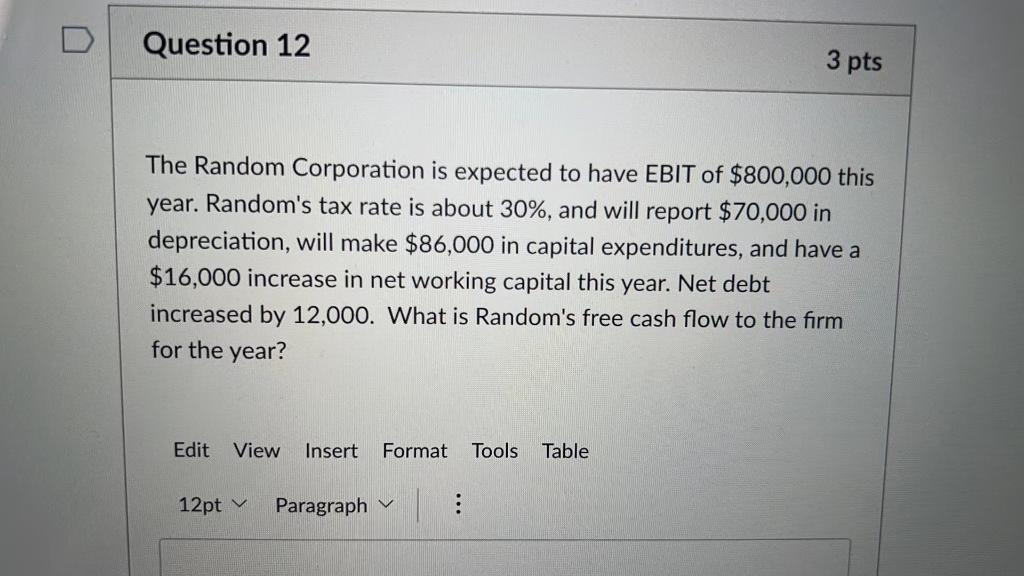

Question 2 5 pi ACME Company is expected to have Operating Earnings (EBIT) of $400,000 for this year that just concluded. The firm's corporate tax rate is 30%. It is expected that $100,000 will be invested in new fixed assets annually for the next several years. Depreciation for the next several years is expected at $120,000. Operating earnings are expected to grow 6% per year constantly into the future. Working capital growth is expected to be minimal over the next several years as the company works to improve asset turnover. The weighted average cost of capital is 12% per year. The cost of equity is 18%. The firm has $100,000 of outstanding debt. A. Based only on the information provided, what is the projected free cash flow to the firm for ACME Company for the coming year? Edit View Insert Format Tools Table 12pt Paragraph come Modules Question 6 5 pts Assignments Quizzes Grades Bob's retirement account is invested entirely in equity securities. Because the international portion of his portfolio has performed poorly in the past, he has reduced his international equity exposure to 2%. His investment advisor has recommended an increased international equity exposure. Bob responds with the following: People Piazza UCI Libraries Collaborations International investments are inherently more risky. Therefore, prefer to purchase any international equity securities in my "speculative account", my best chance at becoming rich. I do not want them in my retirement account, which has to protect me from poverty in my old age. Zoom Indicate the behavioral finance concept that Bob most directly exhibits in his comment (section A). Explain how Bob's comments can be countered using one standard finance approach (section B). Note that you need two answers here. A behavioral finance term and a short statement or term from traditional or standard finance arguments. Edit We are Carmnt Tool Tablo Question 7 3 pts The Smith Company has FCFE of $950. FCFE is expected to grow by 7% next year. The cost of equity is 10% and the WACC is 7.5%. The level of debt is $4000. The number of shares outstanding is 700. Calculate the intrinsic value, (firm's share price). Please show your work. Edit View Insert Format Tools Table v 12pt Paragraph 1 : Question 12 3 pts The Random Corporation is expected to have EBIT of $800,000 this year. Random's tax rate is about 30%, and will report $70,000 in depreciation, will make $86,000 in capital expenditures, and have a $16,000 increase in net working capital this year. Net debt increased by 12,000. What is Random's free cash flow to the form for the year? Edit View Insert Format Tools Table 12pt Paragraph v