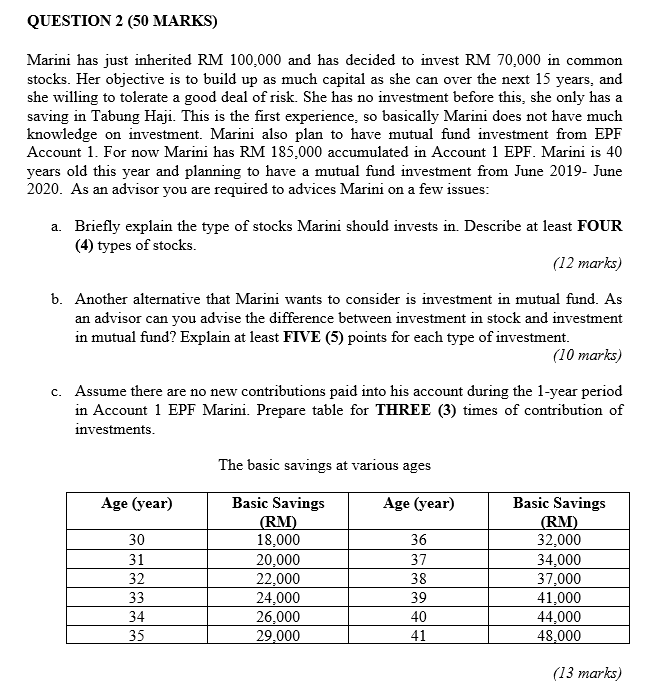

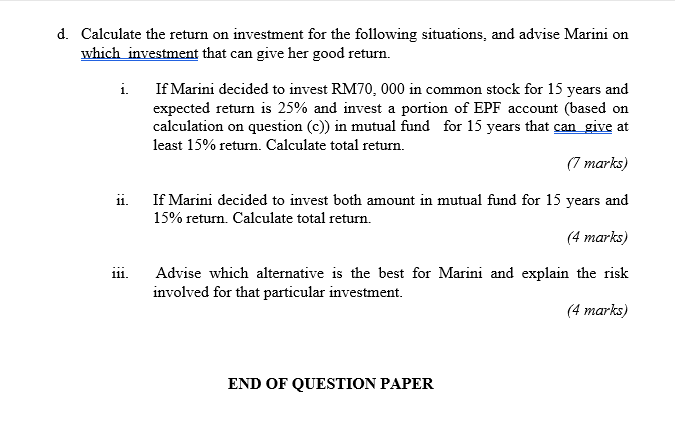

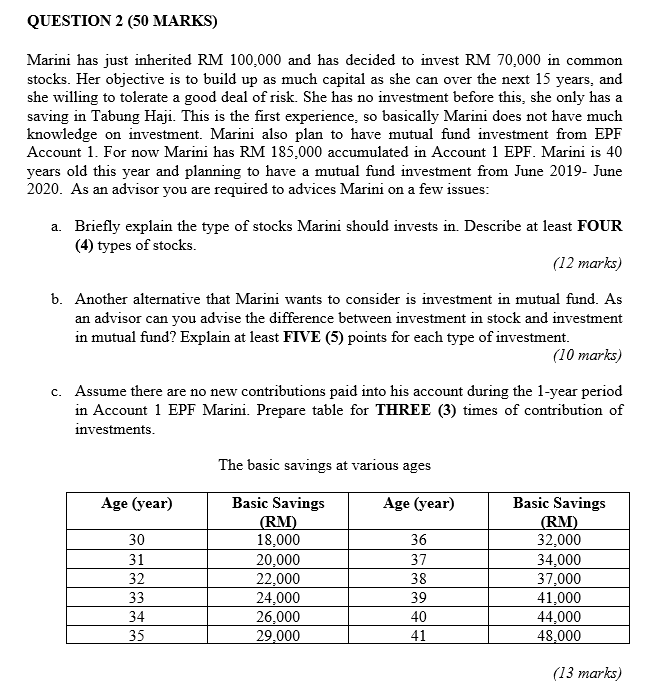

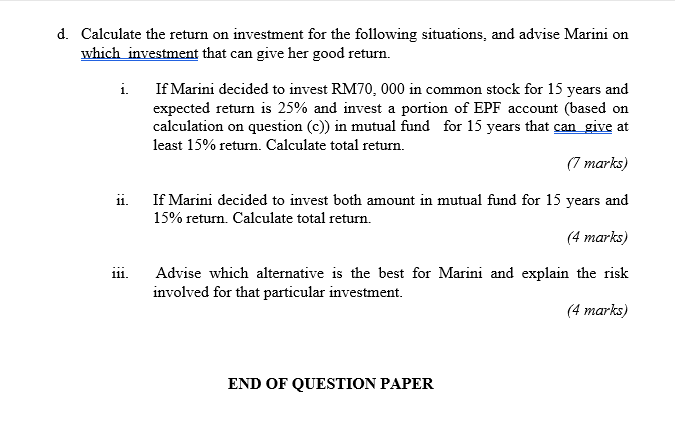

QUESTION 2 (50 MARKS) Marini has just inherited RM 100.000 and has decided to invest RM 70,000 in common stocks. Her objective is to build up as much capital as she can over the next 15 years, and she willing to tolerate a good deal of risk. She has no investment before this, she only has a saving in Tabung Haji. This is the first experience, so basically Marini does not have much knowledge on investment. Marini also plan to have mutual fund investment from EPF Account 1. For now Marini has RM 185,000 accumulated in Account 1 EPF. Marini is 40 years old this year and planning to have a mutual fund investment from June 2019- June 2020. As an advisor you are required to advices Marini on a few issues: a. Briefly explain the type of stocks Marini should invests in. Describe at least FOUR (4) types of stocks. (12 marks) b. Another alternative that Marini wants to consider is investment in mutual fund. As an advisor can you advise the difference between investment in stock and investment in mutual fund? Explain at least FIVE (5) points for each type of investment. (10 marks) c. Assume there are no new contributions paid into his account during the 1-year period in Account 1 EPF Marini. Prepare table for THREE (3) times of contribution of investments. The basic savings at various ages Age (year) Age (year) 30 31 32 33 34 35 Basic Savings (RM) 18,000 20,000 22.000 24,000 26,000 29.000 36 37 38 39 40 41 Basic Savings (RM) 32.000 34.000 37,000 41,000 44.000 48,000 (13 marks) d. Calculate the return on investment for the following situations, and advise Marini on which investment that can give her good return. i If Marini decided to invest RM70,000 in common stock for 15 years and expected return is 25% and invest a portion of EPF account (based on calculation on question (c)) in mutual fund for 15 years that can give at least 15% return. Calculate total return. (7 marks) ii. If Marini decided to invest both amount in mutual fund for 15 years and 15% return. Calculate total return. (4 marks) Advise which alternative is the best for Marini and explain the risk involved for that particular investment. (4 marks) END OF QUESTION PAPER QUESTION 2 (50 MARKS) Marini has just inherited RM 100.000 and has decided to invest RM 70,000 in common stocks. Her objective is to build up as much capital as she can over the next 15 years, and she willing to tolerate a good deal of risk. She has no investment before this, she only has a saving in Tabung Haji. This is the first experience, so basically Marini does not have much knowledge on investment. Marini also plan to have mutual fund investment from EPF Account 1. For now Marini has RM 185,000 accumulated in Account 1 EPF. Marini is 40 years old this year and planning to have a mutual fund investment from June 2019- June 2020. As an advisor you are required to advices Marini on a few issues: a. Briefly explain the type of stocks Marini should invests in. Describe at least FOUR (4) types of stocks. (12 marks) b. Another alternative that Marini wants to consider is investment in mutual fund. As an advisor can you advise the difference between investment in stock and investment in mutual fund? Explain at least FIVE (5) points for each type of investment. (10 marks) c. Assume there are no new contributions paid into his account during the 1-year period in Account 1 EPF Marini. Prepare table for THREE (3) times of contribution of investments. The basic savings at various ages Age (year) Age (year) 30 31 32 33 34 35 Basic Savings (RM) 18,000 20,000 22.000 24,000 26,000 29.000 36 37 38 39 40 41 Basic Savings (RM) 32.000 34.000 37,000 41,000 44.000 48,000 (13 marks) d. Calculate the return on investment for the following situations, and advise Marini on which investment that can give her good return. i If Marini decided to invest RM70,000 in common stock for 15 years and expected return is 25% and invest a portion of EPF account (based on calculation on question (c)) in mutual fund for 15 years that can give at least 15% return. Calculate total return. (7 marks) ii. If Marini decided to invest both amount in mutual fund for 15 years and 15% return. Calculate total return. (4 marks) Advise which alternative is the best for Marini and explain the risk involved for that particular investment. (4 marks) END OF QUESTION PAPER