Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (50 points). Gulf Medical Company (GMC) produced one type of medical equipment. Current manufacturing and marketing costs of this medical equipment as follows:

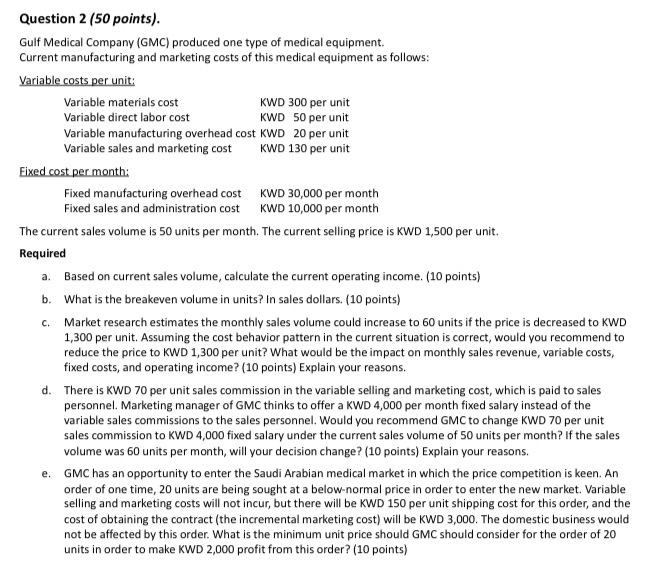

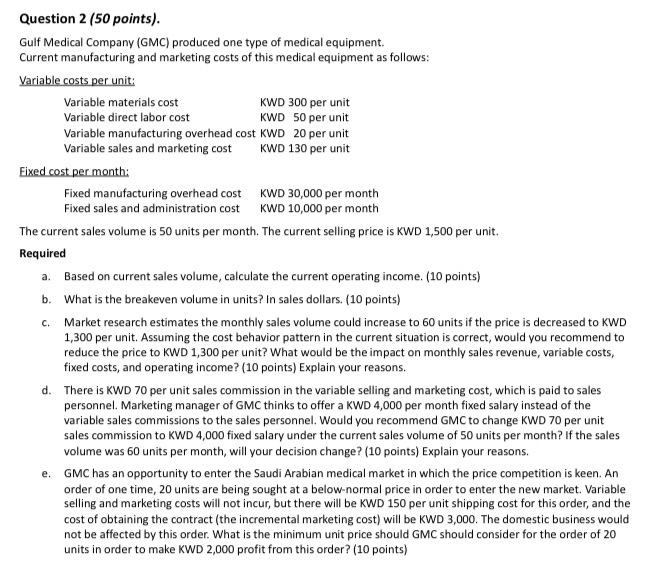

Question 2 (50 points). Gulf Medical Company (GMC) produced one type of medical equipment. Current manufacturing and marketing costs of this medical equipment as follows: Variable costs per unit: Variable materials cost KWD 300 per unit Variable direct labor cost KWD 50 per unit Variable manufacturing overhead cost KWD 20 per unit Variable sales and marketing cost KWD 130 per unit Fixed cost per month: Fixed manufacturing overhead cost KWD 30,000 per month Fixed sales and administration cost KWD 10,000 per month The current sales volume is 50 units per month. The current selling price is KWD 1,500 per unit. Required a. Based on current sales volume, calculate the current operating income. (10 points) b. What is the breakeven volume in units? In sales dollars. (10 points) c. Market research estimates the monthly sales volume could increase to 60 units if the price is decreased to KWD 1,300 per unit. Assuming the cost behavior pattern in the current situation is correct, would you recommend to reduce the price to KWD 1,300 per unit? What would be the impact on monthly sales revenue, variable costs, fixed costs, and operating income? (10 points) Explain your reasons. d. There is KWD 70 per unit sales commission in the variable selling and marketing cost, which is paid to sales personnel. Marketing manager of GMC thinks to offer a KWD 4,000 per month fixed salary instead of the variable sales commissions to the sales personnel. Would you recommend GMC to change KWD 70 per unit sales commission to KWD 4,000 fixed salary under the current sales volume of 50 units per month? If the sales volume was 60 units per month, will your decision change? (10 points) Explain your reasons. e. GMC has an opportunity to enter the Saudi Arabian medical market in which the price competition is keen. An order of one time, 20 units are being sought at a below-normal price in order to enter the new market. Variable selling and marketing costs will not incur, but there will be KWD 150 per unit shipping cost for this order, and the cost of obtaining the contract (the incremental marketing cost) will be KWD 3,000. The domestic business would not be affected by this order. What is the minimum unit price should GMC should consider for the order of 20 units in order to make KWD 2,000 profit from this order? (10 points)

Question 2 (50 points). Gulf Medical Company (GMC) produced one type of medical equipment. Current manufacturing and marketing costs of this medical equipment as follows: Variable costs per unit: Variable materials cost KWD 300 per unit Variable direct labor cost KWD 50 per unit Variable manufacturing overhead cost KWD 20 per unit Variable sales and marketing cost KWD 130 per unit Fixed cost per month: Fixed manufacturing overhead cost KWD 30,000 per month Fixed sales and administration cost KWD 10,000 per month The current sales volume is 50 units per month. The current selling price is KWD 1,500 per unit. Required a. Based on current sales volume, calculate the current operating income. (10 points) b. What is the breakeven volume in units? In sales dollars. (10 points) c. Market research estimates the monthly sales volume could increase to 60 units if the price is decreased to KWD 1,300 per unit. Assuming the cost behavior pattern in the current situation is correct, would you recommend to reduce the price to KWD 1,300 per unit? What would be the impact on monthly sales revenue, variable costs, fixed costs, and operating income? (10 points) Explain your reasons. d. There is KWD 70 per unit sales commission in the variable selling and marketing cost, which is paid to sales personnel. Marketing manager of GMC thinks to offer a KWD 4,000 per month fixed salary instead of the variable sales commissions to the sales personnel. Would you recommend GMC to change KWD 70 per unit sales commission to KWD 4,000 fixed salary under the current sales volume of 50 units per month? If the sales volume was 60 units per month, will your decision change? (10 points) Explain your reasons. e. GMC has an opportunity to enter the Saudi Arabian medical market in which the price competition is keen. An order of one time, 20 units are being sought at a below-normal price in order to enter the new market. Variable selling and marketing costs will not incur, but there will be KWD 150 per unit shipping cost for this order, and the cost of obtaining the contract (the incremental marketing cost) will be KWD 3,000. The domestic business would not be affected by this order. What is the minimum unit price should GMC should consider for the order of 20 units in order to make KWD 2,000 profit from this order? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started