Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (60 marks) Arnold Spider and Taylor Man were in partnership as jewelers in Bloemfontein. They design, make and sell jewelry for men and

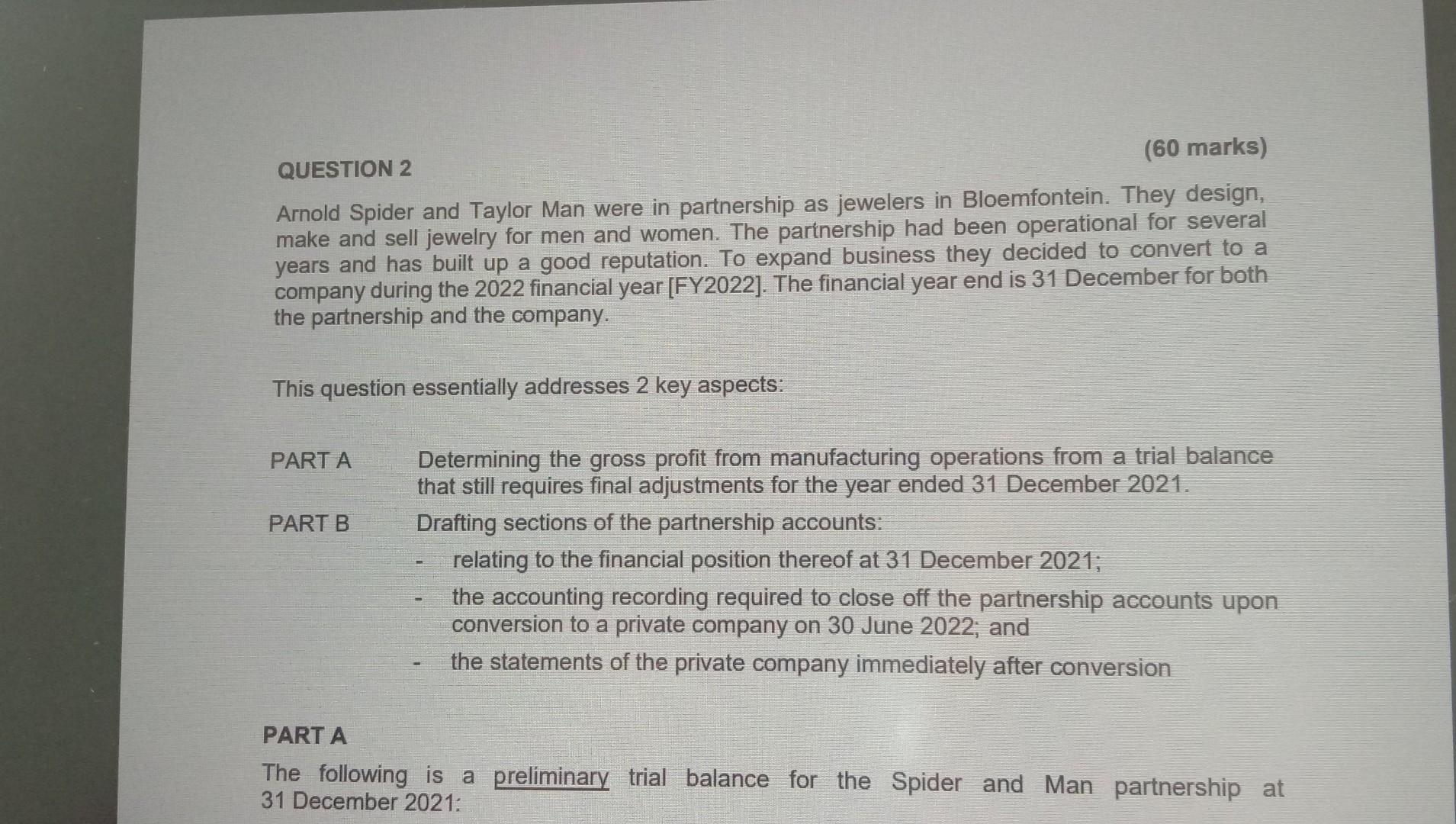

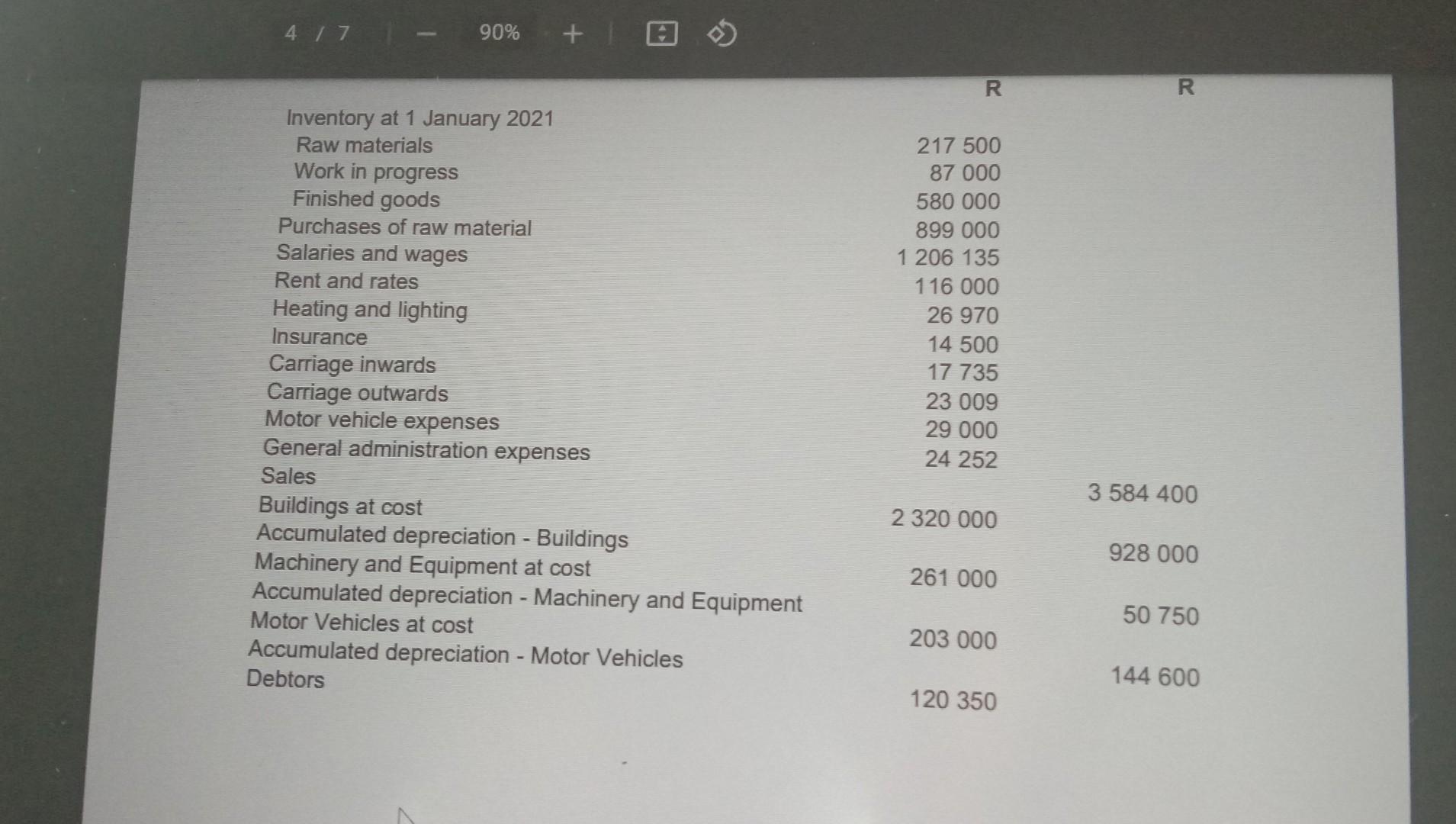

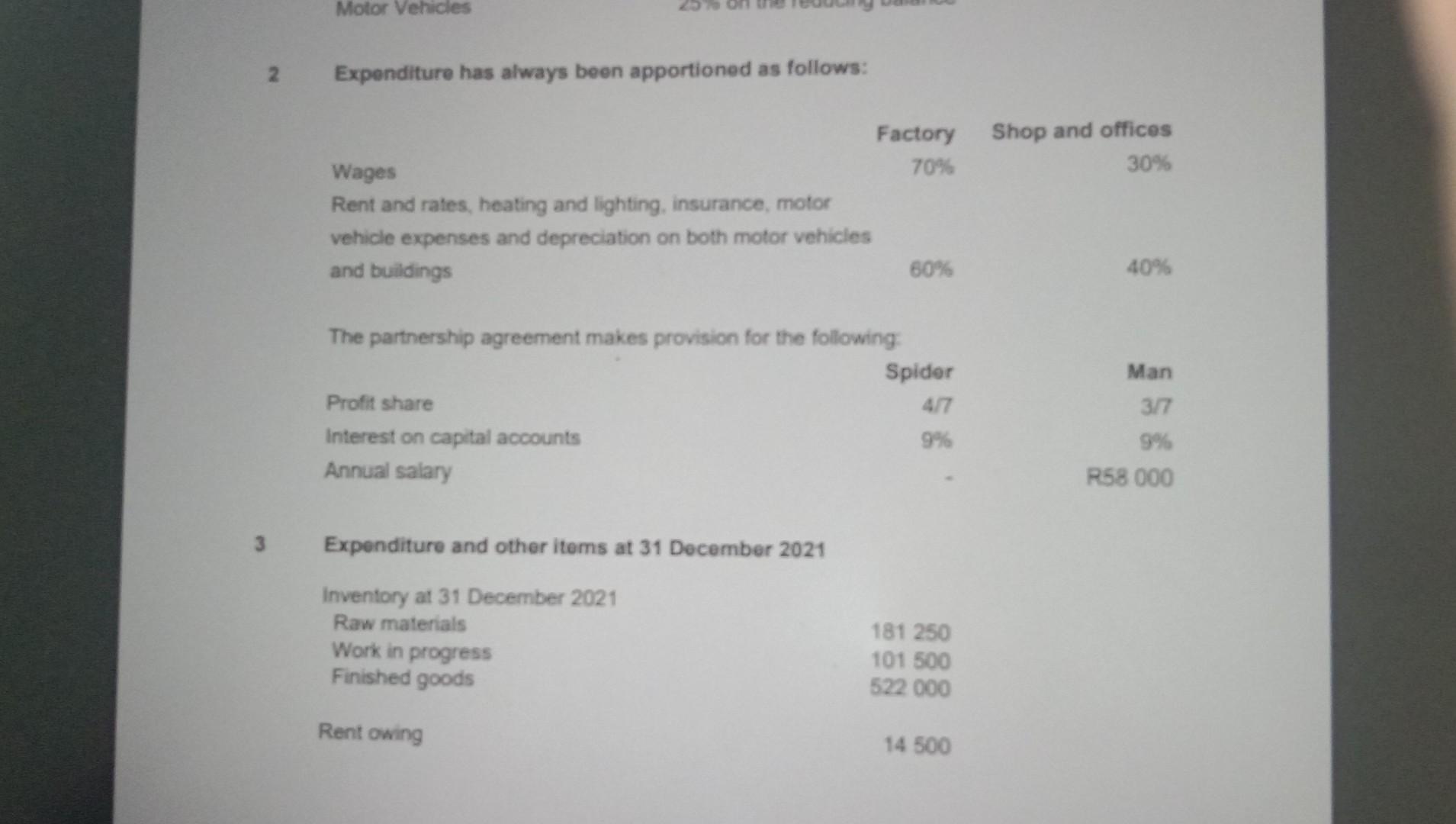

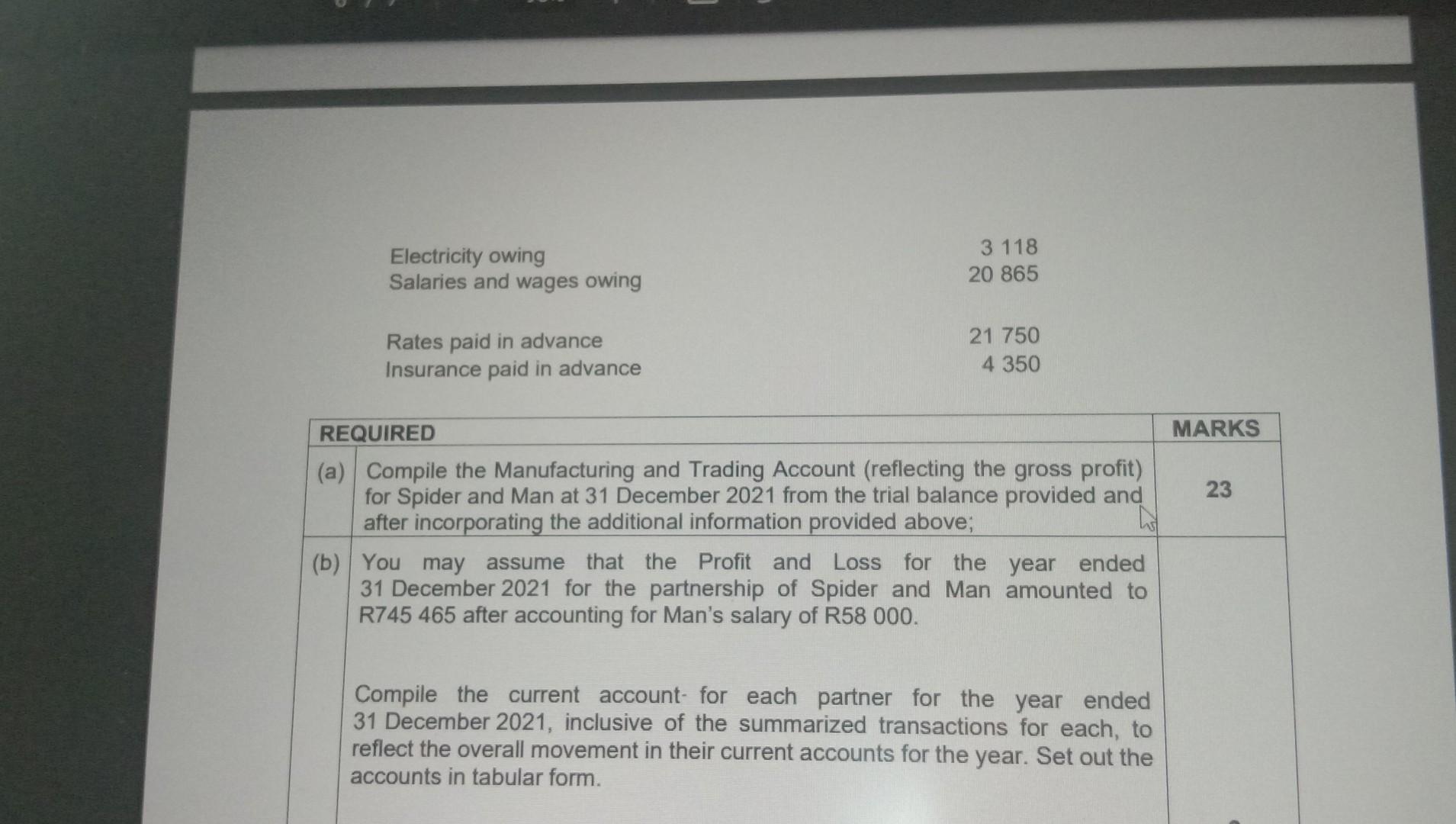

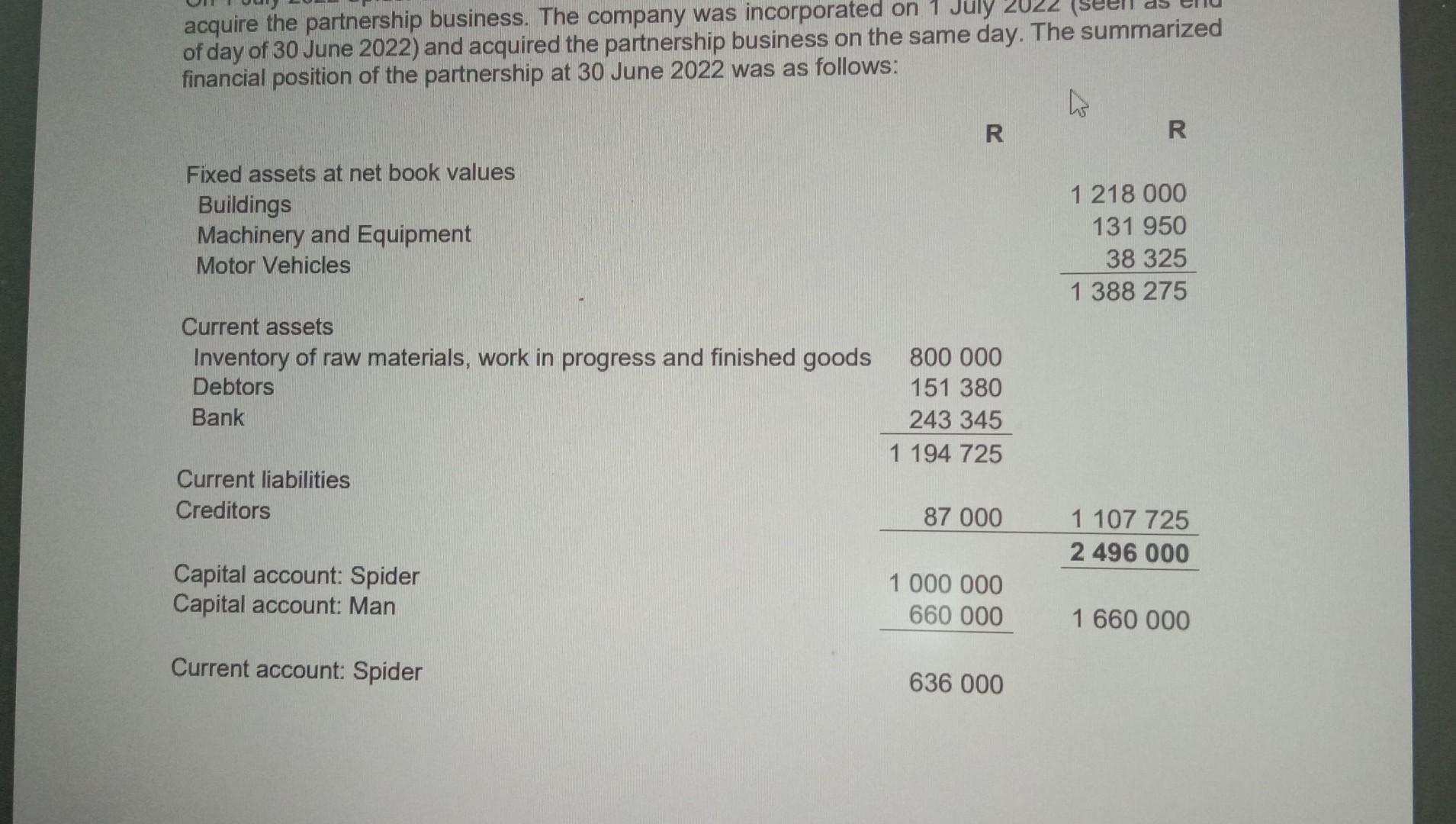

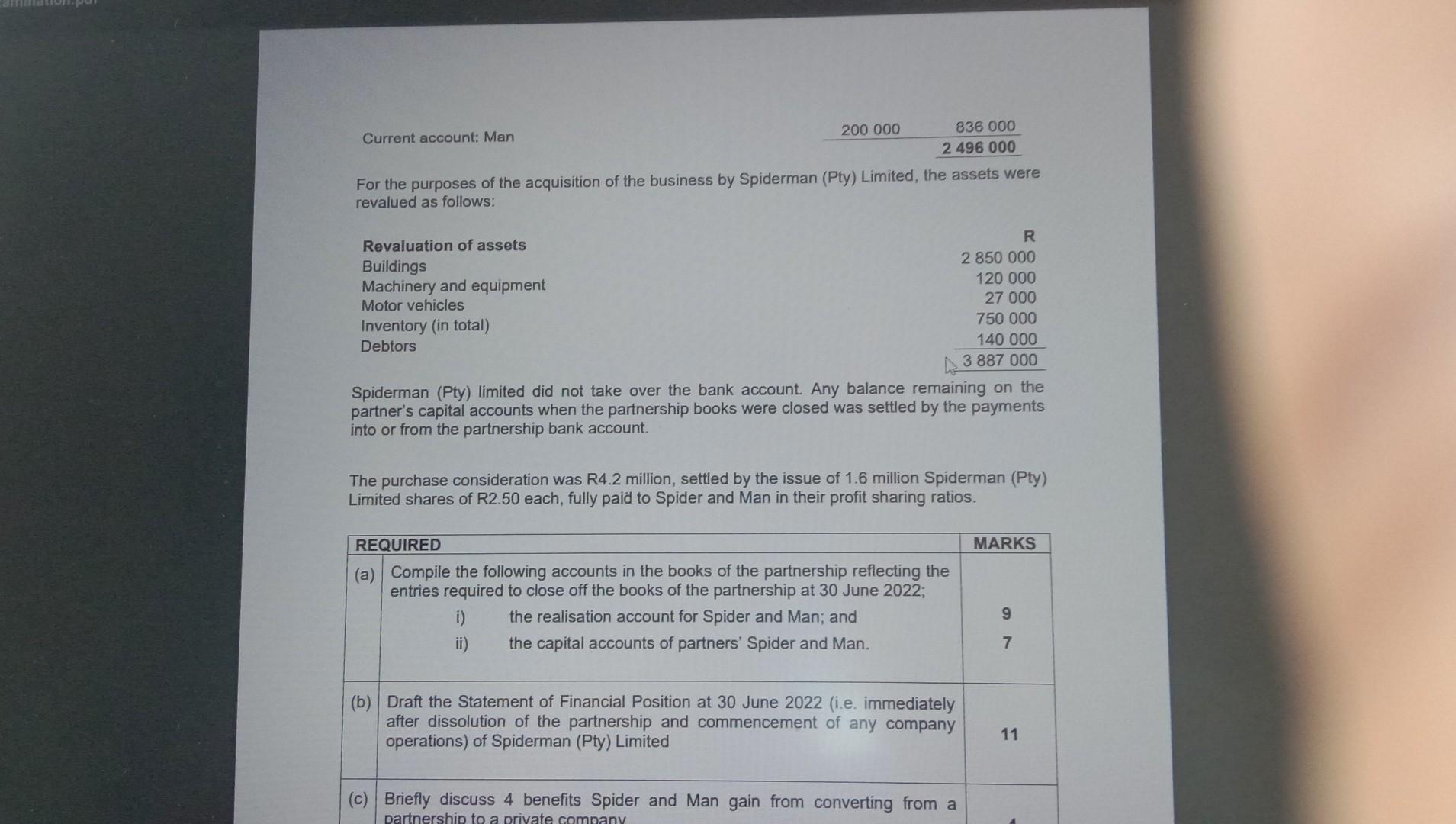

QUESTION 2 (60 marks) Arnold Spider and Taylor Man were in partnership as jewelers in Bloemfontein. They design, make and sell jewelry for men and women. The partinership had been operational for several years and has built up a good reputation. To expand business they decided to convert to a company during the 2022 financial year [FY2022]. The financial year end is 31 December for both the partnership and the company. This question essentially addresses 2 key aspects: PART A Determining the gross profit from manufacturing operations from a trial balance that still requires final adjustments for the year ended 31 December 2021. PART B Drafting sections of the partnership accounts: - relating to the financial position thereof at 31 December 2021; - the accounting recording required to close off the partnership accounts upon conversion to a private company on 30 June 2022 ; and - the statements of the private company immediately after conversion PART A The following is a preliminary trial balance for the Spider and Man partnership at 31 December 2021: Additional information to be considered for finalisation of the trial balance provided above: 1 Annual depreciation (for the partnership and the company) on fixed assets is provided as follows: 2 Expenditure has always been apportioned as follows: The partnership agreement makes provision for the following Expenditure and other items at 31 December 2021 Electricity owing Salaries and wages owing Rates paid in advance 21750 Insurance paid in advance 4350 acquire the partnership business. The company was incorporated on 1 July U2z Summarized of day of 30 June 2022) and acquired the partnership business on the same day. The summarized financial position of the partnership at 30 June 2022 was as follows: For the purposes of the acquisition of the business by Spiderman (Pty) Limited, the assets were revalued as follows: Spiderman (Pty) limited did not take over the bank account. Any balance remaining on the partner's capital accounts when the partnership books were closed was settled by the payments into or from the partnership bank account. The purchase consideration was R4.2 million, settled by the issue of 1.6 million Spiderman (Pty) Limited shares of R2.50 each, fully paid to Spider and Man in their profit sharing ratios. QUESTION 2 (60 marks) Arnold Spider and Taylor Man were in partnership as jewelers in Bloemfontein. They design, make and sell jewelry for men and women. The partinership had been operational for several years and has built up a good reputation. To expand business they decided to convert to a company during the 2022 financial year [FY2022]. The financial year end is 31 December for both the partnership and the company. This question essentially addresses 2 key aspects: PART A Determining the gross profit from manufacturing operations from a trial balance that still requires final adjustments for the year ended 31 December 2021. PART B Drafting sections of the partnership accounts: - relating to the financial position thereof at 31 December 2021; - the accounting recording required to close off the partnership accounts upon conversion to a private company on 30 June 2022 ; and - the statements of the private company immediately after conversion PART A The following is a preliminary trial balance for the Spider and Man partnership at 31 December 2021: Additional information to be considered for finalisation of the trial balance provided above: 1 Annual depreciation (for the partnership and the company) on fixed assets is provided as follows: 2 Expenditure has always been apportioned as follows: The partnership agreement makes provision for the following Expenditure and other items at 31 December 2021 Electricity owing Salaries and wages owing Rates paid in advance 21750 Insurance paid in advance 4350 acquire the partnership business. The company was incorporated on 1 July U2z Summarized of day of 30 June 2022) and acquired the partnership business on the same day. The summarized financial position of the partnership at 30 June 2022 was as follows: For the purposes of the acquisition of the business by Spiderman (Pty) Limited, the assets were revalued as follows: Spiderman (Pty) limited did not take over the bank account. Any balance remaining on the partner's capital accounts when the partnership books were closed was settled by the payments into or from the partnership bank account. The purchase consideration was R4.2 million, settled by the issue of 1.6 million Spiderman (Pty) Limited shares of R2.50 each, fully paid to Spider and Man in their profit sharing ratios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started