Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: (7.5 points): B1, C1, C3 On December 31, 2019, P company issued 30,000 shares of its $2par common stock (current fair value $10

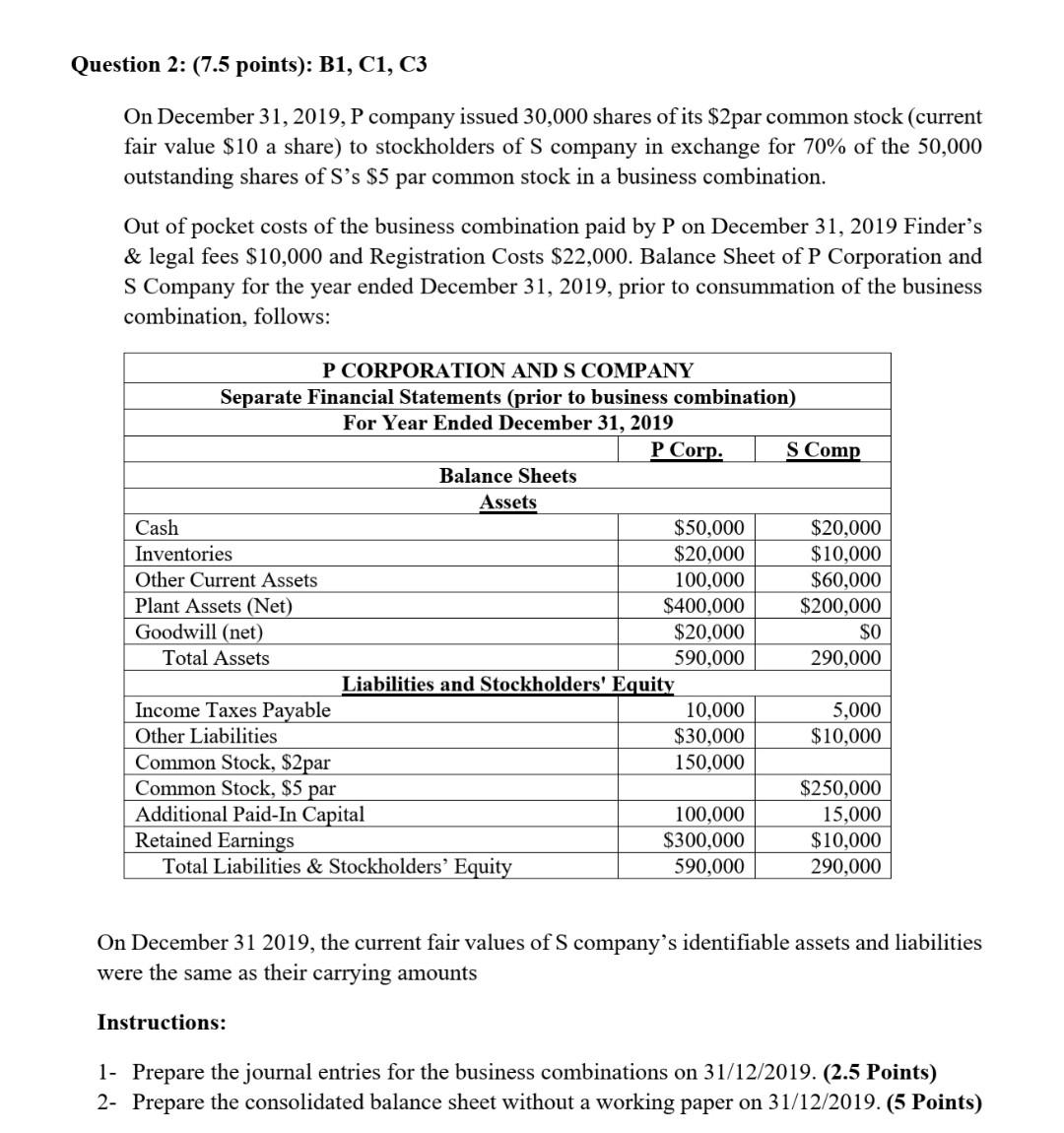

Question 2: (7.5 points): B1, C1, C3 On December 31, 2019, P company issued 30,000 shares of its $2par common stock (current fair value $10 a share) to stockholders of S company in exchange for 70% of the 50,000 outstanding shares of S's $5 par common stock in a business combination. Out of pocket costs of the business combination paid by P on December 31, 2019 Finder's & legal fees $10,000 and Registration Costs $22,000. Balance Sheet of P Corporation and S Company for the year ended December 31, 2019, prior to consummation of the business combination, follows: P CORPORATION AND S COMPANY Separate Financial Statements (prior to business combination) For Year Ended December 31, 2019 P Corp. S Comp Balance Sheets Assets Cash $50,000 $20,000 Inventories $20,000 $10,000 Other Current Assets 100,000 $60,000 Plant Assets (Net) $400,000 $200,000 Goodwill (net) $20,000 $0 Total Assets 590,000 290,000 Liabilities and Stockholders' Equity Income Taxes Payable 10,000 5,000 Other Liabilities $30,000 $10,000 Common Stock, $2par 150,000 Common Stock, $5 par $250,000 Additional Paid-In Capital 100,000 15,000 Retained Earnings $300,000 $10,000 Total Liabilities & Stockholders' Equity 590,000 290,000 On December 31 2019, the current fair values of S company's identifiable assets and liabilities were the same as their carrying amounts Instructions: 1- Prepare the journal entries for the business combinations on 31/12/2019. (2.5 Points) 2- Prepare the consolidated balance sheet without a working paper on 31/12/2019. (5 Points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started