Answered step by step

Verified Expert Solution

Question

1 Approved Answer

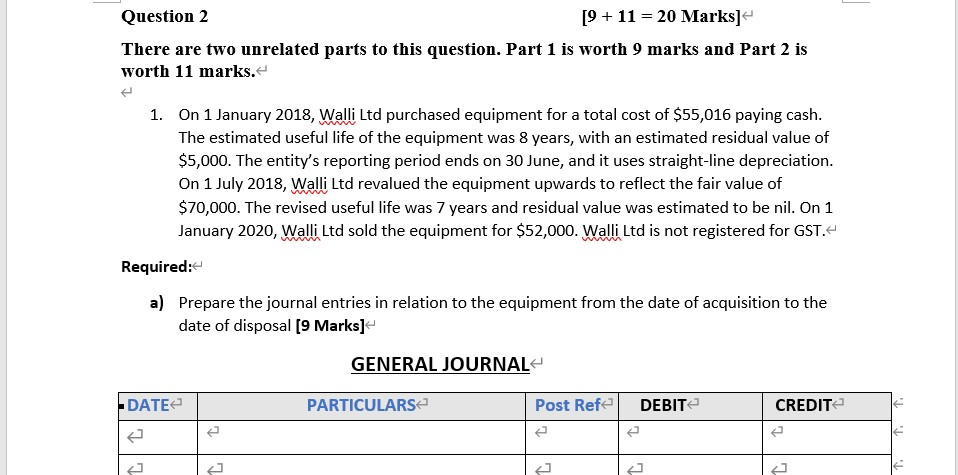

Question 2 [9 + 11 = 20 Marks] There are two unrelated parts to this question. Part 1 is worth 9 marks and Part 2

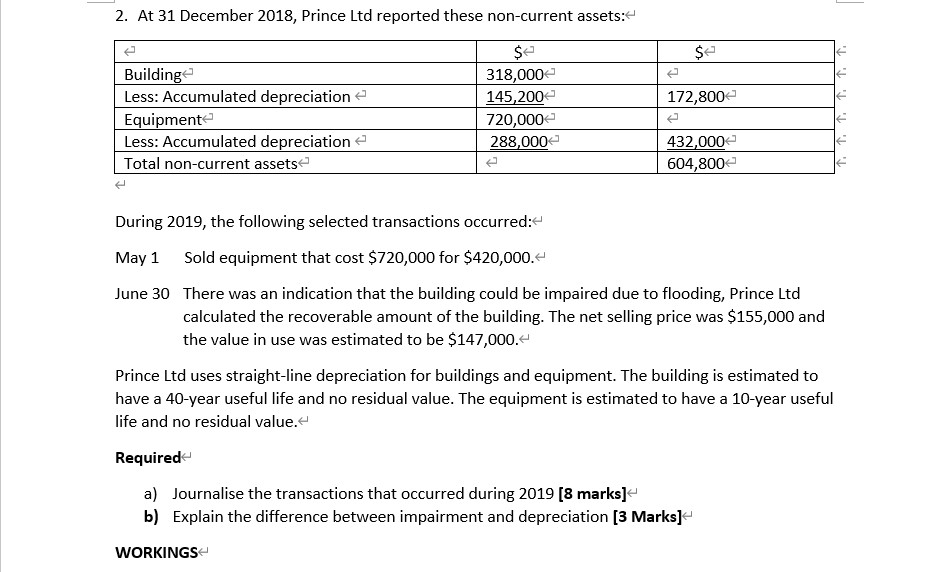

Question 2 [9 + 11 = 20 Marks] There are two unrelated parts to this question. Part 1 is worth 9 marks and Part 2 is worth 11 marks. 1. On 1 January 2018, Walli Ltd purchased equipment for a total cost of $55,016 paying cash. The estimated useful life of the equipment was 8 years, with an estimated residual value of $5,000. The entity's reporting period ends on 30 June, and it uses straight-line depreciation. On 1 July 2018, Walli Ltd revalued the equipment upwards to reflect the fair value of $70,000. The revised useful life was 7 years and residual value was estimated to be nil. On 1 January 2020, Walli Ltd sold the equipment for $52,000. Walli Ltd is not registered for GST. Required: a) Prepare the journal entries in relation to the equipment from the date of acquisition to the date of disposal [9 Marks] GENERAL JOURNAL - DATE PARTICULARS Post Refe DEBIT CREDIT t T e c 2. At 31 December 2018, Prince Ltd reported these non-current assets: $e $e 172,800 Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total non-current assets 318,000 145,200 720,000 288,000 1. 1. 1. 1. 1. 432,000 604,800 During 2019, the following selected transactions occurred: May 1 Sold equipment that cost $720,000 for $420,000.- June 30 There was an indication that the building could be impaired due to flooding, Prince Ltd calculated the recoverable amount of the building. The net selling price was $155,000 and the value in use was estimated to be $147,000.- Prince Ltd uses straight-line depreciation for buildings and equipment. The building is estimated to have a 40-year useful life and no residual value. The equipment is estimated to have a 10-year useful life and no residual value. Required a) Journalise the transactions that occurred during 2019 (8 marks] b) Explain the difference between impairment and depreciation (3 Marks] WORKINGS a) GENERAL JOURNAL DATE PARTICULARS Post Refe DEBITE CREDIT [ [ * 7 ] ] 1 b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started