Answered step by step

Verified Expert Solution

Question

1 Approved Answer

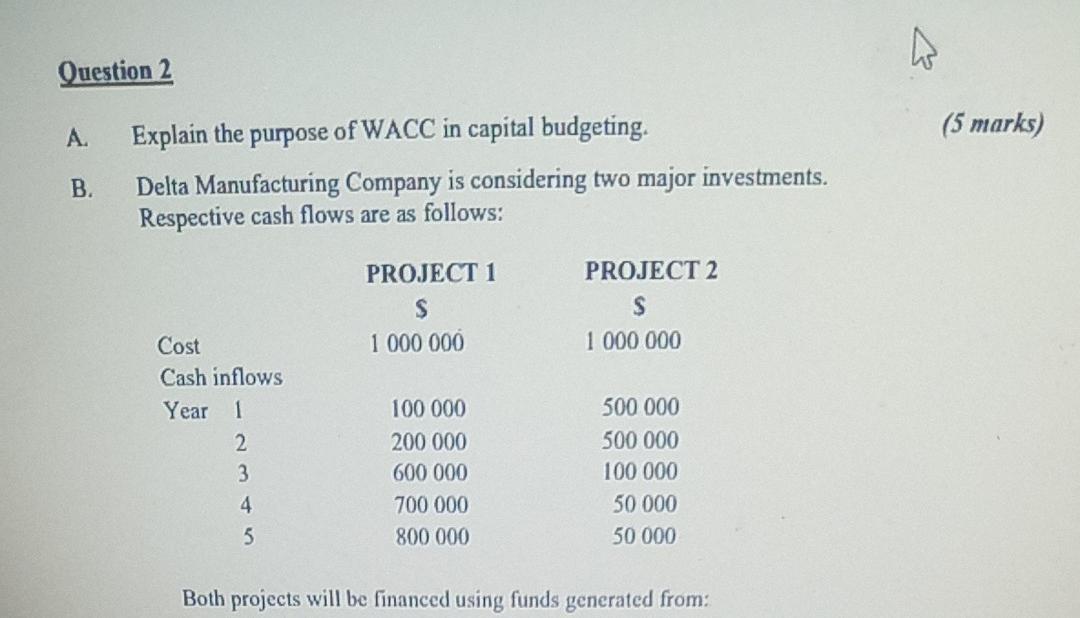

Question 2 A. (5 marks) Explain the purpose of WACC in capital budgeting. B. Delta Manufacturing Company is considering two major investments. Respective cash flows

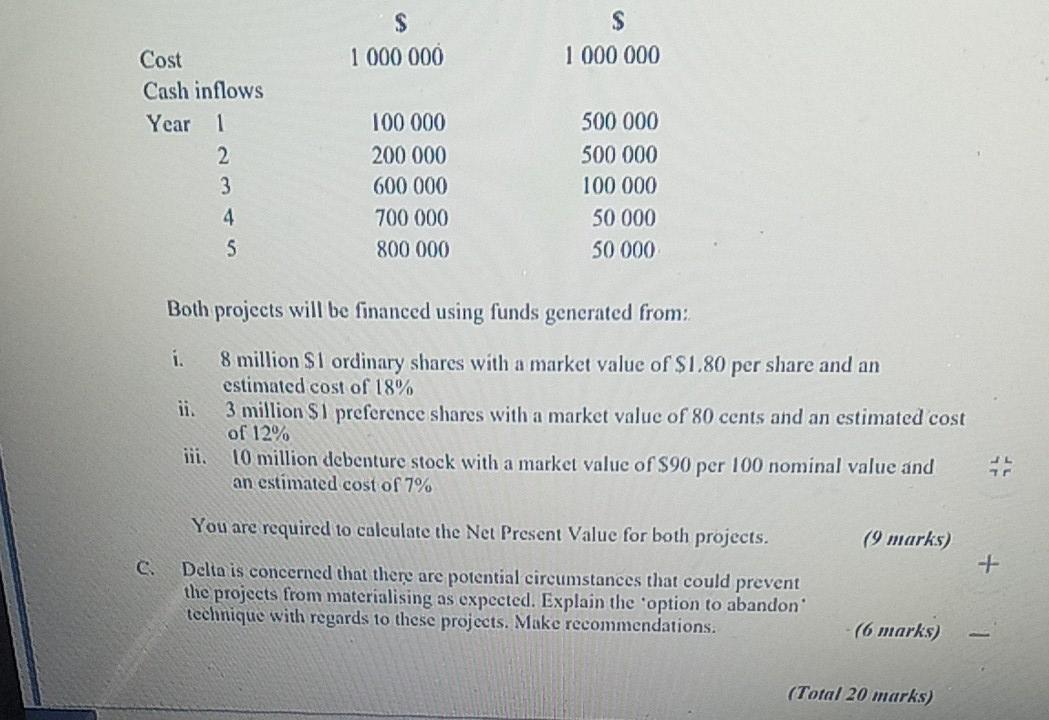

Question 2 A. (5 marks) Explain the purpose of WACC in capital budgeting. B. Delta Manufacturing Company is considering two major investments. Respective cash flows are as follows: PROJECT 1 PROJECT 2 S S 1 000 000 1 000 000 Cost Cash inflows Year 1 100 000 500 000 2 3 200 000 600 000 500 000 100 000 4 700 000 50 000 3 800 000 50 000 Both projects will be financed using funds generated from: S S 1 000 000 1 000 000 Cost Cash inflows Year 1 100 000 500 000 200 000 2 3 500 000 100 000 600 000 4 700 000 50 000 5 800 000 50 000 Both projects will be financed using funds generated from: i. 8 million $1 ordinary shares with a market value of $1.80 per share and an estimated cost of 18% 3 million $1 preference shares with a market value of 80 cents and an estimated cost of 12% 10 million debenture stock with a market value of $90 per 100 nominal value and an estimated cost of 7% 5 You are required to calculate the Net Present Value for both projects. (9 marks) + Delta is concerned that there are potential circumstances that could prevent the projects from materialising as expected. Explain the option to abandon technique with regards to these projects. Make recommendations. (6 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started