Answered step by step

Verified Expert Solution

Question

1 Approved Answer

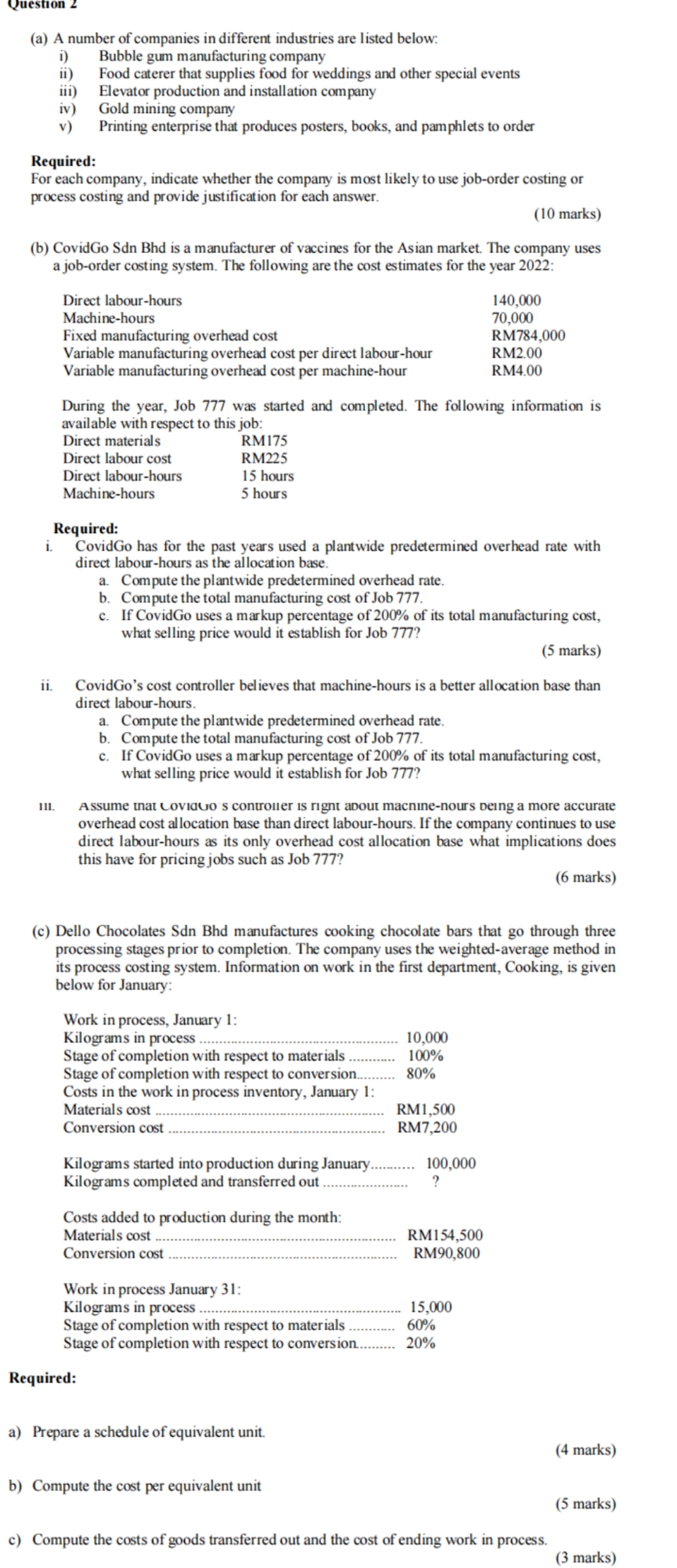

Question 2 (a) A number of companies in different industries are listed below: i) ii) iii) iv) v) Required: Bubble gum manufacturing company Food

Question 2 (a) A number of companies in different industries are listed below: i) ii) iii) iv) v) Required: Bubble gum manufacturing company Food caterer that supplies food for weddings and other special events Elevator production and installation company Gold mining company Printing enterprise that produces posters, books, and pamphlets to order For each company, indicate whether the company is most likely to use job-order costing or process costing and provide justification for each answer. (10 marks) (b) CovidGo Sdn Bhd is a manufacturer of vaccines for the Asian market. The company uses a job-order costing system. The following are the cost estimates for the year 2022: i. Direct labour-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labour-hour Variable manufacturing overhead cost per machine-hour 140,000 70,000 RM784,000 RM2.00 RM4.00 During the year, Job 777 was started and completed. The following information is available with respect to this job: Direct materials Direct labour cost Direct labour-hours Machine-hours Required: RM175 RM225 15 hours 5 hours CovidGo has for the past years used a plantwide predetermined overhead rate with direct labour-hours as the allocation base. a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 777. c. If CovidGo uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 777? (5 marks) ii. 111. CovidGo's cost controller believes that machine-hours is a better allocation base than direct labour-hours. a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 777. c. If CovidGo uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 777? Assume that Coviagos controller is right about machine-nours being a more accurate overhead cost allocation base than direct labour-hours. If the company continues to use direct labour-hours as its only overhead cost allocation base what implications does this have for pricing jobs such as Job 777? (6 marks) (c) Dello Chocolates Sdn Bhd manufactures cooking chocolate bars that go through three processing stages prior to completion. The company uses the weighted-average method in its process costing system. Information on work in the first department, Cooking, is given below for January: Work in process, January 1: Kilograms in process. 10,000 Stage of completion with respect to materials. 100% Stage of completion with respect to conversion... 80% Costs in the work in process inventory, January 1: Materials cost RM1,500 Conversion cost RM7,200 Kilograms started into production during January.. Kilograms completed and transferred out. 100,000 ? Costs added to production during the month: Materials cost Conversion cost Work in process January 31: Kilograms in process Stage of completion with respect to materials. Stage of completion with respect to conversion.... Required: a) Prepare a schedule of equivalent unit. b) Compute the cost per equivalent unit RM154,500 RM90,800 15,000 60% 20% (4 marks) (5 marks) c) Compute the costs of goods transferred out and the cost of ending work in process. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started