Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 a. CME Group trades futures contracts on the S&P500 index as well as options on these futures. From a trader's perspective, what is

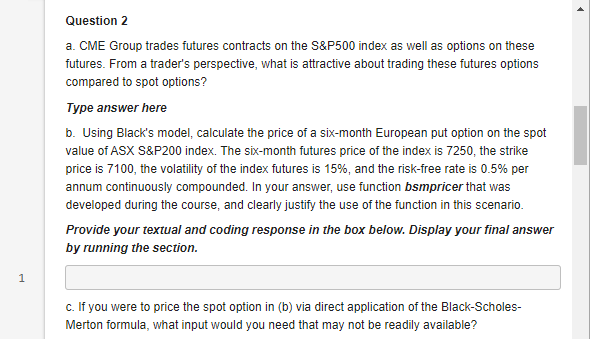

Question 2 a. CME Group trades futures contracts on the S&P500 index as well as options on these futures. From a trader's perspective, what is attractive about trading these futures options compared to spot options? Type answer here b. Using Black's model, calculate the price of a six-month European put option on the spot value of ASX S&P200 index. The six-month futures price of the index is 7250, the strike price is 7100, the volatility of the index futures is 15%, and the risk-free rate is 0.5% per annum continuously compounded. In your answer, use function bsmpricer that was developed during the course, and clearly justify the use of the function in this scenario. Provide your textual and coding response in the box below. Display your final answer by running the section. 1 c. If you were to price the spot option in (b) via direct application of the Black-Scholes- Merton formula, what input would you need that may not be readily available? Question 2 a. CME Group trades futures contracts on the S&P500 index as well as options on these futures. From a trader's perspective, what is attractive about trading these futures options compared to spot options? Type answer here b. Using Black's model, calculate the price of a six-month European put option on the spot value of ASX S&P200 index. The six-month futures price of the index is 7250, the strike price is 7100, the volatility of the index futures is 15%, and the risk-free rate is 0.5% per annum continuously compounded. In your answer, use function bsmpricer that was developed during the course, and clearly justify the use of the function in this scenario. Provide your textual and coding response in the box below. Display your final answer by running the section. 1 c. If you were to price the spot option in (b) via direct application of the Black-Scholes- Merton formula, what input would you need that may not be readily available

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started