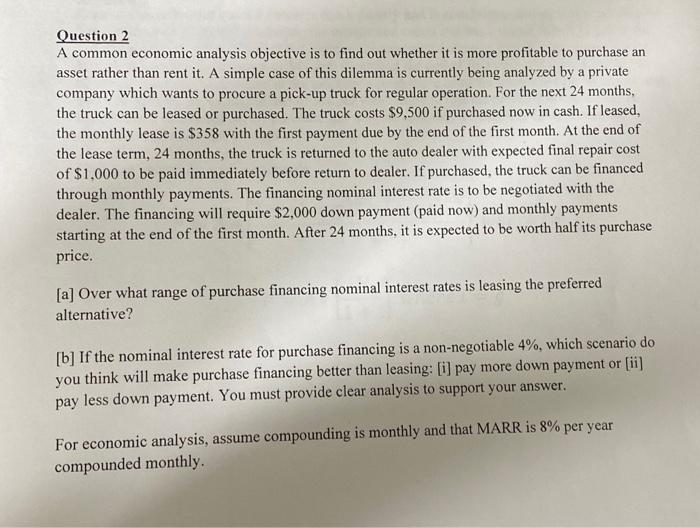

Question 2 A common economic analysis objective is to find out whether it is more profitable to purchase an asset rather than rent it. A simple case of this dilemma is currently being analyzed by a private company which wants to procure a pick-up truck for regular operation. For the next 24 months, the truck can be leased or purchased. The truck costs $9.500 if purchased now in cash. If leased, the monthly lease is $358 with the first payment due by the end of the first month. At the end of the lease term, 24 months, the truck is returned to the auto dealer with expected final repair cost of $1,000 to be paid immediately before return to dealer. If purchased, the truck can be financed through monthly payments. The financing nominal interest rate is to be negotiated with the dealer. The financing will require $2,000 down payment (paid now) and monthly payments starting at the end of the first month. After 24 months, it is expected to be worth half its purchase price. [a] Over what range of purchase financing nominal interest rates is leasing the preferred alternative? [b] If the nominal interest rate for purchase financing is a non-negotiable 4%, which scenario do you think will make purchase financing better than leasing: [i] pay more down payment or (ii) pay less down payment. You must provide clear analysis to support your answer. For economic analysis, assume compounding is monthly and that MARR is 8% per year compounded monthly Question 2 A common economic analysis objective is to find out whether it is more profitable to purchase an asset rather than rent it. A simple case of this dilemma is currently being analyzed by a private company which wants to procure a pick-up truck for regular operation. For the next 24 months, the truck can be leased or purchased. The truck costs $9.500 if purchased now in cash. If leased, the monthly lease is $358 with the first payment due by the end of the first month. At the end of the lease term, 24 months, the truck is returned to the auto dealer with expected final repair cost of $1,000 to be paid immediately before return to dealer. If purchased, the truck can be financed through monthly payments. The financing nominal interest rate is to be negotiated with the dealer. The financing will require $2,000 down payment (paid now) and monthly payments starting at the end of the first month. After 24 months, it is expected to be worth half its purchase price. [a] Over what range of purchase financing nominal interest rates is leasing the preferred alternative? [b] If the nominal interest rate for purchase financing is a non-negotiable 4%, which scenario do you think will make purchase financing better than leasing: [i] pay more down payment or (ii) pay less down payment. You must provide clear analysis to support your answer. For economic analysis, assume compounding is monthly and that MARR is 8% per year compounded monthly