Answered step by step

Verified Expert Solution

Question

1 Approved Answer

----------- QUESTION 2 A company's income statement showed the following: net income of $124,000 and depreciation expense of $30,000. An examination of the company's current

-----------

QUESTION 2

A company's income statement showed the following: net income of $124,000 and depreciation expense of $30,000. An examination of the company's current assets and current liabilities showed the following changes as a result of operating activities: accounts receivable decreased $9,400; merchandise inventory increased $18,000; prepaid expenses decreased $6,200; accounts payable increased $3,400. Calculate the net cash provided or used by operating activities. Be sure to show your work!

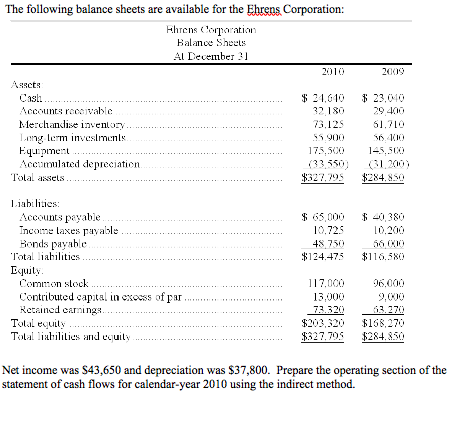

The following balance sheets are available for the Ehrens Corporation: Ehrens Corporation Balance Sheets Al December 31 $ 21,610 32 180 73.125 29 400 51.710 Assets Cast: Accounts receivable Merchandise inventory Long term investments Equipment Accumulated depreciation Total assets..... 145,500 175,500 (33.550) $327.795 $ 40,380 $ 65,000 10.725 48 750 $124.773 56 (KO $116.580 Liabilities: Accounts peyable Income Taxes payable Bonds payable Total abilities Equity Common stock Contributed capital in excess of par Retained camninga. Total equily Total liabilities and equily 165.000 117.000 13,000 73.320 63.270 $158.270 $284.850 $327,705 Net income was $43,650 and depreciation was $37,800. Prepare the operating section of the statement of cash flows for calendar-year 2010 using the indirect methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started