Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (a) Compare and contrast the option trades undertaken by Microsoft and Pemex respectively [4096] (b) Explain how the equity issued by a firm

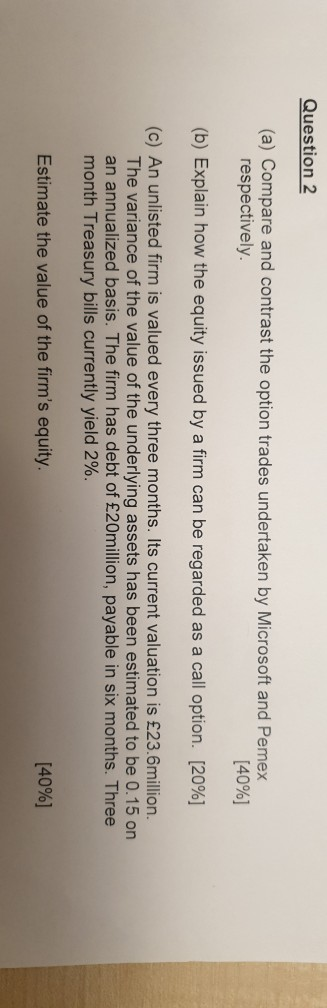

Question 2 (a) Compare and contrast the option trades undertaken by Microsoft and Pemex respectively [4096] (b) Explain how the equity issued by a firm can be regarded as a call option. [20%] (c) An unlisted firm is valued every three months. Its current valuation is 23.6million. The variance of the value of the underlying assets has been estimated to be 0.15 on an annualized basis. The firm has debt of 20million, payable in six months. Three month Treasury bills currently yield 2%. Estimate the value of the firm's equity. [4096] Question 2 (a) Compare and contrast the option trades undertaken by Microsoft and Pemex respectively [4096] (b) Explain how the equity issued by a firm can be regarded as a call option. [20%] (c) An unlisted firm is valued every three months. Its current valuation is 23.6million. The variance of the value of the underlying assets has been estimated to be 0.15 on an annualized basis. The firm has debt of 20million, payable in six months. Three month Treasury bills currently yield 2%. Estimate the value of the firm's equity. [4096]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started