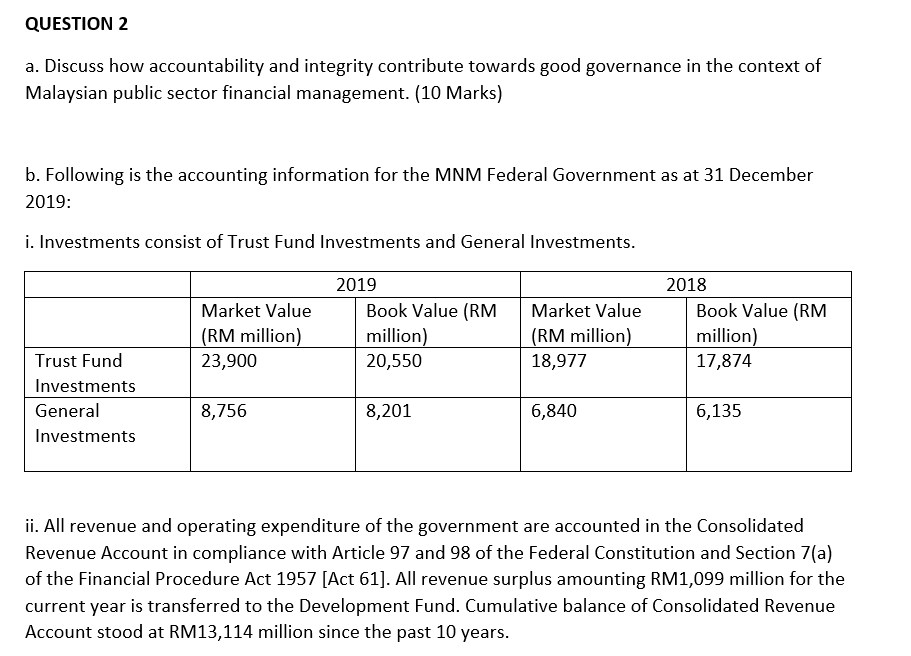

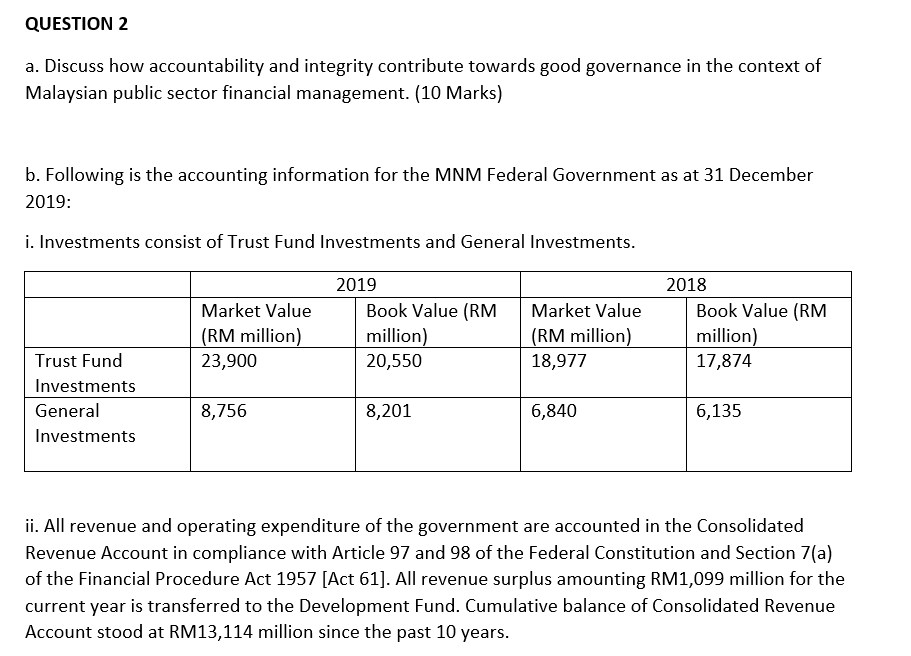

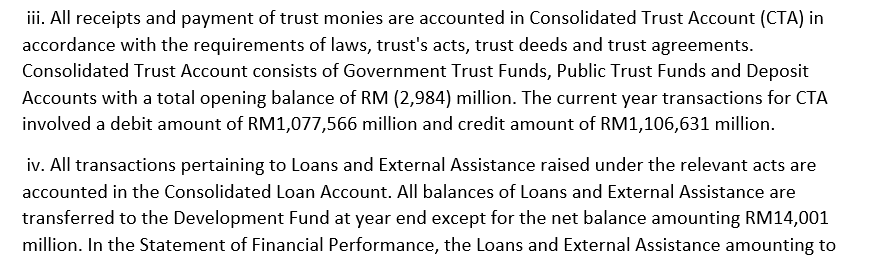

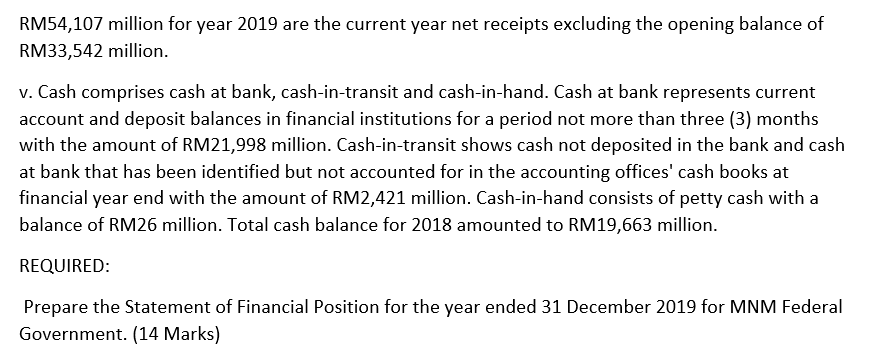

QUESTION 2 a. Discuss how accountability and integrity contribute towards good governance in the context of Malaysian public sector financial management. (10 Marks) b. Following is the accounting information for the MNM Federal Government as at 31 December 2019: i. Investments consist of Trust Fund Investments and General Investments. Market Value (RM million) 23,900 2019 Book Value (RM million) 20,550 Market Value (RM million) 18,977 2018 Book Value (RM million) 17,874 Trust Fund Investments General Investments 8,756 8,201 6,840 6,135 ii. All revenue and operating expenditure of the government are accounted in the Consolidated Revenue Account in compliance with Article 97 and 98 of the Federal Constitution and Section 7(a) of the Financial Procedure Act 1957 [Act 61]. All revenue surplus amounting RM1,099 million for the current year is transferred to the Development Fund. Cumulative balance of Consolidated Revenue Account stood at RM13,114 million since the past 10 years. iii. All receipts and payment of trust monies are accounted in Consolidated Trust Account (CTA) in accordance with the requirements of laws, trust's acts, trust deeds and trust agreements. Consolidated Trust Account consists of Government Trust Funds, Public Trust Funds and Deposit Accounts with a total opening balance of RM (2,984) million. The current year transactions for CTA involved a debit amount of RM1,077,566 million and credit amount of RM1,106,631 million. iv. All transactions pertaining to Loans and External Assistance raised under the relevant acts are accounted in the Consolidated Loan Account. All balances of Loans and External Assistance are transferred to the Development Fund at year end except for the net balance amounting RM14,001 million. In the Statement of Financial Performance, the Loans and External Assistance amounting to RM54,107 million for year 2019 are the current year net receipts excluding the opening balance of RM33,542 million. v. Cash comprises cash at bank, cash-in-transit and cash-in-hand. Cash at bank represents current account and deposit balances in financial institutions for a period not more than three (3) months with the amount of RM21,998 million. Cash-in-transit shows cash not deposited in the bank and cash at bank that has been identified but not accounted for in the accounting offices' cash books at financial year end with the amount of RM2,421 million. Cash-in-hand consists of petty cash with a balance of RM26 million. Total cash balance for 2018 amounted to RM19,663 million. REQUIRED: Prepare the Statement of Financial Position for the year ended 31 December 2019 for MNM Federal Government. (14 Marks) QUESTION 2 a. Discuss how accountability and integrity contribute towards good governance in the context of Malaysian public sector financial management. (10 Marks) b. Following is the accounting information for the MNM Federal Government as at 31 December 2019: i. Investments consist of Trust Fund Investments and General Investments. Market Value (RM million) 23,900 2019 Book Value (RM million) 20,550 Market Value (RM million) 18,977 2018 Book Value (RM million) 17,874 Trust Fund Investments General Investments 8,756 8,201 6,840 6,135 ii. All revenue and operating expenditure of the government are accounted in the Consolidated Revenue Account in compliance with Article 97 and 98 of the Federal Constitution and Section 7(a) of the Financial Procedure Act 1957 [Act 61]. All revenue surplus amounting RM1,099 million for the current year is transferred to the Development Fund. Cumulative balance of Consolidated Revenue Account stood at RM13,114 million since the past 10 years. iii. All receipts and payment of trust monies are accounted in Consolidated Trust Account (CTA) in accordance with the requirements of laws, trust's acts, trust deeds and trust agreements. Consolidated Trust Account consists of Government Trust Funds, Public Trust Funds and Deposit Accounts with a total opening balance of RM (2,984) million. The current year transactions for CTA involved a debit amount of RM1,077,566 million and credit amount of RM1,106,631 million. iv. All transactions pertaining to Loans and External Assistance raised under the relevant acts are accounted in the Consolidated Loan Account. All balances of Loans and External Assistance are transferred to the Development Fund at year end except for the net balance amounting RM14,001 million. In the Statement of Financial Performance, the Loans and External Assistance amounting to RM54,107 million for year 2019 are the current year net receipts excluding the opening balance of RM33,542 million. v. Cash comprises cash at bank, cash-in-transit and cash-in-hand. Cash at bank represents current account and deposit balances in financial institutions for a period not more than three (3) months with the amount of RM21,998 million. Cash-in-transit shows cash not deposited in the bank and cash at bank that has been identified but not accounted for in the accounting offices' cash books at financial year end with the amount of RM2,421 million. Cash-in-hand consists of petty cash with a balance of RM26 million. Total cash balance for 2018 amounted to RM19,663 million. REQUIRED: Prepare the Statement of Financial Position for the year ended 31 December 2019 for MNM Federal Government. (14 Marks)