Answered step by step

Verified Expert Solution

Question

1 Approved Answer

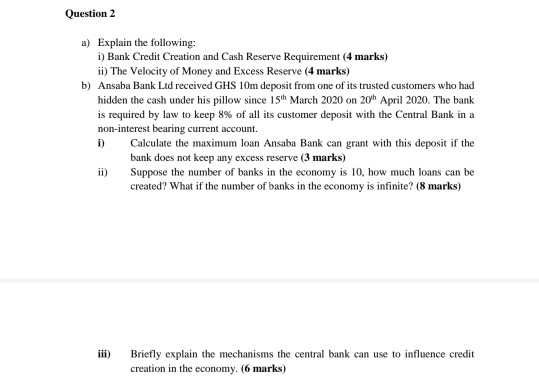

Question 2 a) Explain the following: i) Bank Credit Creation and Cash Reserve Requirement (4 marks) ii) The Velocity of Money and Excess Reserve (4

Question 2 a) Explain the following: i) Bank Credit Creation and Cash Reserve Requirement (4 marks) ii) The Velocity of Money and Excess Reserve (4 marks) b) Ansaba Bank Ltd received GHS 10m deposit from one of its trusted customers who had hidden the cash under his pillow since 15th March 2020 on 2014 April 2020. The bank is required by law to keep 8% of all its customer deposit with the Central Bank in a non-interest bearing current account. Calculate the maximum loan Ansaba Bank can grant with this deposit if the bank does not keep any excess reserve (3 marks) ii) Suppose the number of banks in the economy is 10, how much loans can be created? What if the number of banks in the economy is infinite? (8 marks) Briefly explain the mechanisms the central bank can use to influence credit creation in the economy. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started