Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (a) How does the risk of short-term funds differ from the risk of long-term funds? (10) The principal type of risk for short-term

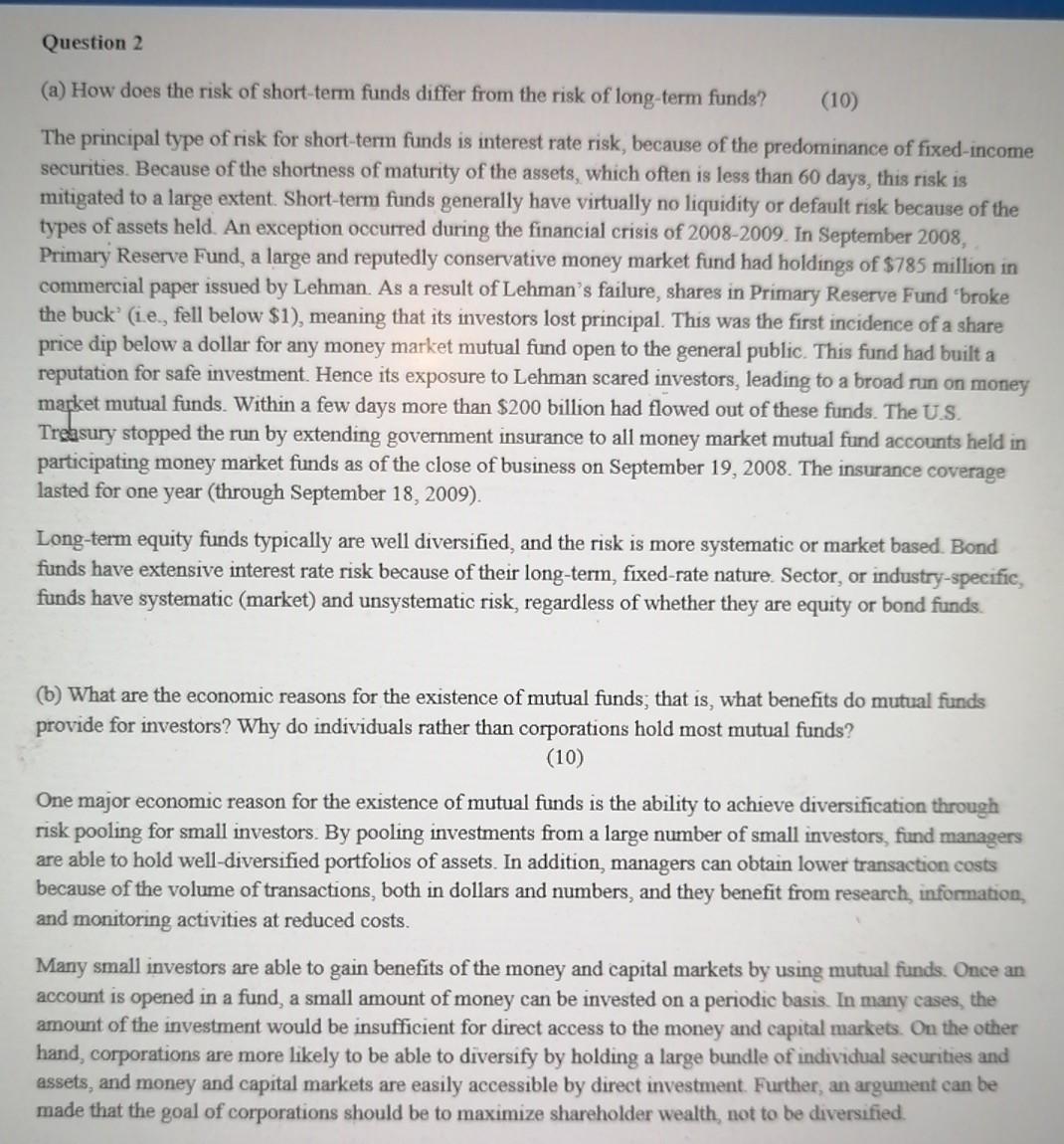

Question 2 (a) How does the risk of short-term funds differ from the risk of long-term funds? (10) The principal type of risk for short-term funds is interest rate risk, because of the predominance of fixed-income securities. Because of the shortness of maturity of the assets, which often is less than 60 days, this risk is mitigated to a large extent. Short-term funds generally have virtually no liquidity or default risk because of the types of assets held. An exception occurred during the financial crisis of 2008-2009. In September 2008, Primary Reserve Fund, a large and reputedly conservative money market fund had holdings of $785 million in commercial paper issued by Lehman. As a result of Lehman's failure, shares in Primary Reserve Fund broke the buck' (i.e., fell below $1), meaning that its investors lost principal. This was the first incidence of a share price dip below a dollar for any money market mutual fund open to the general public. This fund had built a reputation for safe investment. Hence its exposure to Lehman scared investors, leading to a broad run on money market mutual funds. Within a few days more than $200 billion had flowed out of these funds. The U.S. Treasury stopped the run by extending government insurance to all money market mutual fund accounts held in participating money market funds as of the close of business on September 19, 2008. The insurance coverage lasted for one year (through September 18, 2009). Long-term equity funds typically are well diversified, and the risk is more systematic or market based. Bond funds have extensive interest rate risk because of their long-term, fixed-rate nature. Sector, or industry-specific, funds have systematic (market) and unsystematic risk, regardless of whether they are equity or bond funds (b) What are the economic reasons for the existence of mutual funds; that is, what benefits do mutual funds provide for investors? Why do individuals rather than corporations hold most mutual funds? (10) One major economic reason for the existence of mutual funds is the ability to achieve diversification through risk pooling for small investors. By pooling investments from a large number of small investors, fund managers are able to hold well-diversified portfolios of assets. In addition, managers can obtain lower transaction costs because of the volume of transactions, both in dollars and numbers, and they benefit from research information, and monitoring activities at reduced costs. Many small investors are able to gain benefits of the money and capital markets by using mutual funds. Once an account is opened in a fund, a small amount of money can be invested on a periodic basis. In many cases, the amount of the investment would be insufficient for direct access to the money and capital markets. On the other hand, corporations are more likely to be able to diversify by holding a large bundle of individual securities and assets, and money and capital markets are easily accessible by direct investment. Further, an argument can be made that the goal of corporations should be to maximize shareholder wealth, not to be diversified Question 2 (a) How does the risk of short-term funds differ from the risk of long-term funds? (10) The principal type of risk for short-term funds is interest rate risk, because of the predominance of fixed-income securities. Because of the shortness of maturity of the assets, which often is less than 60 days, this risk is mitigated to a large extent. Short-term funds generally have virtually no liquidity or default risk because of the types of assets held. An exception occurred during the financial crisis of 2008-2009. In September 2008, Primary Reserve Fund, a large and reputedly conservative money market fund had holdings of $785 million in commercial paper issued by Lehman. As a result of Lehman's failure, shares in Primary Reserve Fund broke the buck' (i.e., fell below $1), meaning that its investors lost principal. This was the first incidence of a share price dip below a dollar for any money market mutual fund open to the general public. This fund had built a reputation for safe investment. Hence its exposure to Lehman scared investors, leading to a broad run on money market mutual funds. Within a few days more than $200 billion had flowed out of these funds. The U.S. Treasury stopped the run by extending government insurance to all money market mutual fund accounts held in participating money market funds as of the close of business on September 19, 2008. The insurance coverage lasted for one year (through September 18, 2009). Long-term equity funds typically are well diversified, and the risk is more systematic or market based. Bond funds have extensive interest rate risk because of their long-term, fixed-rate nature. Sector, or industry-specific, funds have systematic (market) and unsystematic risk, regardless of whether they are equity or bond funds (b) What are the economic reasons for the existence of mutual funds; that is, what benefits do mutual funds provide for investors? Why do individuals rather than corporations hold most mutual funds? (10) One major economic reason for the existence of mutual funds is the ability to achieve diversification through risk pooling for small investors. By pooling investments from a large number of small investors, fund managers are able to hold well-diversified portfolios of assets. In addition, managers can obtain lower transaction costs because of the volume of transactions, both in dollars and numbers, and they benefit from research information, and monitoring activities at reduced costs. Many small investors are able to gain benefits of the money and capital markets by using mutual funds. Once an account is opened in a fund, a small amount of money can be invested on a periodic basis. In many cases, the amount of the investment would be insufficient for direct access to the money and capital markets. On the other hand, corporations are more likely to be able to diversify by holding a large bundle of individual securities and assets, and money and capital markets are easily accessible by direct investment. Further, an argument can be made that the goal of corporations should be to maximize shareholder wealth, not to be diversified

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started