Answered step by step

Verified Expert Solution

Question

1 Approved Answer

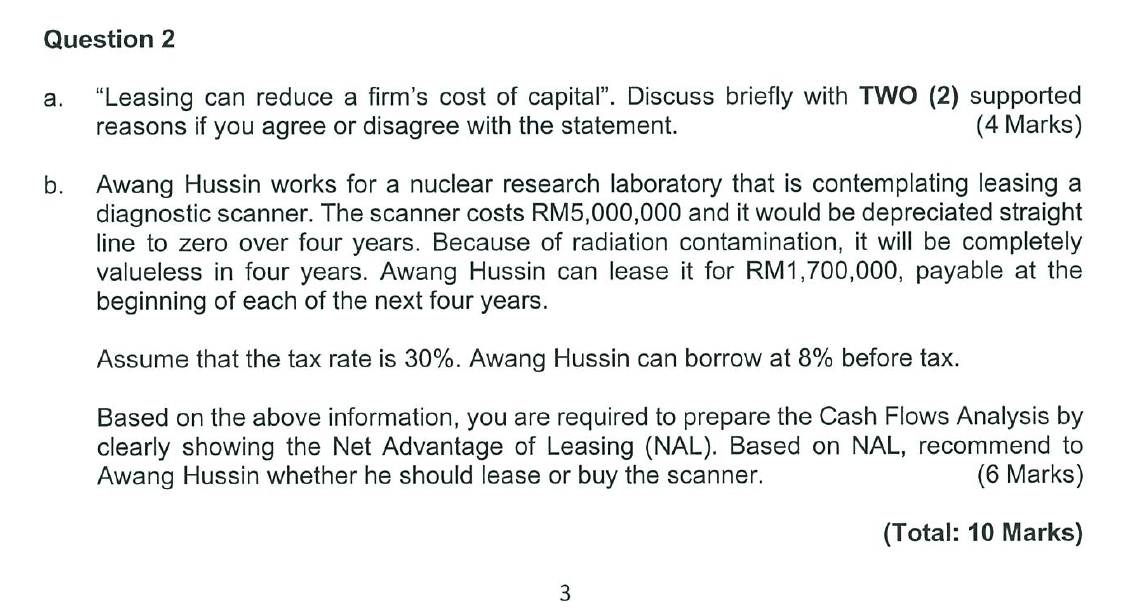

Question 2 a . Leasing can reduce a firm's cost of capital. Discuss briefly with TWO ( 2 ) supported reasons if you agree or

Question

a "Leasing can reduce a firm's cost of capital". Discuss briefly with TWO supported

reasons if you agree or disagree with the statement.

b Awang Hussin works for a nuclear research laboratory that is contemplating leasing a

diagnostic scanner. The scanner costs RM and it would be depreciated straight

line to zero over four years. Because of radiation contamination, it will be completely

valueless in four years. Awang Hussin can lease it for RM payable at the

beginning of each of the next four years.

Assume that the tax rate is Awang Hussin can borrow at before tax.

Based on the above information, you are required to prepare the Cash Flows Analysis by

clearly showing the Net Advantage of Leasing NAL Based on NAL, recommend to

Awang Hussin whether he should lease or buy the scanner.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started