Answered step by step

Verified Expert Solution

Question

1 Approved Answer

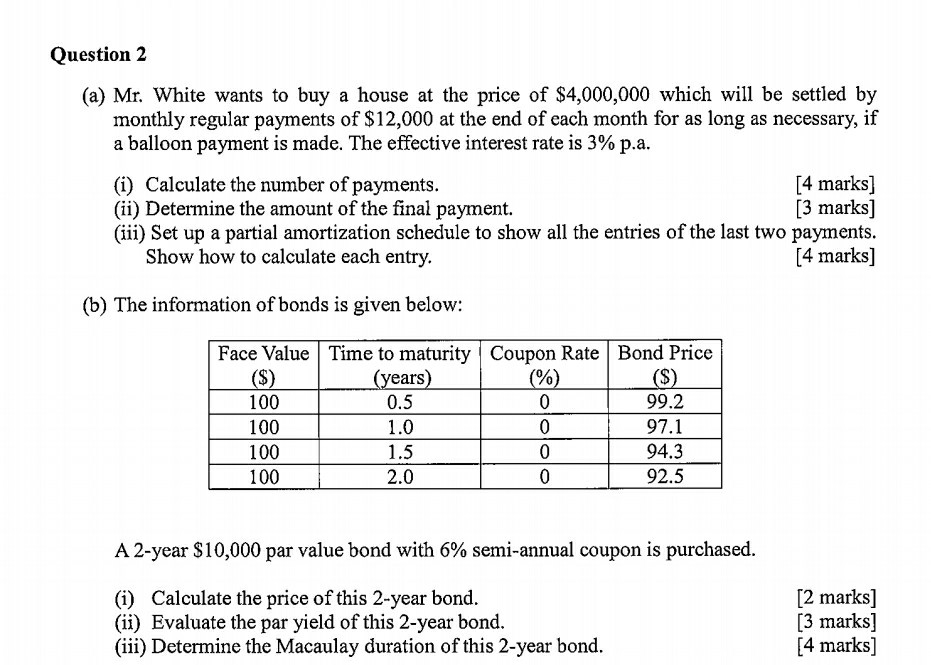

Question 2 (a) Mr. White wants to buy a house at the price of $4,000,000 which will be settled by monthly regular payments of $12,000

Question 2 (a) Mr. White wants to buy a house at the price of $4,000,000 which will be settled by monthly regular payments of $12,000 at the end of each month for as long as necessary, if a balloon payment is made. The effective interest rate is 3% pa [4 marks] [3 marks] (iii) Set up a partial amortization schedule to show all the entries of the last two payments. [4 marks] (i) Calculate the number of payments. (ii) Determine the amount of the final payment. Show how to calculate each entry. (b) The information of bonds is given below: Face Value Time to maturity Coupon Rate Bond Price ears 100 99.2 97.1 94.3 92.5 0.5 0 100 100 2.0 A 2-year $10,000 par value bond with 6% semi-annual coupon is purchased (i) Calculate the price of this 2-year bond (ii) Evaluate the par yield of this 2-year bond (iii) Determine the Macaulay duration of this 2-year bond [2 marks] [3 marks] [4 marks] Question 2 (a) Mr. White wants to buy a house at the price of $4,000,000 which will be settled by monthly regular payments of $12,000 at the end of each month for as long as necessary, if a balloon payment is made. The effective interest rate is 3% pa [4 marks] [3 marks] (iii) Set up a partial amortization schedule to show all the entries of the last two payments. [4 marks] (i) Calculate the number of payments. (ii) Determine the amount of the final payment. Show how to calculate each entry. (b) The information of bonds is given below: Face Value Time to maturity Coupon Rate Bond Price ears 100 99.2 97.1 94.3 92.5 0.5 0 100 100 2.0 A 2-year $10,000 par value bond with 6% semi-annual coupon is purchased (i) Calculate the price of this 2-year bond (ii) Evaluate the par yield of this 2-year bond (iii) Determine the Macaulay duration of this 2-year bond [2 marks] [3 marks] [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started