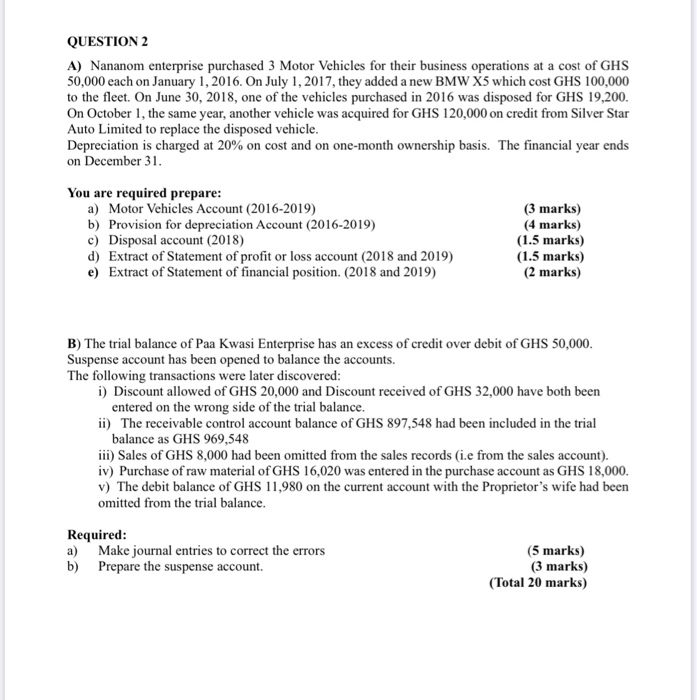

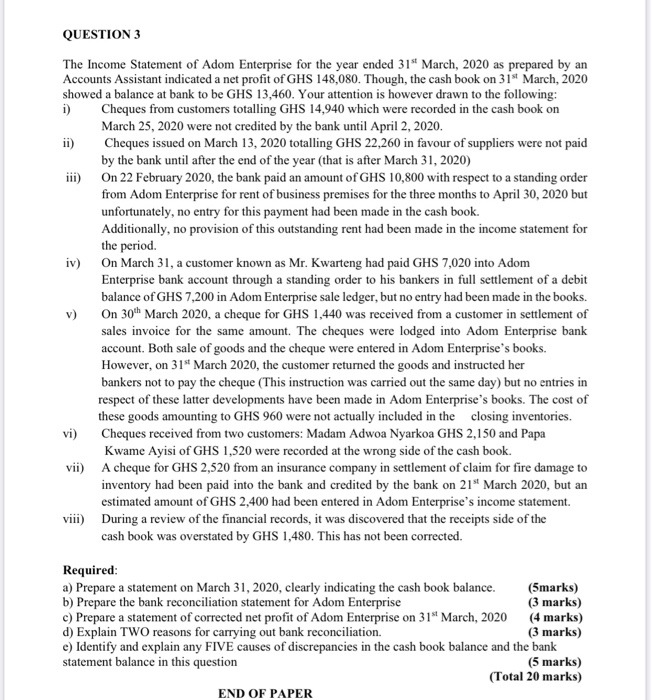

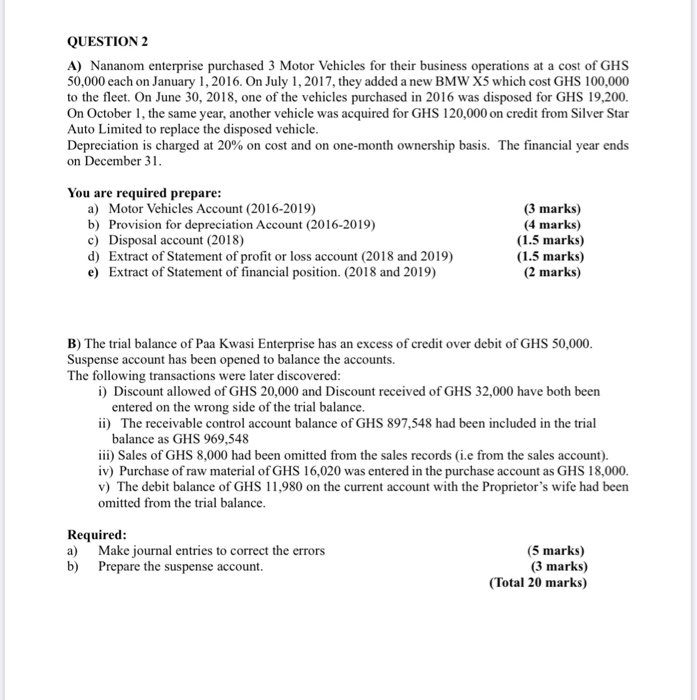

QUESTION 2 A) Nananom enterprise purchased 3 Motor Vehicles for their business operations at a cost of GHS 50,000 each on January 1, 2016. On July 1, 2017, they added a new BMW X5 which cost GHS 100,000 to the fleet. On June 30, 2018, one of the vehicles purchased in 2016 was disposed for GHS 19,200. On October 1, the same year, another vehicle was acquired for GHS 120,000 on credit from Silver Star Auto Limited to replace the disposed vehicle. Depreciation is charged at 20% on cost and on one-month ownership basis. The financial year ends on December 31. You are required prepare: a) Motor Vehicles Account (2016-2019) (3 marks) b) Provision for depreciation Account (2016-2019) (4 marks) c) Disposal account (2018) (1.5 marks) d) Extract of Statement of profit or loss account (2018 and 2019) (1.5 marks) e) Extract of Statement of financial position. (2018 and 2019) (2 marks) B) The trial balance of Paa Kwasi Enterprise has an excess of credit over debit of GHS 50,000. Suspense account has been opened to balance the accounts. The following transactions were later discovered: i) Discount allowed of GHS 20,000 and Discount received of GHS 32,000 have both been entered on the wrong side of the trial balance. ii) The receivable control account balance of GHS 897,548 had been included in the trial balance as GHS 969,548 iii) Sales of GHS 8,000 had been omitted from the sales records (i.e from the sales account). iv) Purchase of raw material of GHS 16,020 was entered in the purchase account as GHS 18,000. v) The debit balance of GHS 11,980 on the current account with the Proprietor's wife had been omitted from the trial balance. Required: a) Make journal entries to correct the errors (5 marks) b) Prepare the suspense account. (3 marks) (Total 20 marks) QUESTION 3 The Income Statement of Adom Enterprise for the year ended 31" March, 2020 as prepared by an Accounts Assistant indicated a net profit of GHS 148,080. Though, the cash book on 31st March, 2020 showed a balance at bank to be GHS 13,460. Your attention is however drawn to the following: 1) Cheques from customers totalling GHS 14,940 which were recorded in the cash book on March 25, 2020 were not credited by the bank until April 2, 2020. ii) Cheques issued on March 13, 2020 totalling GHS 22,260 in favour of suppliers were not paid by the bank until after the end of the year (that is after March 31, 2020) iii) On 22 February 2020, the bank paid an amount of GHS 10,800 with respect to a standing order from Adom Enterprise for rent of business premises for the three months to April 30, 2020 but unfortunately, no entry for this payment had been made in the cash book. Additionally, no provision of this outstanding rent had been made in the income statement for the period. iv) On March 31, a customer known as Mr. Kwarteng had paid GHS 7,020 into Adom Enterprise bank account through a standing order to his bankers in full settlement of a debit balance of GHS 7,200 in Adom Enterprise sale ledger, but no entry had been made in the books. v) On 30th March 2020, a cheque for GHS 1,440 was received from a customer in settlement of sales invoice for the same amount. The cheques were lodged into Adom Enterprise bank account. Both sale of goods and the cheque were entered in Adom Enterprise's books. However, on 314 March 2020, the customer returned the goods and instructed her bankers not to pay the cheque (This instruction was carried out the same day) but no entries in respect of these latter developments have been made in Adom Enterprise's books. The cost of these goods amounting to GHS 960 were not actually included in the closing inventories. vi) Cheques received from two customers: Madam Adwoa Nyarkoa GHS 2,150 and Papa Kwame Ayisi of GHS 1,520 were recorded at the wrong side of the cash book. vii) A cheque for GHS 2,520 from an insurance company in settlement of claim for fire damage to inventory had been paid into the bank and credited by the bank on 21" March 2020, but an estimated amount of GHS 2,400 had been entered in Adom Enterprise's income statement. viii) During a review of the financial records, it was discovered that the receipts side of the cash book was overstated by GHS 1,480. This has not been corrected. Required: a) Prepare a statement on March 31, 2020, clearly indicating the cash book balance. (5marks) b) Prepare the bank reconciliation statement for Adom Enterprise (3 marks) c) Prepare a statement of corrected net profit of Adom Enterprise on 31" March, 2020 (4 marks) d) Explain TWO reasons for carrying out bank reconciliation. (3 marks) e) Identify and explain any FIVE causes of discrepancies in the cash book balance and the bank statement balance in this question (5 marks) (Total 20 marks) END OF PAPER QUESTION 2 A) Nananom enterprise purchased 3 Motor Vehicles for their business operations at a cost of GHS 50,000 each on January 1, 2016. On July 1, 2017, they added a new BMW X5 which cost GHS 100,000 to the fleet. On June 30, 2018, one of the vehicles purchased in 2016 was disposed for GHS 19,200. On October 1, the same year, another vehicle was acquired for GHS 120,000 on credit from Silver Star Auto Limited to replace the disposed vehicle. Depreciation is charged at 20% on cost and on one-month ownership basis. The financial year ends on December 31. You are required prepare: a) Motor Vehicles Account (2016-2019) (3 marks) b) Provision for depreciation Account (2016-2019) (4 marks) c) Disposal account (2018) (1.5 marks) d) Extract of Statement of profit or loss account (2018 and 2019) (1.5 marks) e) Extract of Statement of financial position. (2018 and 2019) (2 marks) B) The trial balance of Paa Kwasi Enterprise has an excess of credit over debit of GHS 50,000. Suspense account has been opened to balance the accounts. The following transactions were later discovered: i) Discount allowed of GHS 20,000 and Discount received of GHS 32,000 have both been entered on the wrong side of the trial balance. ii) The receivable control account balance of GHS 897,548 had been included in the trial balance as GHS 969,548 iii) Sales of GHS 8,000 had been omitted from the sales records (i.e from the sales account). iv) Purchase of raw material of GHS 16,020 was entered in the purchase account as GHS 18,000. v) The debit balance of GHS 11,980 on the current account with the Proprietor's wife had been omitted from the trial balance. Required: a) Make journal entries to correct the errors (5 marks) b) Prepare the suspense account. (3 marks) (Total 20 marks)