Answered step by step

Verified Expert Solution

Question

1 Approved Answer

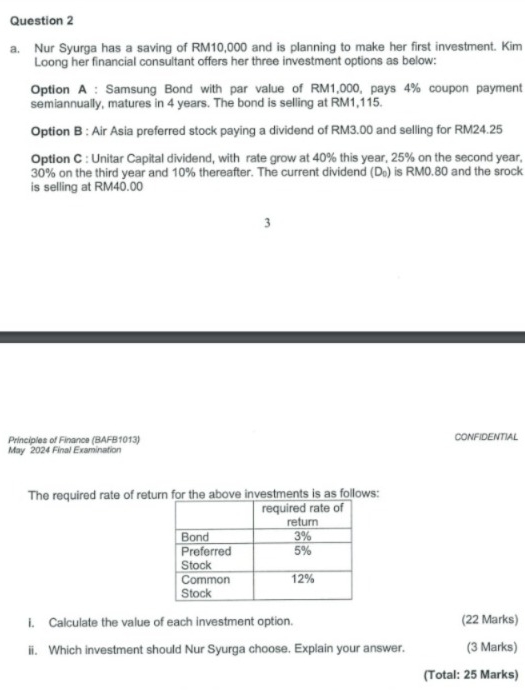

Question 2 a . Nur Syurga has a saving of RM 1 0 , 0 0 0 and is planning to make her first investment.

Question

a Nur Syurga has a saving of RM and is planning to make her first investment. Kim Loong her financial consultant offers her three investment options as below:

Option A : Samsung Bond with par value of RM pays coupon payment semiannually, matures in years. The bond is selling at RM

Option B : Air Asia preferred stock paying a dividend of RM and selling for RM

Option C : Unitar Capital dividend, with rate grow at this year, on the second year, on the third year and thereafter. The current dividend is RMO and the srock is selling at RM

The required rate of return for the above investments is as follows:

tabletablerequired rate ofreturnBond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started