Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 A Senko Bhd (Senko) is a company producing plastic kitchenware in Kluang. At present, the capital structure of the firm is considered at

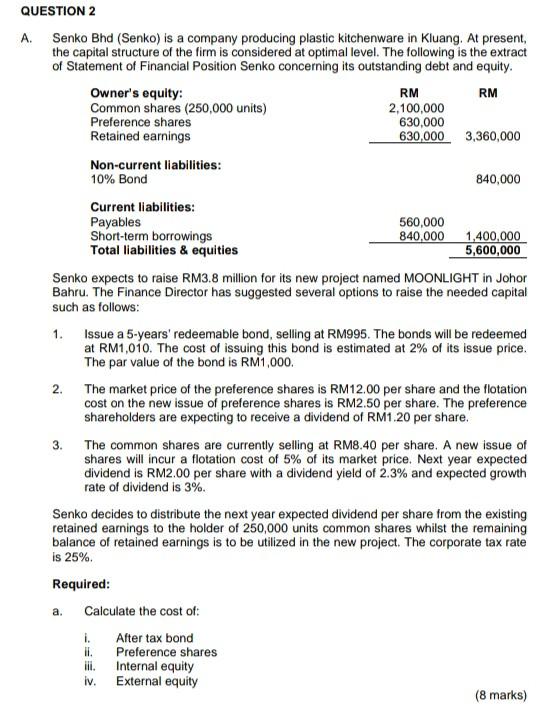

QUESTION 2 A Senko Bhd (Senko) is a company producing plastic kitchenware in Kluang. At present, the capital structure of the firm is considered at optimal level. The following is the extract of Statement of Financial Position Senko concerning its outstanding debt and equity. Owner's equity: RM RM Common shares (250,000 units) 2,100,000 Preference shares 630,000 Retained earnings 630,000 3,360,000 Non-current liabilities: 10% Bond 840,000 Current liabilities: Payables 560,000 Short-term borrowings 840,000 1,400,000 Total liabilities & equities 5,600,000 Senko expects to raise RM3.8 million for its new project named MOONLIGHT in Johor Bahru. The Finance Director has suggested several options to raise the needed capital such as follows: 1. Issue a 5-years' redeemable bond, selling at RM995. The bonds will be redeemed at RM1,010. The cost of issuing this bond is estimated at 2% of its issue price. The par value of the bond is RM1,000. 2. The market price of the preference shares is RM12.00 per share and the flotation cost on the new issue of preference shares is RM2.50 per share. The preference shareholders are expecting to receive a dividend of RM1.20 per share. 3. The common shares are currently selling at RM8.40 per share. A new issue of shares will incur a flotation cost of 5% of its market price. Next year expected dividend is RM2.00 per share with a dividend yield of 2.3% and expected growth rate of dividend is 3%. Senko decides to distribute the next year expected dividend per share from the existing retained earnings to the holder of 250,000 units common shares whilst the remaining balance of retained earnings is to be utilized in the new project. The corporate tax rate is 25% Required: a. Calculate the cost of 1. After tax bond ii. Preference shares iii. Internal equity iv. External equity (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started