Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 - Accounting for Leases (12 marks] Giant King Limited decided to lease a new machine from Artley Finance Ltd. to increase its production

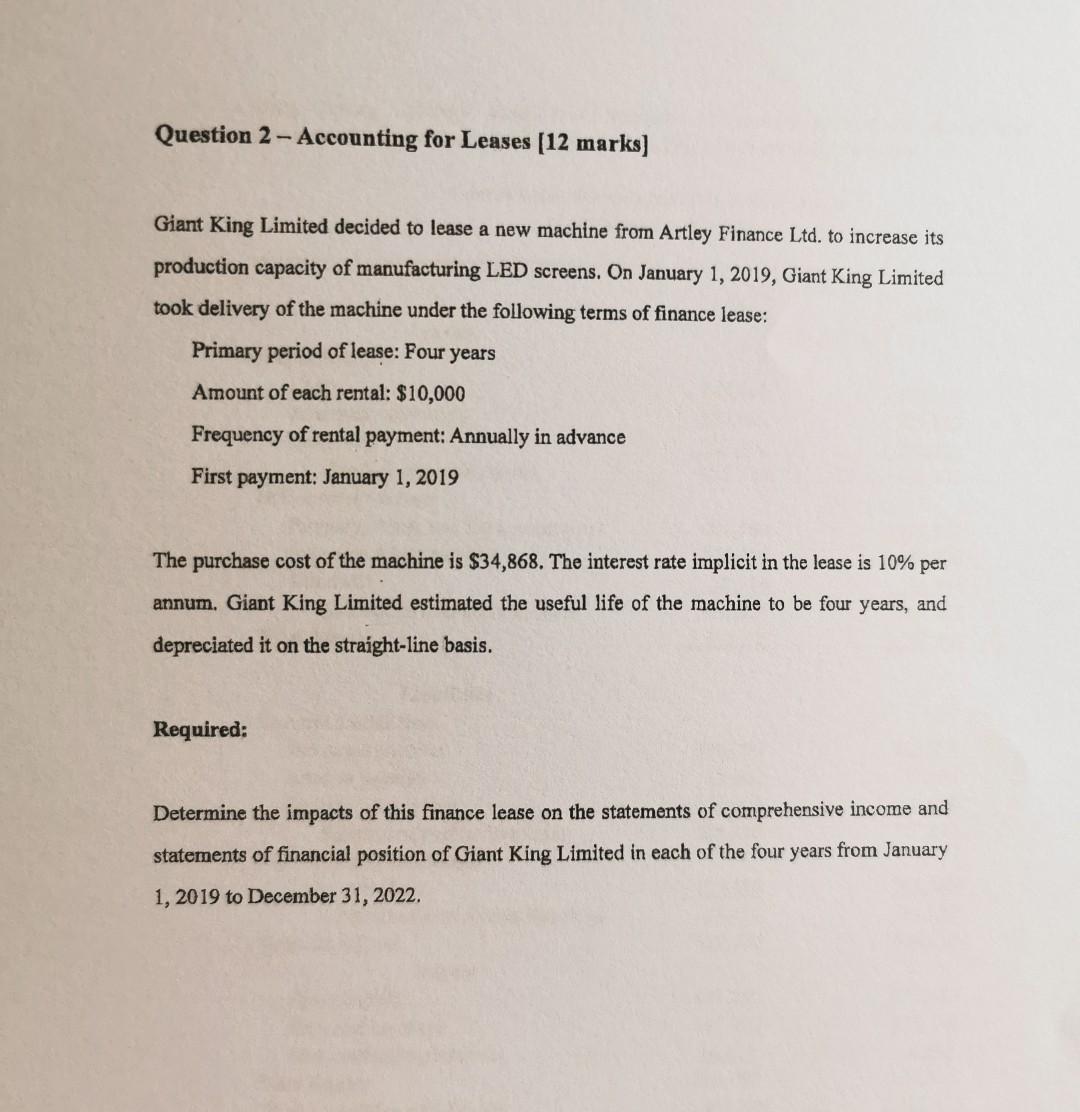

Question 2 - Accounting for Leases (12 marks] Giant King Limited decided to lease a new machine from Artley Finance Ltd. to increase its production capacity of manufacturing LED screens. On January 1, 2019, Giant King Limited took delivery of the machine under the following terms of finance lease: Primary period of lease: Four years Amount of each rental: $10,000 Frequency of rental payment: Annually in advance First payment: January 1, 2019 The purchase cost of the machine is $34,868. The interest rate implicit in the lease is 10% per annum. Giant King Limited estimated the useful life of the machine to be four years, and depreciated it on the straight-line basis. Required: Determine the impacts of this finance lease on the statements of comprehensive income and statements of financial position of Giant King Limited in each of the four years from January 1, 2019 to December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started