Answered step by step

Verified Expert Solution

Question

1 Approved Answer

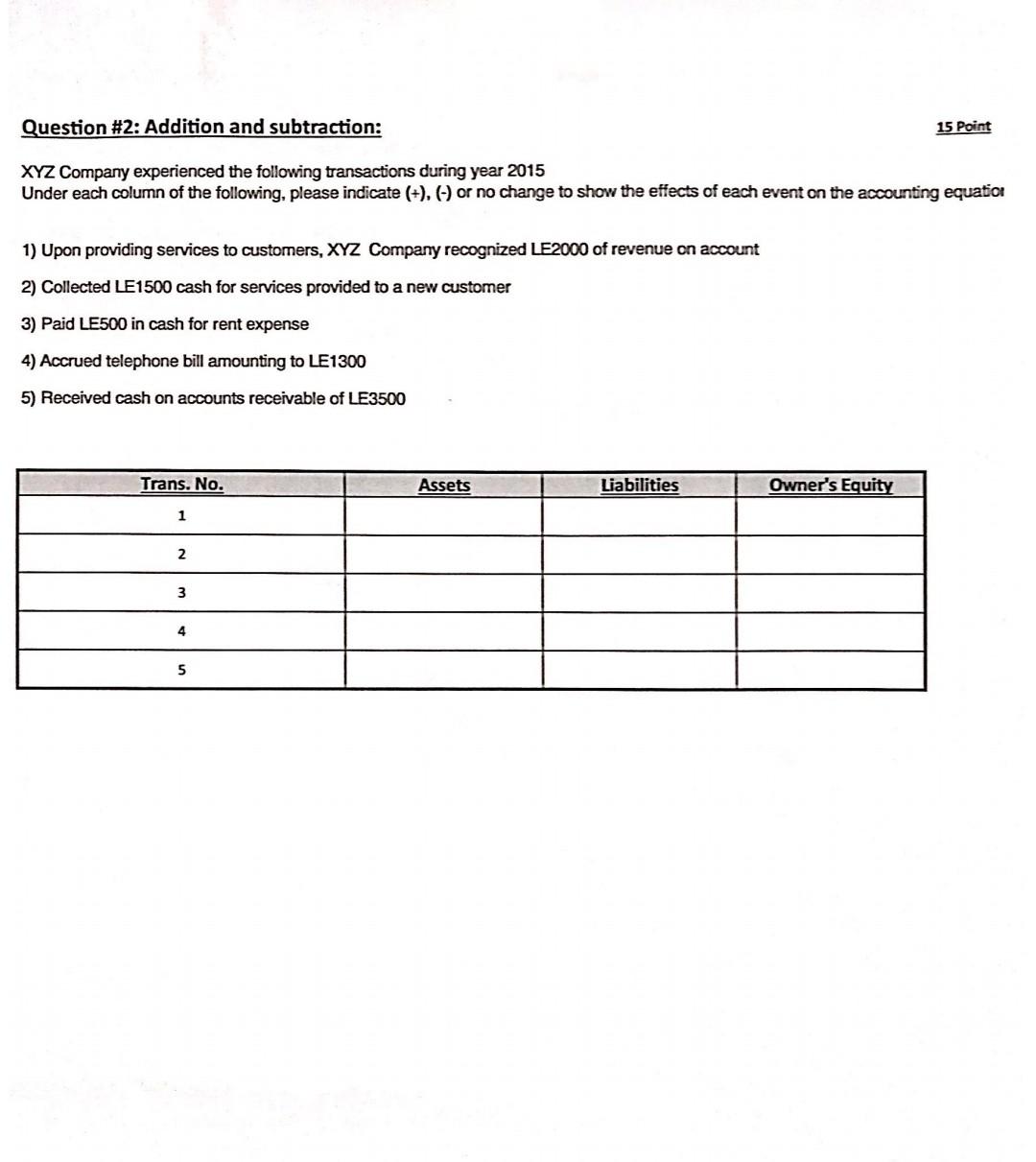

Question #2: Addition and subtraction: ( underline{15 text { point }} ) XYZ Company experienced the following transactions during year 2015 Under each column of

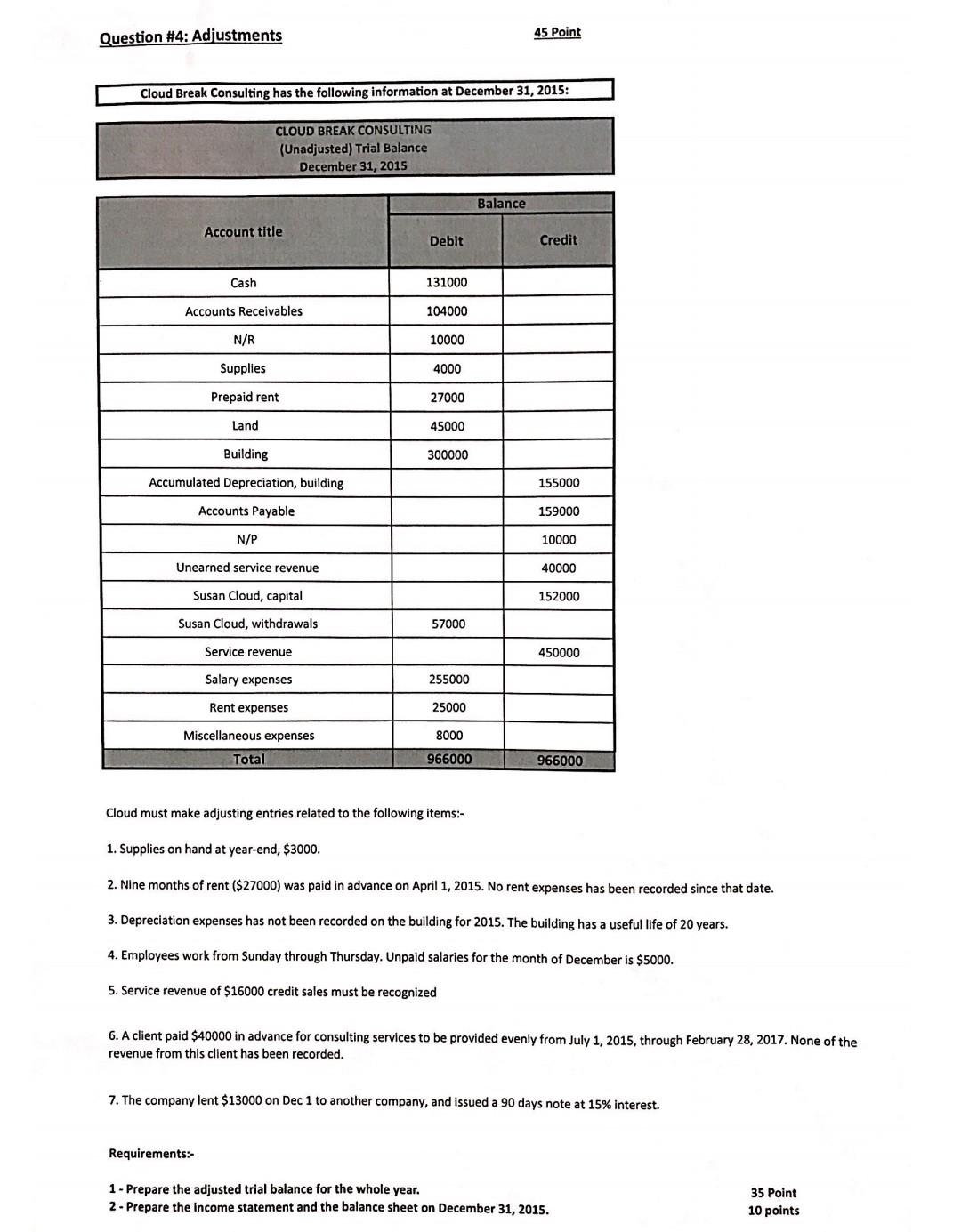

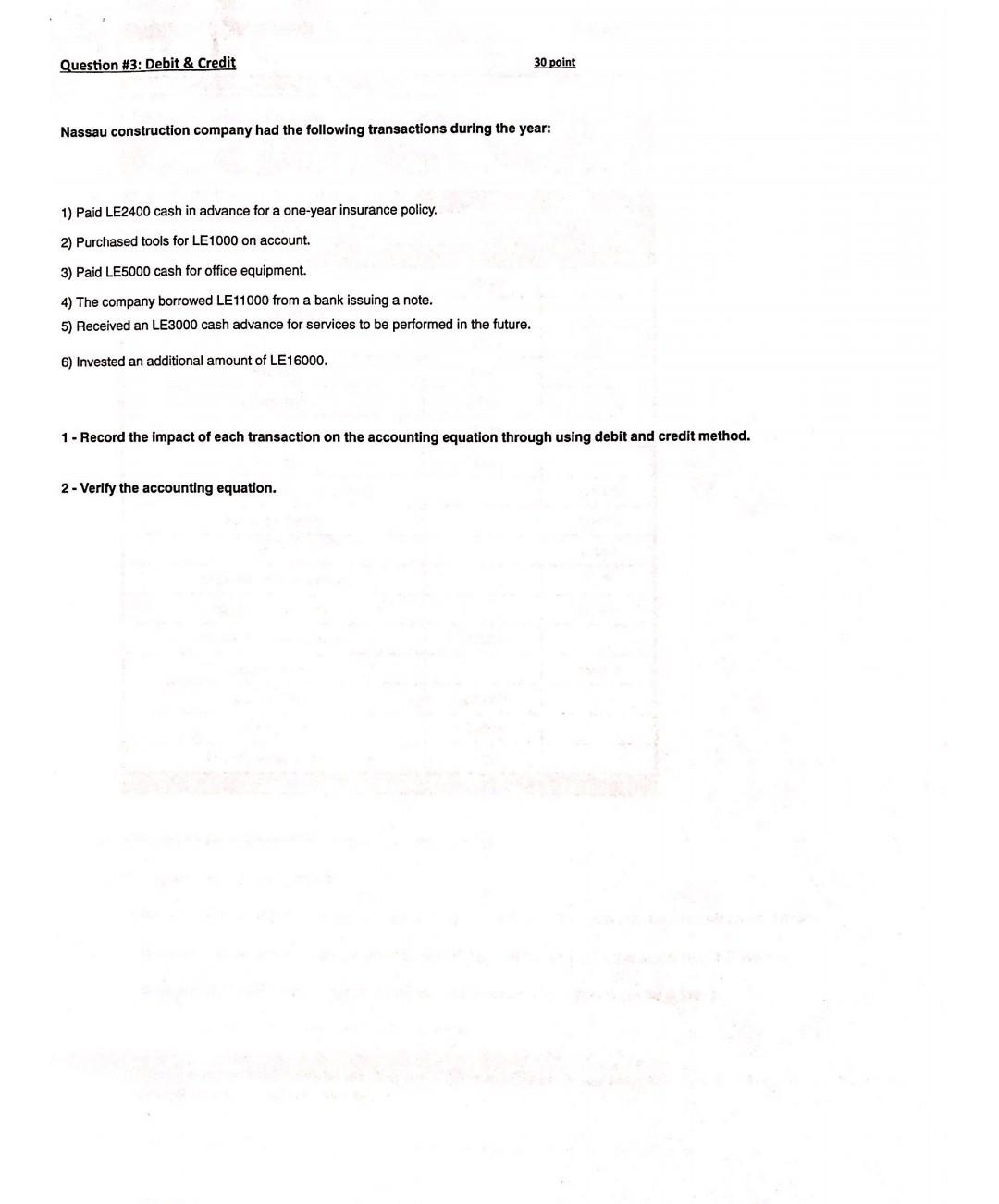

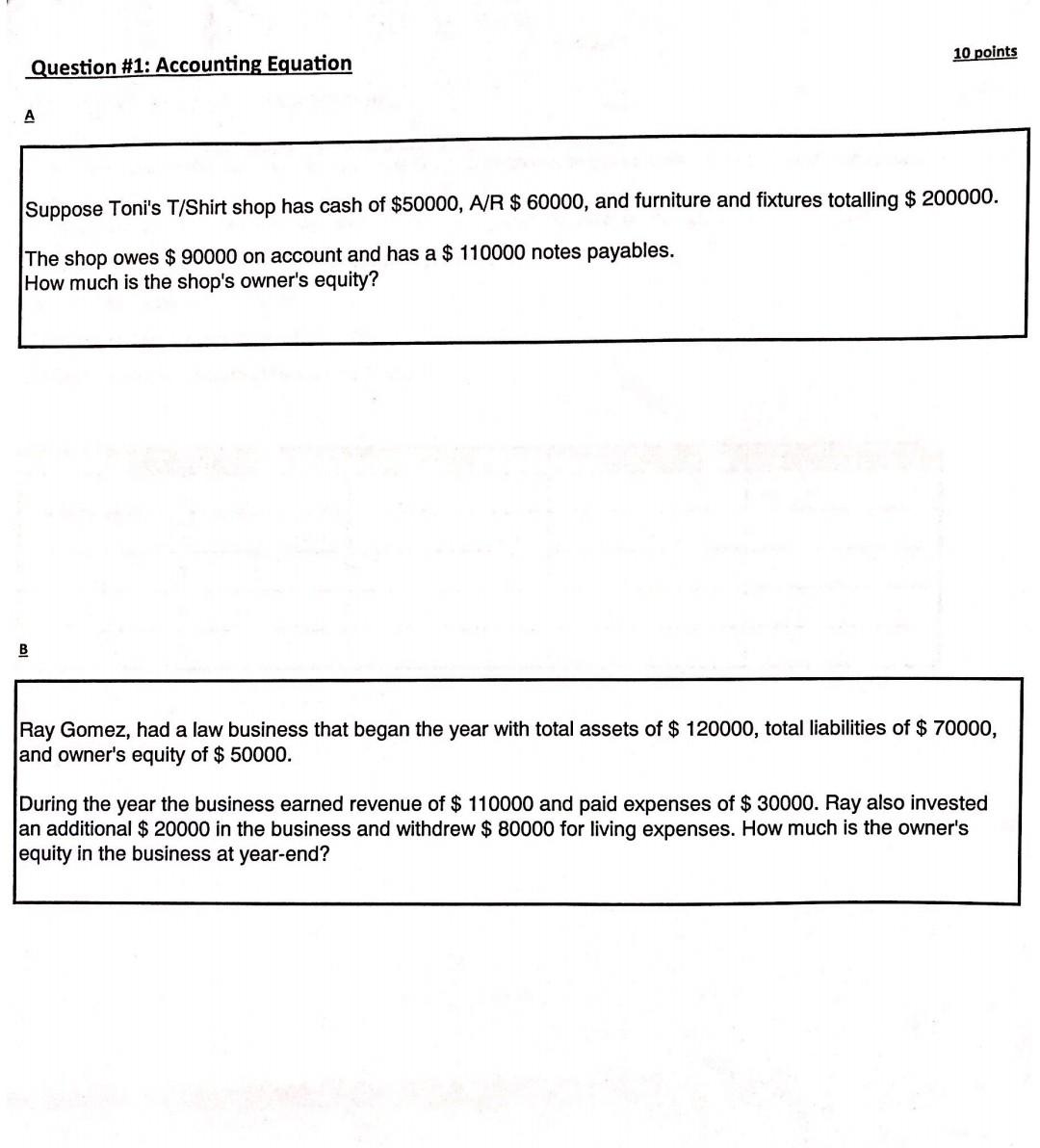

Question \\#2: Addition and subtraction: \\( \\underline{15 \\text { point }} \\) XYZ Company experienced the following transactions during year 2015 Under each column of the following, please indicate \\( (+),(-) \\) or no change to show the effects of each event on the accounting equation 1) Upon providing services to customers, XYZ Company recognized LF2000 of revenue on account 2) Collected LE1500 cash for services provided to a new customer 3) Paid LE500 in cash for rent expense 4) Accrued telephone bill amounting to LE1300 5) Received cash on accounts receivable of LE3500 Question \\#1: Accounting Equation 10 points \\( \\underline{\\mathbf{A}} \\) Suppose Toni's T/Shirt shop has cash of \\( \\$ 50000 \\), A/R \\( \\$ 60000 \\), and furniture and fixtures totalling \\( \\$ 200000 \\). The shop owes \\( \\$ 90000 \\) on account and has a \\( \\$ 110000 \\) notes payables. How much is the shop's owner's equity? \\( \\underline{B} \\) Ray Gomez, had a law business that began the year with total assets of \\( \\$ 120000 \\), total liabilities of \\( \\$ 70000 \\), and owner's equity of \\( \\$ 50000 \\). During the year the business earned revenue of \\( \\$ 110000 \\) and paid expenses of \\( \\$ 30000 \\). Ray also invested an additional \\( \\$ 20000 \\) in the business and withdrew \\( \\$ 80000 \\) for living expenses. How much is the owner's equity in the business at year-end? Question \\#4: Adjustments 45 Point Cloud must make adjusting entries related to the following items:- 1. Supplies on hand at year-end, \\( \\$ 3000 \\). 2. Nine months of rent \\( (\\$ 27000) \\) was paid in advance on April 1, 2015. No rent expenses has been recorded since that date. 3. Depreciation expenses has not been recorded on the building for 2015 . The building has a useful life of 20 years. 4. Employees work from Sunday through Thursday. Unpaid salaries for the month of December is \\( \\$ 5000 \\). 5. Service revenue of \\( \\$ 16000 \\) credit sales must be recognized 6. A client paid \\( \\$ 40000 \\) in advance for consulting services to be provided evenly from July 1,2015 , through February 28,2017 . None of the revenue from this client has been recorded. 7. The company lent \\( \\$ 13000 \\) on Dec 1 to another company, and issued a 90 days note at \15 interest. Question \\#3: Debit \\& Credit 30 point Nassau construction company had the following transactions during the year: 1) Paid LE2400 cash in advance for a one-year insurance policy. 2) Purchased tools for LE1000 on account. 3) Paid LE5000 cash for office equipment. 4) The company borrowed LE11000 from a bank issuing a note. 5) Received an LE3000 cash advance for services to be performed in the future. 6) Invested an additional amount of LE16000. 1- Record the impact of each transaction on the accounting equation through using debit and credit method. 2- Verify the accounting equation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started